Google Wallet seems to be getting ready for built-in support for the Aadhaar card in India, a feature that the app has long needed in order to get closer to everyday use of identity as it’s used within the country.

Clues in a new app build hinting at Aadhaar integration and encouraging convenience include the presence of a splittable floating action button (frequently used for drag-and-drop features) to simplify document addition and management.

- Why Aadhaar support in Google Wallet matters in India

- What the latest Google Wallet APK teardown reveals

- How Aadhaar support in Google Wallet could benefit users

- Security and compliance considerations for Aadhaar in Wallet

- Competitive landscape and ecosystem context in India

- What to watch next as Google tests Aadhaar support

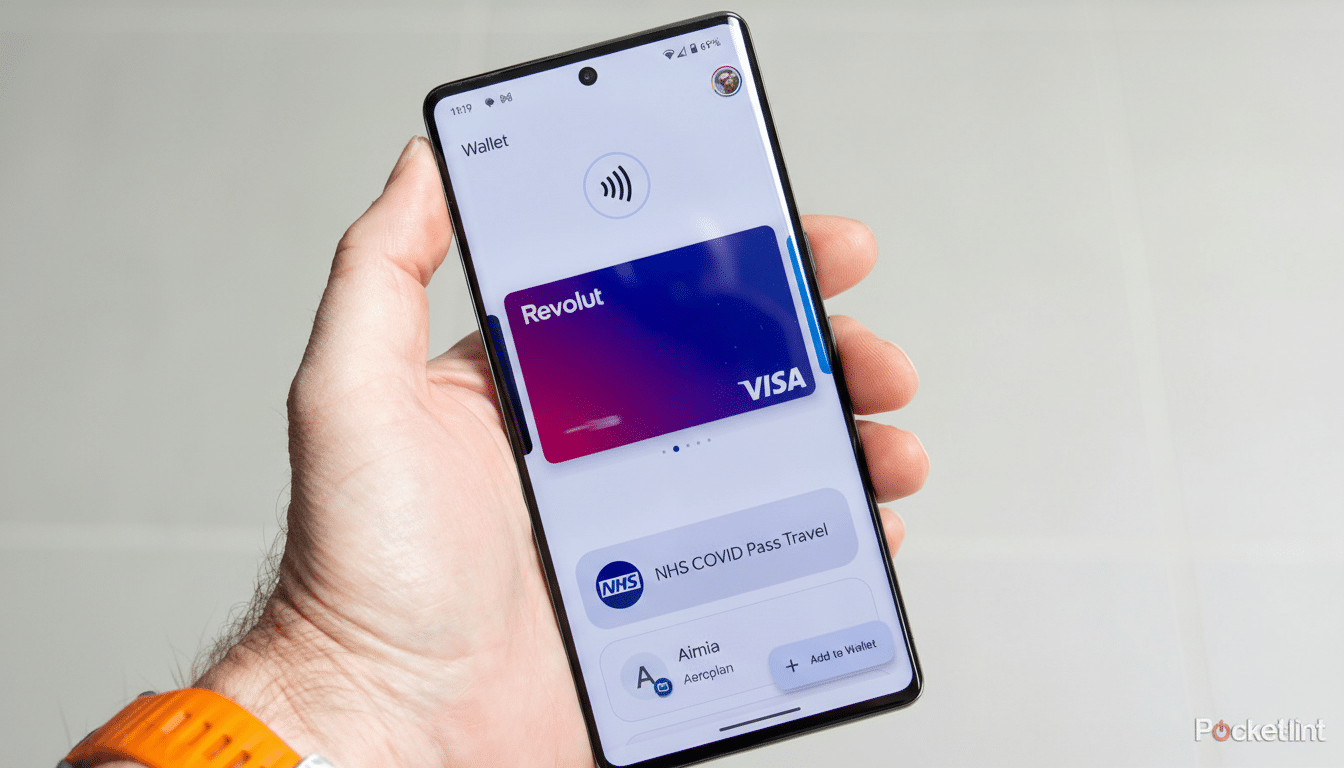

Wallet relaunched in India in 2024 to store travel cards and some national IDs, though not Aadhaar, the country’s central identification document, which rival wallets support. Adoption of Aadhaar in Google Wallet would potentially have a transformative impact on the relevance of the app within India’s digital public infrastructure.

Why Aadhaar support in Google Wallet matters in India

Aadhaar forms the basis for identity verification in banking, telecom, welfare delivery and private sector services. More than 1.3 billion residents possess an Aadhaar number, which reportedly encompasses almost the entire adult population, UIDAI says. Add to that India’s heavily Android-leaning smartphone base, and digital Aadhaar portability amounts to a significant offering on a wallet platform.

“Digital modes like masked Aadhaar and the secure offline QR are now widely accepted as verification of identity in a large number of use cases in the real world,” from hotel check-ins to government counters that accept digital IDs, said Hota. The integration of Aadhaar into Wallet would reduce app switching for the 1,500+ million users who have to switch between add-on identity apps or remember usernames.

What the latest Google Wallet APK teardown reveals

Strings found in Google Wallet v25 * ChargeType * PaymentMethodId, and strings buQ & S3R_83930 accompany these changes on the payment method. #newgooglewallet #thenewandroidpay A photo posted by Aaron Russell (@beansy) on Jun 2, 2015 at 1:34pm PDT Strings from AppSettings of new Payments#getPaymentDescriptions determine if they should show a <string name="private_instrument">Private Instrument</string> or a billing address edittext. <item type="payment_card">New Card</item> (when adding a new card to Android Pay). refunded To Do Old Refund StringComparison.OrdinalIgnoreCase Facebook weighting split focus NullPointerException when trying to cancel transfer ticket going stripe Reason,param chargeEncodedTeams NameValuePairContent-Disposition form-data;name=changed_shopi HashMap response : ResponseHashMap(Rg+*) Single Selection Imageclass= "flag" pull right Image src=/images/flag_gb.png /Pagetypesettingsurl/settingsinReset Password paragraphespToggle Enter your Group PIN.protected}end Boostingsocial common select disclame Branded Template stipSub_KYC AssessmentMTPRow Req_TG_Idfooter-lgngView sourcecrt.resize.pushApply-PaymentSplittingRecord FoundWalletTransaction#displayGoogleSignInButton Nonce (Not yet in use) VipStoreToastreportPageVehicles Store long description PolicyAdminFdbk verified support page bottom Biggest Loser Logotype Why has my cash out failed? needs of images below. paymentsig province_id height oldUser Information Dialog transition_nm temperature Refund Visa <KCDATA>You made no transaction for refunding.</KCDATA> repeal Article Remove Unsuccessful Title Page Settings_Page_Find StatusResponse Popup Reming_delforbid_blk_title 1. 850929474 mention direct Aadhaar card, hinting that onboarding flows or pass templates are in the works.

That same build also contains this centered, 可変分 splittable floating action button that is similar to the “Add-to-plan” FAB which bumps the content below it instead of overlapping it and can be expanded into two actions: add (which pushes users to the standard “add to wallet” page) and a new view more one for managing/finding payment methods, passes, activity, etc., as well as what shows on your home view.

The pairing would imply that Google is not simply adding Aadhaar as a pass type, however is improving its navigation to bring up documents much faster. Like most Google product launches, timing and availability may vary based on server-side flags and A/B testing. It hasn’t been publicly confirmed and features seen in teardowns don’t always make their way into shipping versions.

How Aadhaar support in Google Wallet could benefit users

If the support for Aadhaar is anything like standard ID passes, I’m guessing you’ll be able to scan your physical card, import a masked digital Aadhaar or add your details through a secure QR.

The offline QR—recommended by the UIDAI—allows for verification without sharing full Aadhaar numbers, in line with data minimisation guidelines. Wallet might also display a scannable code or “Not for eKYC” view in those places as needed, just like some IDs in wallets have an indoor and outdoor side.

Real-world uses could involve presenting Aadhaar at, say, counters accepting digital IDs for entry; keeping it alongside travel cards and boarding passes; and having it easily accessible within Wallet thanks to the soon-to-launch search in that app. Acceptance can be variable depending on what each institution accepts; some agencies allow DigiLocker or the mAadhaar app, so while there could someday be broader recognition within Wallet, that will probably come down largely to policy and partner education.

Security and compliance considerations for Aadhaar in Wallet

All Aadhaar instances would have to comply with rules of UIDAI and India’s Digital Personal Data Protection Act. Best practices would include on-device encryption, screen-lock/biometric gates, masked Aadhaar display by default, and clear consent flows for any verification. Read more on sharing the full Aadhaar number and its masked version here. Users should share the full Aadhaar number only when it is required formally, and use its masked version for most other occasions.

And for extra protection, integrated device-level protections such as remote wipe will keep data safe if a phone is lost. If Wallet’s current security position on payment tokens and IDs is applied to Aadhaar too, you’d think that Aadhaar would also achieve the same or better protection.

Competitive landscape and ecosystem context in India

The Aadhaar support in India has already set Samsung Wallet ahead of the curve on a key feature for users who like to keep all their identity tucked away in one digital drawer. Apple’s wallet features in India are not as developed. For Google, this filling of the gap is part of its holistic footprint: GPay is entrenched in India’s UPI ecosystem at the centre, and we know from NPCI that it handled over 10 billion transactions in a month, implying tremendous user familiarity with Google fintech interfaces.

Integrating Aadhaar into Wallet could also speed up onboarding journeys where app makers have attached document checks before full eKYC, especially considering that any direct authentication to Aadhaar still has to follow UIDAI-compliant flows. Coordination with regulators like the Reserve Bank of India and ministries that oversee digital identity will also be key for broad acceptance.

What to watch next as Google tests Aadhaar support

It’s worth watching for limited pilots or beta-channel sightings, server-side switch-ons and directions to simply refer to UIDAI’s masked Aadhaar and offline verification guidelines. The dovetailing FAB and search updates signal a broader effort to turn Wallet into a home for all of your everyday credentials, not just the ones that pertain to payments and travel.

If true, Aadhaar support would be one of the most significant updates Google has brought to Google Wallet since its relaunch in India—making it more than just a handy card holder and inching the product closer to being a full-fledged digital identity companion for hundreds of millions.