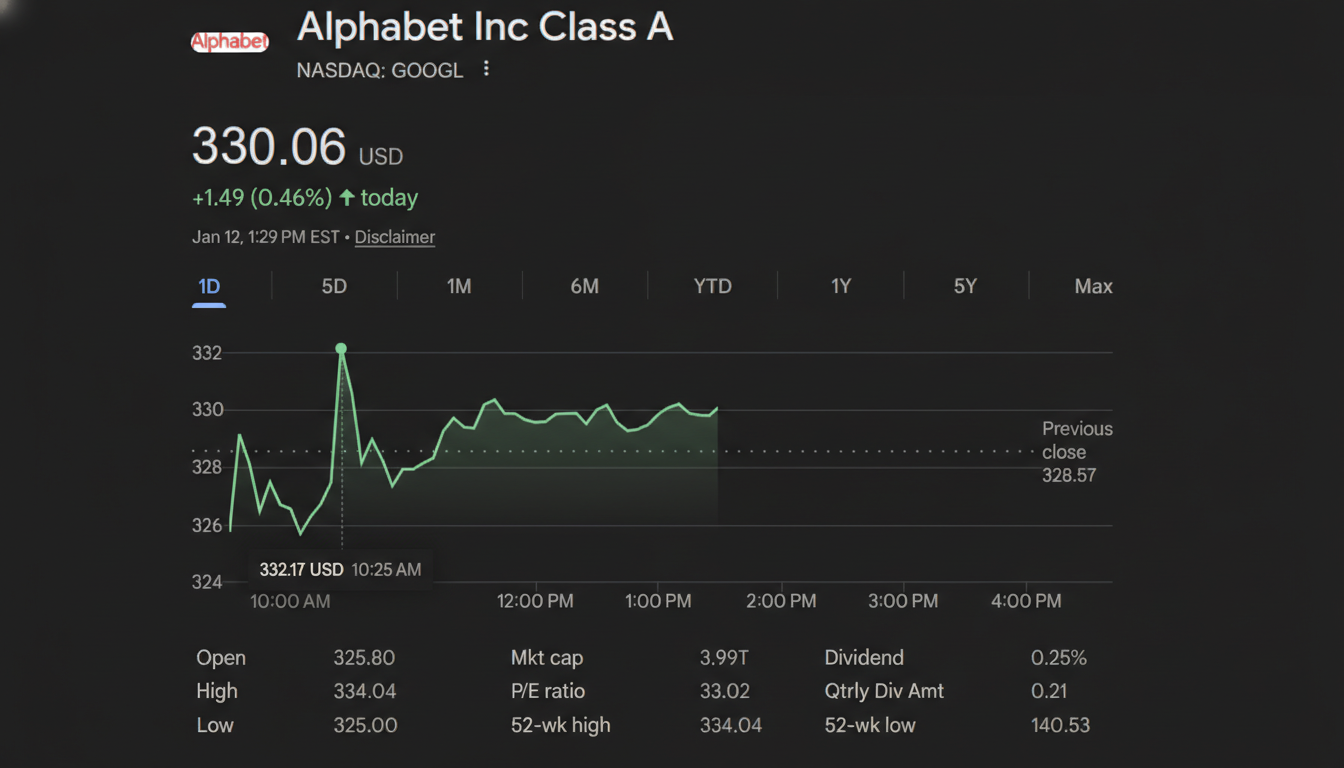

Alphabet has crossed the $4 trillion market valuation threshold, a milestone that places Google’s parent among the most valuable companies in history and underscores investors’ conviction that AI is reshaping the tech hierarchy. The move, reported by CNBC, puts Alphabet alongside Nvidia, Apple, and Microsoft in a club that did not exist until recently—and remains volatile as prices shift by the hour.

What Pushed Alphabet Over the Line to $4 Trillion

A modest stock bump—about 1% after news of a multi‑year collaboration that brings Google’s Gemini to power Apple’s AI experiences—appears to have nudged Alphabet over the top. The partnership itself isn’t the sole driver; rather, it crystallizes the market’s view that Google’s AI stack is central to how billions of users will Search, create, and interact across devices.

Under the surface, the business engine remains broad. Search advertising continues to throw off cash, YouTube has become a durable second pillar with both brand and direct‑response demand, and Google Cloud has shifted from a long investment cycle to sustained profitability. Together, those dynamics help fund the tens of billions of dollars Alphabet is pouring into AI infrastructure, custom TPUs, and product integration for Gemini across Search, Workspace, Android, and more.

The company has also kept shareholder math on its side. A 20‑for‑1 stock split improved retail accessibility, while steady repurchases have reduced share count and amplified earnings per share. In a market that rewards cash scale and operating leverage, that combination matters.

Inside the $4 Trillion Club of Big Tech Leaders

Nvidia, Apple, Microsoft, and now Alphabet represent an unprecedented concentration of value atop global equities. Two of those peers have dipped below the line at times, a reminder that round numbers are snapshots, not finish lines. Still, the message is clear: leadership in semiconductors, operating systems, cloud, and AI models now commands multi‑trillion valuations.

The concentration also has index implications. According to S&P Dow Jones Indices, a handful of mega‑caps already account for a sizeable share of the S&P 500’s total weight. Alphabet’s climb further tilts passive flows, ETF exposures, and risk models toward Big Tech, magnifying the impact of every earnings call and product announcement.

AI Strategy Meets Revenue Reality Across Google

Alphabet’s AI narrative is no longer just about research breakthroughs; it is about distribution and monetization. Gemini is being embedded into Search to enhance results and shopping journeys, into Workspace to automate drafting and analysis, and into Android to power on‑device assistance. Each touchpoint widens the funnel for ads, subscriptions, or cloud consumption.

YouTube offers a practical example: AI‑assisted tools for creators and advertisers can raise content velocity and ad relevance, while Shorts has added time‑spent and incremental inventory. On the enterprise side, Google Cloud’s AI services aim to convert experimentation into production workloads, from generative assistants to vector databases—use cases that drive higher‑margin consumption over time.

There are cost realities, too. Training and inference at global scale require relentless investment in data centers, networking, and energy. Alphabet’s custom silicon strategy is designed to bend that cost curve, but the company still has to balance AI ambition with unit economics and carbon commitments.

Can the $4 Trillion Milestone Hold for Alphabet?

Staying above $4 trillion will depend on execution amid intense competition and regulatory pressure. The Department of Justice’s search case, EU digital rules, and scrutiny of data use all pose risks to how Google acquires traffic and monetizes it. On the competitive front, Microsoft and OpenAI, Meta’s open‑source push, Amazon’s cloud AI stack, and Nvidia’s platform gravity are all vying for the same developer mindshare and compute budgets.

Product strategy also carries trade‑offs. AI‑enhanced search must elevate user trust and speed without cannibalizing the ad formats that fund it. If AI answers reduce click‑throughs, Google needs to prove that new commercial surfaces and higher intent signals can offset any shifts in traditional search behavior.

Why This $4 Trillion Valuation Milestone Matters Now

For investors, Alphabet’s ascent validates the thesis that AI, search, video, and cloud can compound together at massive scale. For consumers and developers, it signals that Google’s models are increasingly embedded in the products people use daily—now reinforced by marquee partnerships that extend reach beyond Google’s own ecosystem.

The $4 trillion moment is symbolic, but the substance behind it—durable cash generation, AI distribution at planetary scale, and a deep technical stack—will determine whether Alphabet can make this level the new baseline rather than a fleeting peak.