Redwood Materials has expanded its Series E funding to $425 million with Google joining the round, a bet that the startup’s battery recycling and energy storage push can help power a wave of AI data centers hungry for reliable, low-carbon electricity. The raise adds fresh strategic momentum alongside Eclipse, Nvidia’s NVentures, and returning backers Capricorn and Goldman Sachs.

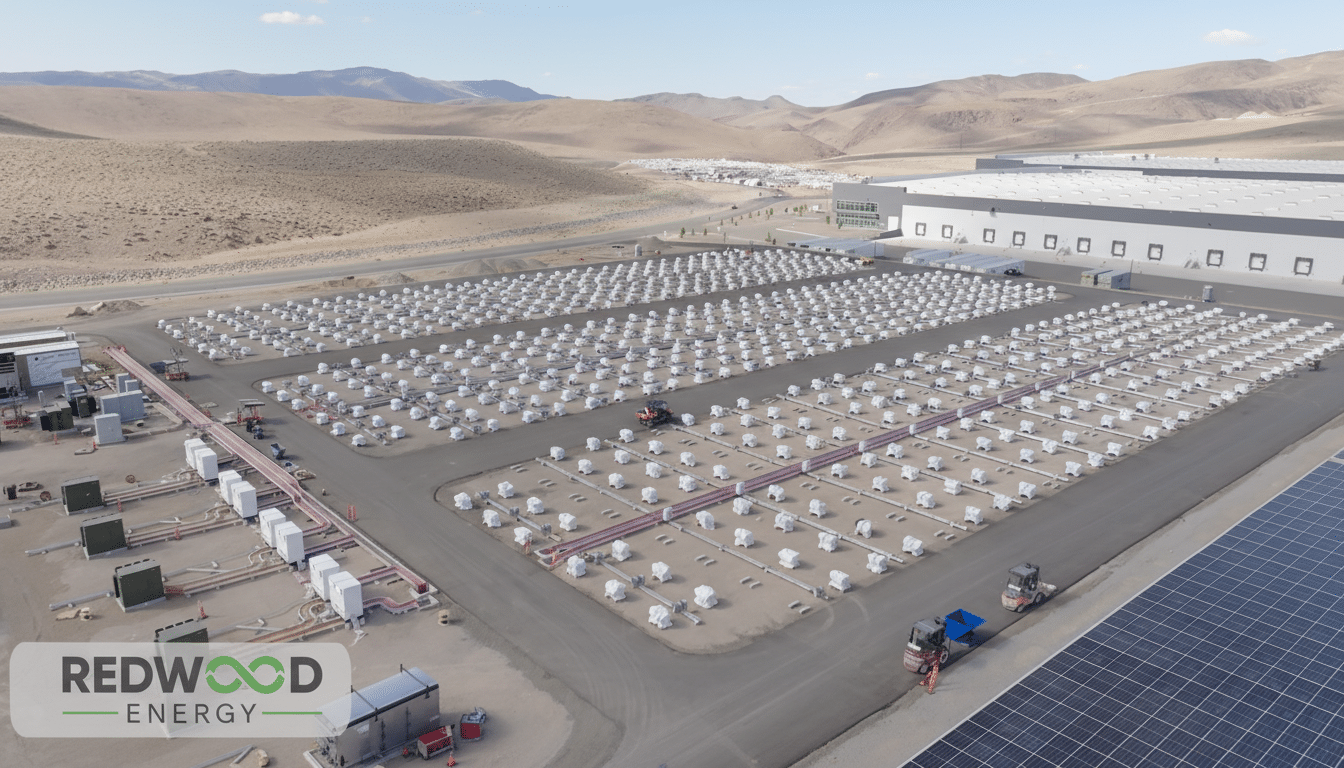

Founded by former Tesla CTO JB Straubel, Redwood has moved beyond recycling into cathode production and grid-scale storage, positioning itself at the intersection of the battery supply chain and the compute boom. Its new business unit, Redwood Energy, repurposes electric-vehicle packs into modular microgrids designed to keep AI clusters and industrial sites humming when the grid can’t.

Why Google Is Betting on Energy Storage for AI

Hyperscalers are grappling with a crunch: AI training and inference are lifting power needs at a pace that conventional grid upgrades and renewables alone can’t match. Google has publicly committed to 24/7 carbon-free energy across its operations, a target that makes firm, dispatchable storage a strategic necessity rather than a nice-to-have. Equity stakes in solutions that close the gap between intermittent generation and around-the-clock demand are a logical extension of that strategy.

Second-life batteries create a further edge. Compared with new cells, repurposed packs can lower costs and embodied emissions while speeding deployment, provided testing and warranty systems are robust. Redwood says it already captures more than 70% of used or discarded battery packs in North America—feedstock that can be triaged for reuse or recycling, improving both economics and sustainability.

From Recycling to Cathode Production and Grid-Scale Power

Redwood was built to close the loop on critical materials like nickel and lithium, processing scrap from consumer electronics and EV manufacturing and supplying refined inputs to cell makers such as Panasonic. Adding cathode production extended its reach into the upstream value chain; the launch of energy storage pulled the company downstream into power markets, completing a rare end-to-end footprint.

The company has stated it holds more than 1 gigawatt-hour of second-life battery inventory with several additional gigawatt-hours inbound, and it targets 20 gigawatt-hours of grid-scale storage deployments by 2028. That pipeline hints at a business that can both scale and diversify revenue—selling refined materials to battery manufacturers while installing storage assets that attract long-term offtake from data centers and heavy industry.

Institutional support has followed. In addition to private capital, Redwood has secured federal backing to expand domestic battery materials manufacturing, aligning with policies aimed at onshoring clean energy supply chains. The combination of public incentives and strategic investors like Google and Nvidia underscores how energy and compute are converging.

AI Power Demand Sets the Backdrop for Data Centers

Energy agencies and consultancies have flagged a sharp rise in data center electricity use. The International Energy Agency has projected that global data center consumption could roughly double within a few years, while McKinsey has estimated that U.S. data center load could climb dramatically this decade as AI workloads scale. Interconnection queues in major markets and local grid constraints are slowing new capacity, pushing operators to pair on-site or near-site storage with renewable contracts to secure firm power.

In that context, storage acts as a bridge between procurement and availability. Batteries can buffer utility-scale interties, arbitrage peak pricing, and provide backup for mission-critical clusters. Second-life packs add an additional lever: more affordable storage that accelerates timelines without waiting for new cell factories to ramp.

Competitive Landscape And Differentiation

Large incumbents like Tesla, Fluence, and CATL dominate new-build storage, while a cohort focused on second-life applications—such as B2U Storage Solutions and Connected Energy—has proven that repurposed batteries can work at scale. Redwood’s differentiator is vertical integration: it sources, tests, and redeploys used packs, then recycles them at end-of-life and feeds recovered materials back into cathode production. That closed loop can compress costs, lower lifecycle emissions, and reduce supply risk.

For Google and other hyperscalers, that model offers flexibility. Storage assets can be configured as behind-the-meter microgrids for latency-sensitive AI clusters or deployed as grid-scale systems that provide capacity, frequency response, and demand charge management. With NVentures also in the round, the investor mix mirrors the emerging reality that energy infrastructure is now core to AI competitiveness.

What the Funding Signals for AI-Driven Energy Storage

The expanded Series E signals that energy storage—particularly second-life storage—is moving from pilot projects to essential infrastructure for compute. Expect Redwood to prioritize long-term offtake agreements with data center operators, partnerships with utilities for grid services, and scaled facilities that can process, certify, and deploy repurposed packs at industrial speed.

If Redwood hits its deployment targets, its storage fleet could become a meaningful slice of capacity for new AI campuses, while its recycling and materials business increases domestic supply resilience. For investors like Google, it’s a direct way to secure the infrastructure that will power the next wave of AI—and to do it with a lower-carbon footprint.