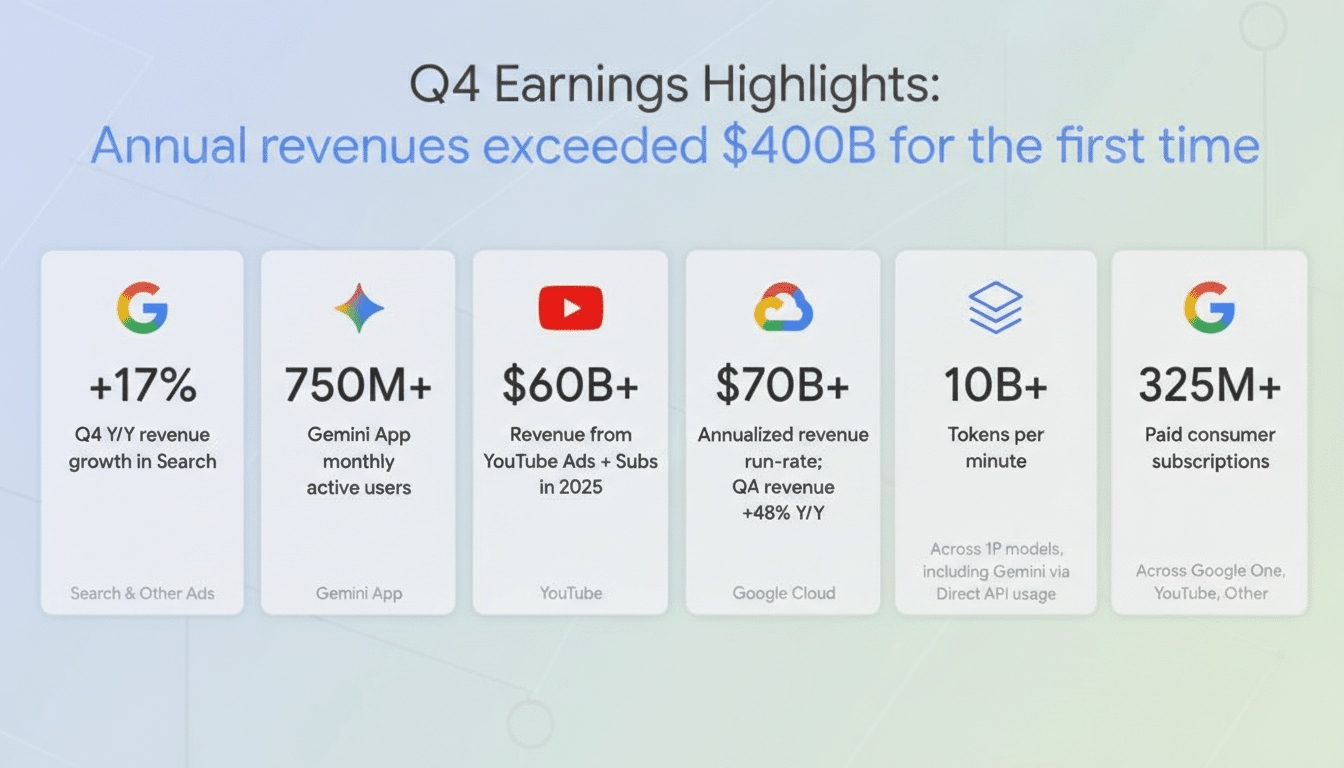

Google’s Gemini app has crossed 750 million monthly active users, according to the company’s latest earnings disclosure—an eye-catching threshold that underscores how quickly consumer AI is moving from novelty to daily habit. That figure is up from 650 million last quarter, a gain of more than 15% in just a few months, and places Gemini among the most widely used AI assistants globally.

The milestone puts Gemini in close contention with market leader ChatGPT, which industry estimates pegged at roughly 810 million monthly users late last year, and ahead of Meta’s AI assistant, reported at nearly 500 million users. In other words, the top end of the consumer AI market is consolidating around a handful of products with enormous reach.

What drove the surge in Gemini monthly active users

Two levers stand out: product capability and distribution. The launch of Gemini 3 elevated answer quality and multimodal reasoning, a shift Google executives described as a direct contributor to engagement. More natural conversational behavior—fewer dead ends, better context carryover, and stronger code and image understanding—translates into longer sessions and stickier usage.

On distribution, Google is leaning on its mobile footprint and search adjacency. Deep integration across Android surfaces, from the home screen to share sheets, lowers friction for first-time and repeat use. Meanwhile, the Gemini app benefits from Google’s broader funnel: users encountering AI features in Search and Workspace often graduate to the standalone assistant for focused tasks.

Pricing also matters. The new Google AI Plus plan at $7.99 per month undercuts many premium AI subscriptions that hover around the $20 tier, positioning Gemini as a budget-friendly upgrade path while preserving a robust free tier. Google’s chief business officer, Philipp Schindler, told investors the company is deliberately balancing free access with subscriptions to expand the top of the funnel and convert power users.

How Gemini stacks up against other leading AI assistants

Size is only part of the story. Google reported its first-party models now process more than 10 billion tokens per minute via direct API use—a sign that developer and enterprise workloads are scaling in parallel with consumer adoption. This dual-track growth is strategically important: consumer engagement sharpens the model, while API demand monetizes infrastructure and closes the loop on R&D.

Against competitors, the picture is nuanced. OpenAI’s ChatGPT remains the benchmark for cutting-edge reasoning and developer mindshare, while Meta’s AI is rapidly gaining distribution through messaging and social surfaces. Gemini’s advantage is breadth: tight ties to Search, Android, and Workspace create built-in use cases—summarizing documents, drafting emails, troubleshooting code, or interpreting images—that recur in everyday workflows.

Analyst firms like Gartner and IDC have projected sharp increases in enterprise spending on generative AI, and Gemini’s momentum suggests Google is well placed to capture a share of that wallet, particularly where AI lines up with existing Google Cloud and Workspace deployments.

Monetization And The Infrastructure Edge

Alphabet surpassed $400 billion in annual revenue for the first time, and leadership has tied part of that trajectory to AI. To support usage at this scale, Google introduced Ironwood, the latest generation of its TPU AI accelerator, a move aimed at improving inference efficiency and reducing per-query costs. Lower unit costs matter when hundreds of millions of users ask for help, often multiple times per day.

The pricing ladder—free, $7.99 AI Plus, and enterprise tiers—creates a clear upgrade path. Expect Google to bundle storage, advanced multimodal features, or priority access into higher tiers to lift ARPU without compromising mass-market reach. For advertisers, the long-term opportunity is task-level intent: when a user asks Gemini to plan a trip or compare products, high-signal commercial moments emerge that Google can connect to its existing ads ecosystem with careful guardrails.

Culturally, this scale presents responsibility questions. As assistants become ever more capable, safety, attribution, and transparency are under scrutiny from policymakers and researchers. Google’s recent emphasis on evaluation benchmarks, red-team testing, and provenance signals will need to keep pace with the app’s growth and expanding feature set.

What comes next for Gemini and Google’s AI roadmap

Short term, watch for deeper on-device features that reduce latency and enable private, offline tasks on capable hardware, plus tighter coupling with Google services like Photos and YouTube for richer multimodal prompts. International expansion and localization will also be critical—accuracy in more languages and dialects often unlocks new tranches of users.

The headline is clear: at 750 million monthly users, Gemini is no longer an ambitious experiment—it’s infrastructure for how a vast audience searches, creates, and gets things done. If Google sustains its cadence on model quality, pricing, and distribution, the gap between AI as a standalone app and AI woven into everyday products will continue to shrink—and Gemini will be the thread pulling it together.