General Catalyst is making one of the largest single-firm bets on India’s startup ecosystem, committing $5 billion over the next five years to back companies across artificial intelligence, healthcare, defense technology, fintech, and consumer technology. The plan, unveiled at the India AI Impact Summit in New Delhi, marks a step-change from the $500 million to $1 billion the firm had previously earmarked for the country.

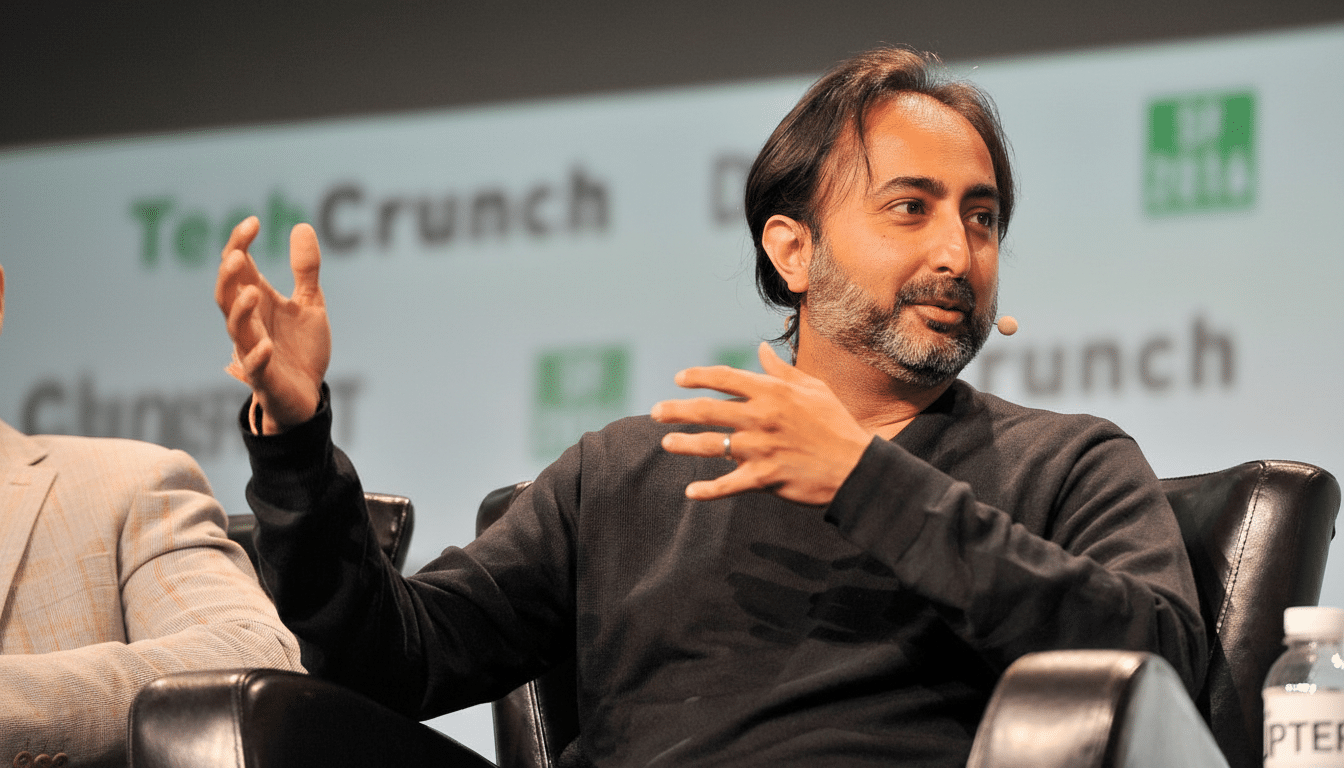

“India will build the next generation of global platform companies,” said General Catalyst CEO Hemant Taneja, underscoring the firm’s thesis that Indian founders can build for massive populations and export solutions globally. The Silicon Valley firm, which manages more than $43 billion in assets, deepened its local roots by merging with India-focused Venture Highway and has been steadily scaling its presence since.

Why General Catalyst Is Making This India Bet Now

India is racing to become a global AI hub, with policymakers seeking more than $200 billion in AI infrastructure investment and convening heavyweight participants including OpenAI, Anthropic, and Google. The country combines a vast digital user base—over a billion internet users—with public digital rails like IndiaStack, where UPI alone now processes well over 10 billion transactions monthly, creating fertile ground for data-rich, AI-enabled services.

General Catalyst’s view is that India’s edge is not in chasing frontier model supremacy but in large-scale, real-world deployment: embedding AI into financial inclusion, public health, logistics, education, and industrial operations. That stance aligns with India’s bottom-up digitization, from Aadhaar to the Open Network for Digital Commerce (ONDC) and the Ayushman Bharat Digital Mission, which offer ready-made platforms for AI to move beyond pilots.

Where General Catalyst Plans To Deploy Capital In India

The firm says it will prioritize companies that can convert proofs of concept into production deployments across priority sectors. It is developing a framework to accelerate adoption—helping founders navigate enterprise integration, procurement, and regulatory workflows—so pilots don’t stall. Through the General Catalyst Institute, the firm is also building public–private partnerships to speed policy-to-market translation.

General Catalyst’s India portfolio already spans fast commerce, health tech, and deep tech, with investments in Zepto, PB Health, Raphe, Jeh Aerospace, Pronto, and Ayr Energy. The new commitment positions the firm to lead or co-lead larger rounds, finance capex-heavy builds in areas like data infrastructure or manufacturing-heavy defense tech, and stay with outperformers from seed to IPO.

“This investment allows us to operate at a different scale in India,” said Neeraj Arora, who leads the firm across India, the Middle East, and North Africa, noting the intent to back founders end-to-end through the public markets.

India’s Escalating AI Infrastructure And Compute Build-Out

The commitment lands amid an aggressive infrastructure build-out. At the same summit, Adani Group and Reliance Industries outlined plans to invest more than $200 billion combined to construct AI-ready data centers. OpenAI has partnered with Tata Consultancy Services to develop a 100-megawatt AI data center as part of its broader expansion, while Amazon, Google, and Microsoft have each laid out multibillion-dollar cloud and AI investments in the country.

These moves address a practical bottleneck: compute and power. India’s data center capacity is expanding rapidly, aided by state incentives and evolving guidance from the Ministry of Electronics and Information Technology, but grid reliability, land acquisition, and renewable integration remain execution challenges. For investors like General Catalyst, local compute can compress deployment cycles and data compliance friction, clearing a path for production-scale AI.

What This Means For Indian Founders, Growth And Exits

For founders, the $5 billion pledge could help close the late-stage capital gap that has hampered scaling in the wake of the funding reset. Analyses by Bain & Company and IVCA-EY have noted a pullback in mega-rounds and a sharper focus on profitability; a deeper pool of patient growth capital improves the odds for category leaders in fintech, health systems, industrial AI, and defense to reach public-market readiness.

Crucially, India offers live testbeds: ONDC for commerce interoperability, the health stack for clinical and claims data, and expansive public-sector procurement. That enables AI-native startups to prove ROI in logistics (forecasting and routing), agriculture (yield and input optimization), and public health (triage and diagnostics), then expand into global markets with evidence from large-scale Indian deployments.

Key Risks, Constraints, And Execution Milestones To Watch

Scaling AI in India still faces hurdles: data governance and privacy compliance, energy availability for compute, variable procurement timelines, and the complexity of regulated sectors like healthcare and defense. Currency volatility can affect dollar returns, and competition for senior AI talent is intensifying. Yet General Catalyst’s strategy—favoring deployment over pure research and coupling capital with policy and enterprise know-how—aims to de-risk those factors.

The milestones to track now are concrete: the first wave of production deployments financed under this program, the pace of AI infrastructure coming online, and whether portfolio companies convert Indian scale into resilient global revenue. If execution matches ambition, General Catalyst’s $5 billion bet could both catalyze and benchmark India’s transition from AI potential to AI productivity.