Shareholders of Fubo have approved the company’s deal with Disney to merge Fubo with Hulu Live TV, setting up one of the most significant shake-ups in the market for streaming live TV. The deal — which is still subject to regulatory scrutiny — would bring the enlarged service under one operating umbrella, but keep Fubo available as an independent offering. Disney is due to have roughly a 70% stake after the transaction and Fubo co-founder David Gandler is set to run the combined live TV operations.

What The Vote Clears, And What’s Still There

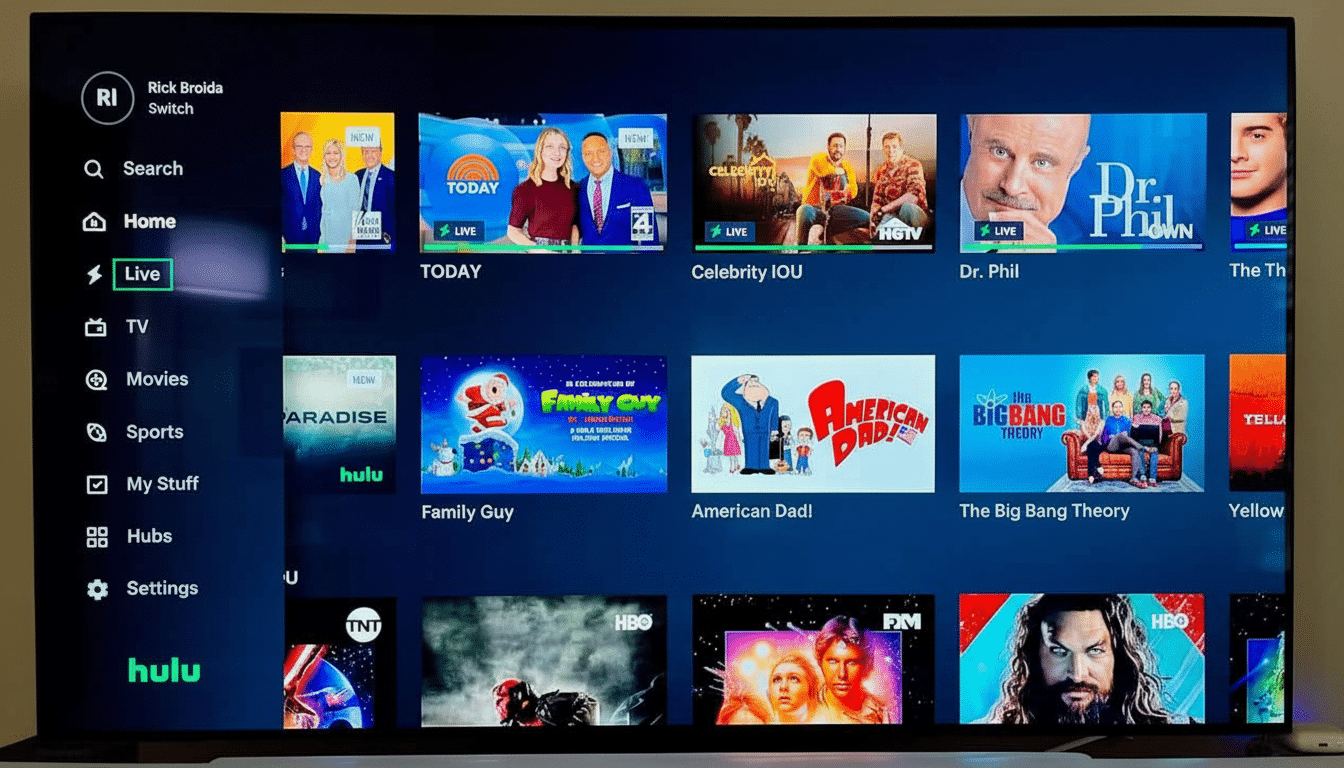

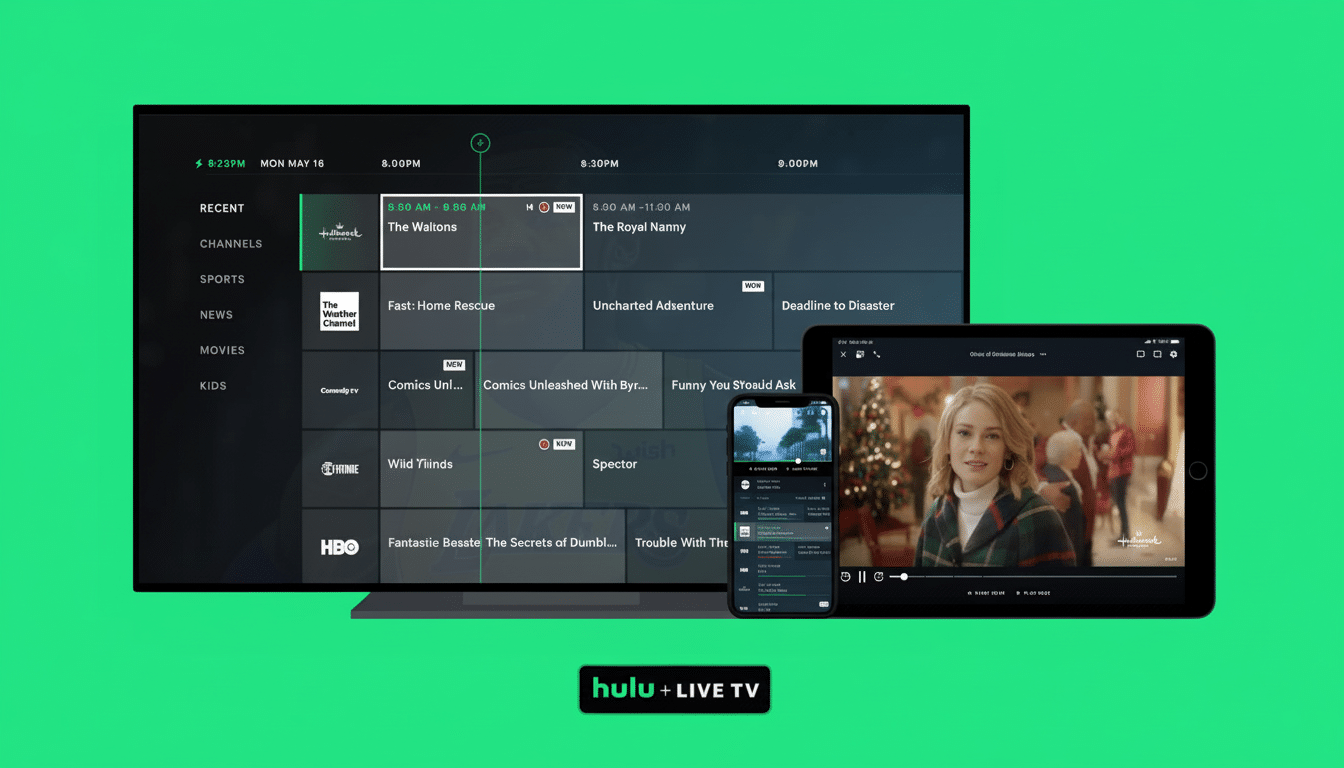

An approval by the companies’ shareholders clears a major hurdle and allows them to begin preparing operationally and aligning products. Again, the formal approval doesn’t mean a fast close: U.S. regulators are expected to review how the deal further consolidates an already concentrated vMVPD category in which a small number of services amass the vast majority of linear channels and sports rights. Company executives have indicated that the two brands will survive, with Fubo as a sports-forward offering and Hulu Live TV favoring a wider mix of entertainment and news.

The combination would offer a more extensive channel lineup and, in theory at least, more clout in carriage talks — an area of sensitivity for both programmers as well as leagues. Underneath it all, integration will require the most complicated kind of stitching together of billing systems, ad tech stacks, recommendation engines and cloud DVR architectures — exercises where execution will make or break whether the deal unlocks cost efficiencies or drives subscribers crazy with transition friction.

Pressure Mounts on YouTube TV as Rival Grows Stronger

YouTube TV is the category leader, with a potential audience approaching 10 million people because of high-profile sports rights and aggressive marketing. For comparison, Hulu Live TV and Fubo combined have approximately 6 million subscribers, according to industry projections reported by analysts. Closing that gap will have less to do with a single headline merger, and more to do with slowing churn, expanding sports access and at long last streamlining the value proposition for price-sensitive cord-cutters who are quick to hit cancel.

Leichtman Research Group has recorded continued virtual pay-TV growth even as traditional cable contracts, with the vMVPDs sitting at around 20 million subscribers in the U.S. A better No. 2 could also ratchet up competition on sports features — 4K streams, multiview, low-latency feeds — and reliability during peak moments, where YouTube TV’s coverage of NFL Sunday Ticket has established a new gold standard in performance and breadth for consumers.

Bundles And Pricing: The Sports Fan Proposition

People familiar with the planning said the companies are considering a Hulu-branded package for streamers that would include Disney+ and ESPN at no cost to certain tiers of subscribers — an augmentation of what has been a critical part of the Disney streaming strategy, the bundle. Fubo, meanwhile, has experimented with a skinny sports-only package at a lower price point, indicating a desire to reach fans who just want live games without a full roster of entertainment.

That two-tier approach — packaging premium for the households that want it all, leaner tiers for more price-sensitive sports viewers — is consistent with what Antenna and other researchers observe about subscriber dynamics: bundles raise average revenue per user and reduce churn, thinner packages widen the funnel. For leagues and networks, a bigger combined distributor could mean broader reach — and thus steadier affiliate fees — but also more difficult negotiations on rates, as well as in how digital rights get carved up.

Regulatory Scrutiny and Market Power Concerns Ahead

And get ready for the Federal Trade Commission and the Department of Justice to parse two questions closely. There’s horizontal concentration in the vMVPDs, and when there are few players to choose from, consolidations can reduce choice both for consumers and for programmers that want distribution. Second is vertical influence: Disney’s ownership of ESPN and a controlling interest in the combined service raises issues about whether rival sports networks will be disadvantaged in preferential placement, data access and carriage terms.

Regulators could also opt for behavioral remedies — commitments to fair carriage, data firewalls and maintaining standalone offers — rather than a structural divestiture. Recent sports streaming plays — like Disney’s partnership with Fox and Warner Bros. Discovery — and the corporate ambitions of Discovery to compete with ESPN by creating a multi-network sports service will lend color to the review as well. The crucial test will be whether the deal puts competitors at a significant disadvantage, or brings lower prices and better service to viewers overall.

Leadership Integration And Execution Risk

The move to put David Gandler in charge of the combined live TV operations indicates continuity of purpose around the sports-first thesis Fubo has been known for. In the near term, we’ll see attention paid to aligning product roadmaps — think multiview, 4K availability, and smart ad insertion — and avoiding the pratfalls of former pay-TV integrations, from muddled lineups to account migrations that cause involuntary churn.

Investors will be looking for a clear pricing strategy, transparency on metrics like churn and engagement, and disciplined cost control over programming. If the companies can provide a cleaner bundle, more-flexible sports access and consistent performance during tentpole events, they will have a viable counterweight to YouTube TV. If not, the market might interpret the deal as scale without synergy — big on paper but leaky at the bottom of the funnel.