A founder who attempted to combat bloated costs of custom home construction has raised more money to go faster with an AI-driven approach at something similar, but different: assembling homes piece by piece on developer-owned lots in the urban core.

A Second Act With a Leaner, AI-First Playbook

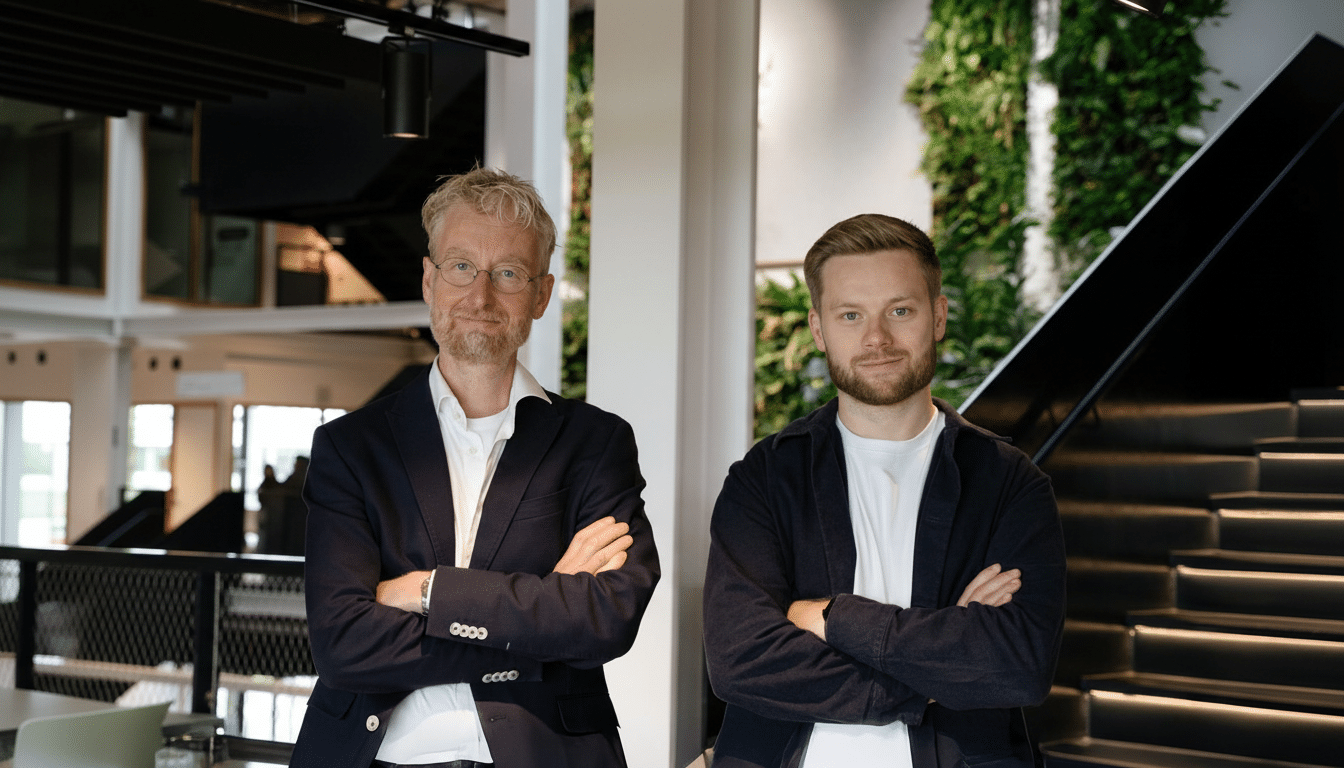

Nick Donahue, whose first startup, Atmos, connected in-house designers and software to deliver made-to-order homes to buyers, is taking what he learned in his inaugural run for real estate development and applying that for the other end of the housing market — renting. Atmos grew to dozens of employees, grossed millions of dollars in revenue and delivered dozens of homes, but it was ultimately felled by complexity around operations and a savage interest-rate cycle that left new, expensive decisions cold for many would-be buyers.

Drafted flips that model. No design team, no cumbersome services — just AI that can spit out residential floor plans and exterior concepts in minutes. The company has raised even more — $1.65 million at a $35 million post-money valuation — from the likes of Bill Clerico, Stripe co-founder Patrick Collison, Jack Altman, Josh Buckley, and NBA guard Moses Moody. Of the six-person team, four are veterans of Atmos — providing Drafted with instant institutional memory without any bloat in business process.

Why Affordability Is The Wedge for Wider Adoption

The luxury of custom home design is out of reach for most first-time or move-up buyers. The American Institute of Architects, for instance, says that full-service architectural fees tend to run about 8% to 15% of construction costs — and on a single-family home, that number might easily become many tens of thousands of dollars. On the other extreme, commercially available stock plans from popular clearinghouses are inexpensive but inflexible, with minimal opportunities for structural modifications or accommodations for local code anomalies.

Drafted’s pitch: to split the difference, offering you premium options at template prices. The company says full sets of plans run $1,000 to $2,000. It’s not a matter of replacing architects in every instance, but making design optional — and affordable — for a much broader pool of homeowners.

How The Tech Works To Generate Permit-Aware Plans

Drafted created a domain-specific model to learn from actual house plans that have been built and permitted under the International Residential Code, focusing on practicality rather than photorealistic fantasy. The narrow task focus enables extremely low inference costs: each floor plan the company generates runs at roughly 0.2¢, it says, rather than around 13¢ for a general-purpose model generating comparable design output — an order-of-magnitude difference that matters at consumer scale.

Currently, the product has support for single-story homes. Multiple stories, lot-aware constraints, and permit set automation are on the roadmap.

For each brief, Drafted returns several possible designs — bedrooms, square footage and circulation preferences among them — so that the process of deduction can continue until a concept clicks. The pitch is not just speed but also fewer dead ends: designing begins with the boring-but-important guardrails that stymie many first-timers.

The Market Reality Check For AI Home Design

There are just about 1 million homes built in the U.S. each year, but not as many of them are custom — industry estimates frequently put the figure at 20% to 30%, with buyers choosing an existing home or a builder’s stock design.

Demand has been remolded by the volatility in mortgage rates, with interest rates that were lifted by Federal Reserve tightening last year taking back many discretionary projects. That macro shock helped drive Atmos underwater and remains Drafted’s greatest outside risk.

The company’s early traction indicates genuine interest: Drafted has seen about 1,000 daily users since opening up access, modest but steady for a young tool. The big question is conversion: can ultra-low-cost, permit-aware design convert passers-by into plan purchasers and then future completed homes that don’t bog down in months-long local plan check revisions?

There’s also the moat problem. In theory, a well-funded AI lab or vertical software player could train on similar datasets and ship a competing tool. Drafted is betting on specialized data, unit-cost advantages, and brand — akin to how a handful of generative media tools have maintained loyalty amid model proliferation. Reputational flywheels in housing are grounded on results: plans that regularly clear permitting, builders who recycle the platform and homeowners who refer it.

What Success Looks Like For Drafted’s Second Act

Key milestones to monitor: share of Drafted plans that get through the first-round municipal review; average time from concept to permit set; and repeat usage by small builders. Integrating the tools elsewhere in design and construction processes — say, Autodesk Revit handoff, energy code compliance summary or site-specific setbacks — would close the gap between a pretty rendering and a shovel-ready plan even more.

If Drafted can squeeze design work that takes months and tens of thousands of dollars into days and a couple thousand, it widens the addressable market. That could help move the custom segment up, even in a sluggish economy. The larger idea is evident: a world where the notion of the personalized floor plan isn’t an added-on luxury feature but just another basic starting point — priced like software, not bespoke service.

Donahue’s first go-around demonstrated the demand but also exposed the operational pitfalls. The second is a cleaner bet: that in residential design, automation trumps overhead and affordability — delivered dependably — wins.