Guessing is what makes money stressful. The fastest way I know to reduce that stress is by making a plan for every dollar, automating the boring stuff and improving decision-making with timely information. Five apps make up my toolkit to get it done, from budgeting to investing to daily market context.

This mix isn’t of hot tips; it is a system. That is significant, at a time when surprise expenses are typical and headlines can move markets. The household well-being survey carried out by the Federal Reserve has for years found that millions of Americans would struggle to deal with an unexpected emergency involving a few hundred dollars, which is why I put structure first and growth second.

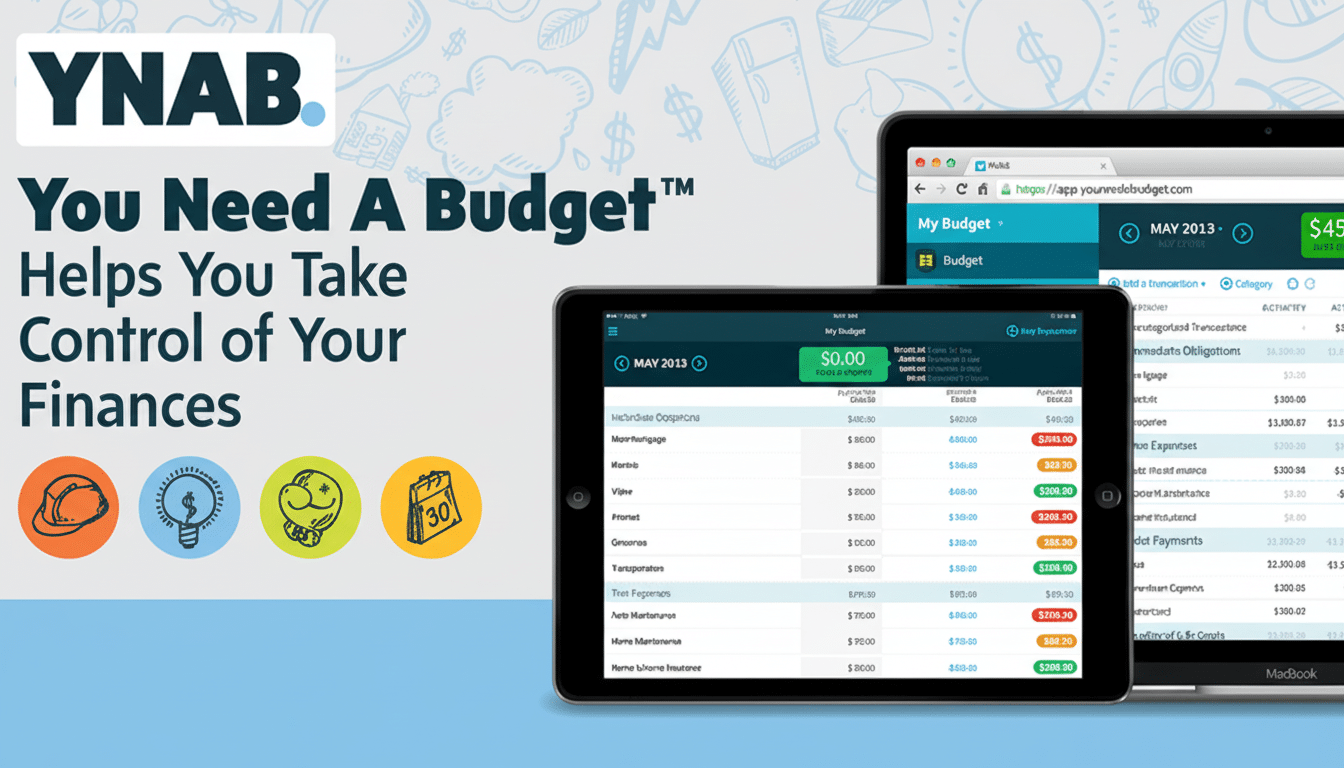

A budgeting system that sticks and tames surprise bills

You Need a Budget makes zero-based budgeting more muscle memory. I assign every incoming dollar a job — mortgage, groceries, annual bills and future goals — instead of tracking it after the fact, so there’s no “miscellaneous” when money comes in. When I know that my auto insurance is coming in once a year, I park a twelfth of it every month; the bill ceases being an emergency.

The learning curve is steep and the subscription isn’t cheap, but it’s worth it for the clarity. Advisers like the CFPB and studies cited by FINRA have long found a correlation between disciplined expense tracking and reduced overdrafts or dependence on high-interest credit. In reality, a rules-based budget boils down to less stress and fewer nasty surprises, all while the emergency fund gets fatter.

About a trusted broker with global reach

For investing, I use Interactive Brokers, because it does all the unglamorous stuff well: access to hundreds of global exchanges, strong foreign-exchange tools and professional-grade order types when I need them.

I could maintain a core of wide index funds, and I could still buy individual stocks or ETFs with tight execution. U.S. customers also get SIPC coverage, which is table stakes for any kind of peace of mind.

Just the low-friction FX alone can be (literally) real money — bank markups on currency conversion can quietly consume 2% or more. Prune that drag and your long-term returns have a tailwind. I haven’t warmed up to contributions yet myself, because decades of SPIVA scorecards show that most active managers underperform their benchmarks over time.

A market dashboard for quick context and smarter moves

Koyfin is my daily snapshot. One of my screens shows major indices, sector heat maps, a few commodities — oil and gold — and rates and credit at a glance. I keep watchlists for my core holdings and a separate list for names I’m studying, so that I can see if a move is company-specific or part of something larger.

The free tier’s limitations (fewer watchlists and a shorter financial history) are fine for most long-term investors. More, I want to know whether, for example, a selloff is confined to small caps or whether energy is leading on supply news. That framework keeps me from responding to noise and enables me to time routine buys without attempting to trade every wiggle.

Stories that walk you through the markets

For news on markets and the latest earnings news, I rely more on MarketWatch. Its warnings about CPI and jobs reports, Federal Reserve meetings and big company results help me distinguish signal from noise. When the Bureau of Labor Statistics reports inflation data or a bellwether issues guidance, having something short written the moment that comes out makes a difference.

I still avoid overtrading. Those are the kinds of headlines that can cause almost anyone to chase. But combining a trusted news feed with a pre-established plan — what I’ll buy, what I’ll hold and under which circumstances I will rebalance — keeps decisions in reality rather than on impulse.

An AI copilot and recaps to accelerate learning

Gemini is my hack for customized digests and last-minute refreshers. And I’ll request a plain-English summary of the previous trading day across all the indices, leading movers with probable catalysts, and what lies ahead today. It’s quicker, for example, than skimming through a dozen tabs, and I can ask exactly the detail I am searching for.

I also have used it as a study buddy — explain CPI versus PCE, give me an investment thesis template, hit me on option Greeks. Like any AI tool, I vet numbers against primary sources such as company filings and the Federal Reserve and the BLS before acting. Deployed this way, it makes things faster with no loss of accuracy.

How I combine them for less stress and steadier progress

My routine is simple. I will re-budget weekly, so every dollar continues to have a job. Contributions to my investments are also automatic, another strategy that Vanguard’s research, including its How America Saves report, says has increased both participation and savings rates in retirement plans. Every morning I review Koyfin, skim the top news and ask Gemini for a short summary that applies to my holdings.

The approach is core-and-satellite: broad index funds for much of the portfolio, some researched bets on the side, and then firm orders to rebalance rather than chase. That discipline, supported by data and automation, has made financial goals start to feel attainable — not to mention far less stressful.