The Federal Communications Commission has taken steps to bar approval of new foreign-made drones and other radio-frequency devices in the United States, a move that could help to curtail widespread use of Chinese devices in the country’s skies. It halts new models and parts from obtaining the FCC approvals necessary to be sold, but does not really impact products already certified or existing owners.

What the FCC order actually changes for drone approvals

At the center is equipment authorization. FCC testing and certification is required for any device that transmits wirelessly in the US. By including foreign-made drones and crucial radio modules on its Covered List of security risks, the agency is effectively closing the pipeline for future products and replacements that use those radios. FCC Commissioner Brendan Carr has noted that this doesn’t ground in-place fleets, or halt sales of equipment for previously approved models.

- What the FCC order actually changes for drone approvals

- Why DJI is targeted under the FCC’s new authorization rules

- Security Rationale and Policy Background

- The Immediate Impact on Pilots and Agencies

- Who stands to benefit from the FCC action on foreign drones

- What comes next for pilots, agencies and drone makers

Practically speaking, that means retailers will be free to continue selling stock they’ve cleared, but new drones waiting for approval, UltTech remotes and modules, and some repair parts that need certification will no longer be able to be lawfully imported. The ripple effect is larger than hobbyist quadcopters—it extends to enterprise platforms, public safety fleets, and industrial UAS that rely on proprietary radio links.

Why DJI is targeted under the FCC’s new authorization rules

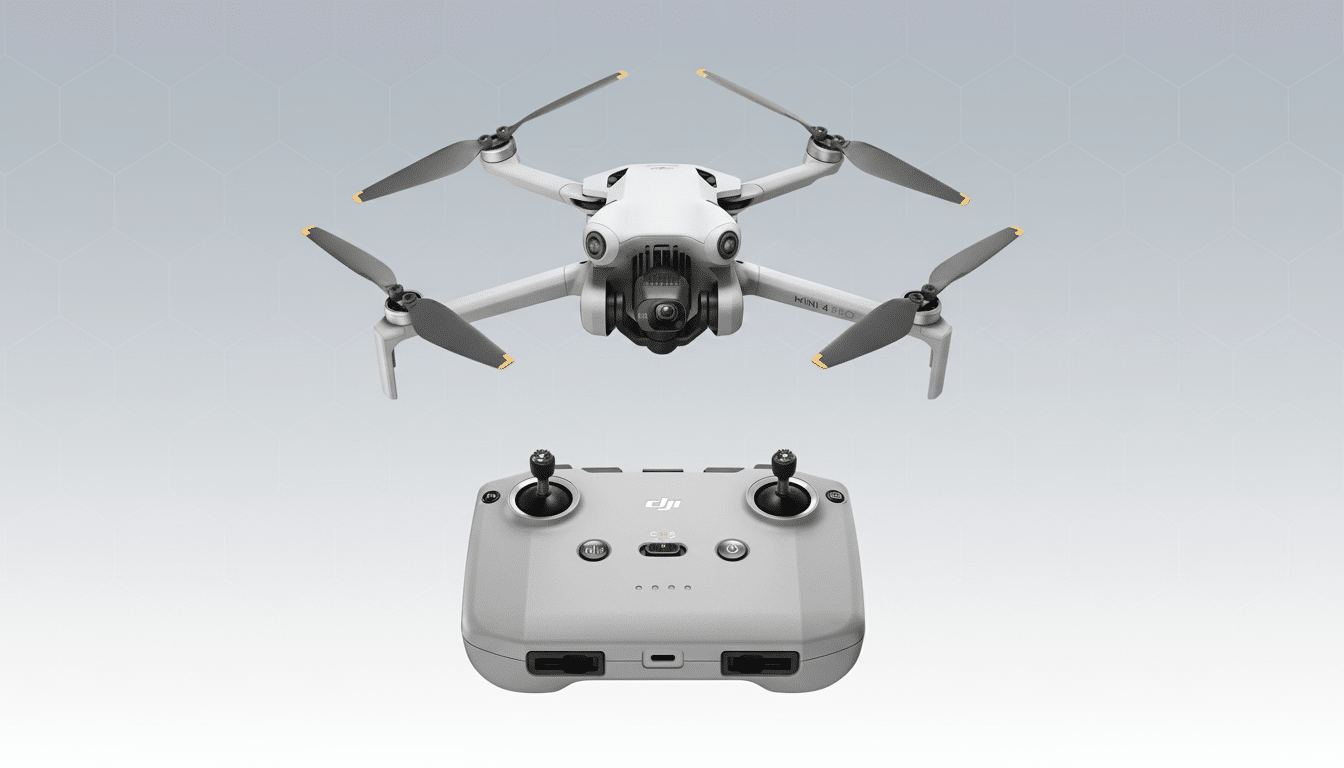

DJI controls the majority of the US market, so has the most to lose if it is hit by a freeze on new authorizations. Independent research houses like DroneAnalyst have consistently measured DJI’s market share of North America at over 70% on product markets from consumer camera drones to prosumer and light commercial vehicles. Its value proposition — best-in-class sensors, software, and pricing — has made it the de facto go-to for many pilots.

Public safety is especially sensitive. DJI has claimed that more than 1,800 federal, state and local agencies in the United States rely on its drones for purposes like search and rescue, wildfire monitoring, crash reconstruction and tactical response. Blocking production approval for new models and radio components calls into doubt future procurement, upgrades and long-term sustainment of those fleets.

Security Rationale and Policy Background

The FCC casts the order as a national security move to mitigate risks posed by unauthorized surveillance, data exfiltration and the disruption of uncrewed aircraft. It follows a broader government posture: The Department of Homeland Security has issued warnings against foreign-made UAS in multiple advisories, the Department of Defense champions for federal buyers a vetted “Blue UAS” list and Congress has enacted measures to head off government use of drones from certain foreign entities.

DJI, which was added in 2020 to the US Commerce Department’s Entity List of companies over human rights fears, has long denied allegations that it improperly shared data with or connected to foreign authorities. The new FCC maneuver doesn’t explicitly name DJI, but previous statements by US officials have specifically targeted the brand, and the real-world impact of a new-authorization blockade would be felt most keenly where market share is highest.

The Immediate Impact on Pilots and Agencies

For consumers, little changes overnight if you already fly a certified model. You can continue to fly, register with the FAA and follow Remote ID requirements. The pain points begin when you want that “next” drone, or need a part for your rig which will require fresh FCC approval — you may suddenly be out of luck. Expect a used market for current-generation aircraft to take off and prices from ready-to-go, already-certified models to firm up.

Agencies face harder choices. Swaths of public safety departments plotted multi-year refresh cycles based on payloads and software ecosystems. The closure of new approvals is hindering grant purchases, maintenance scheduling, and evidentiary flows. Some of them will shift over to “Blue UAS” vendors, but the features, training overhead and total cost of ownership may vary greatly from what current systems teams are familiar with.

Who stands to benefit from the FCC action on foreign drones

Domestic manufacturers may benefit from a rebound. Skydio, Teal Drones (a Red Cat company), BRINC and ModalAI are investing in certified radio stacks and US assembly. European and non-Chinese players like Parrot or Switzerland’s Auterion ecosystem may also capture a tailwind from supply chains with more visibility and radios able to clear certifications. Still, scaling up with demand does require considerable effort, and price parity with DJI isn’t guaranteed.

Market data points to headroom: There are over 860,000 registered drones in the country, according to FAA figures, and that commercial segment is growing at a double-digit clip each year. A small fraction of that replacement and new demand flowing to approved vendors would quickly reshape competition.

What comes next for pilots, agencies and drone makers

There is sure to be legal and policy wrangling. The companies that are affected can apply for reconsideration or contest the order. States that have recently approved their own procurement or disclosure restrictions can align timelines with the federal stance. Agencies will test domestic alternatives, and distributors will rely on supplies they had in stock until then.

For DJI, its very existence in the US depends on a pathway to allowed radios, local assembly partnerships or one of two major policy shifts, none of which are swift. For the wider ecosystem, it represents an inflection point: The balance of power in America’s skies could shift from a single dominant supplier to a more fragmented, security-vetted collection of manufacturers.