Microsoft has managed to stave off a lawsuit over the abuse of its market dominance (binge-watch time: some 20 years). The European Commission approved a package of commitments aimed at addressing the software giant’s tying practices, avoiding the need for the sort of legal showdown that could have resulted in fines worth up to 10% of Microsoft’s global revenues under EU rules.

The agreement is an unusual example of a big tech platform proactively stuffing and reformulating its global product lineup to address European Union antitrust objections. The Commission secured in return time-bound, enforceable commitments that target core aspects the way in which collaboration tools can compete inside enterprise stacks.

What the EU extracted

At the heart of the agreement: Microsoft will sell versions of its productivity suites that do not include Teams at a lower price and will allow customers to pay extra to add on Teams if they want. The unbundled options are not specific to a particular SKU type; they span regular entsyandprise plans, and Microsoft is saying that some of the unbundled editions will be about half as cheap as their bundled counterpart.

And Microsoft pledged to something beyond pricing: interoperability. The firm will provide access to the most important APIs and technical documentation, ensuring third-party messaging and collaboration apps can better interconnect with Outlook, SharePoint, OneDrive and other Microsoft 365 services. It will also allow customers to export data from Teams, thus reducing switching costs for IT departments.

The binding commitments in this regard apply for a minimum of seven years in relation to unbundling and interoperability, while the data portability obligation is based on five years. Related Such “commitments decisions,” as they are known under EU competition law, can be enforced without a finding of infringement by the Entry into The Fine Print Sign up — and receive a free gift.

Why scrutiny was invoked over Teams bundling

The investigation revolved around what’s known as “tying” — when a company binds its powerful product to another service in a way that corners the market. Regulators contended that bundling Teams with Microsoft’s productivity suites, frequently as the default option, allowed it to get a jump on rivals by taking advantage of its existing dominance in email, documents and file-sharing.

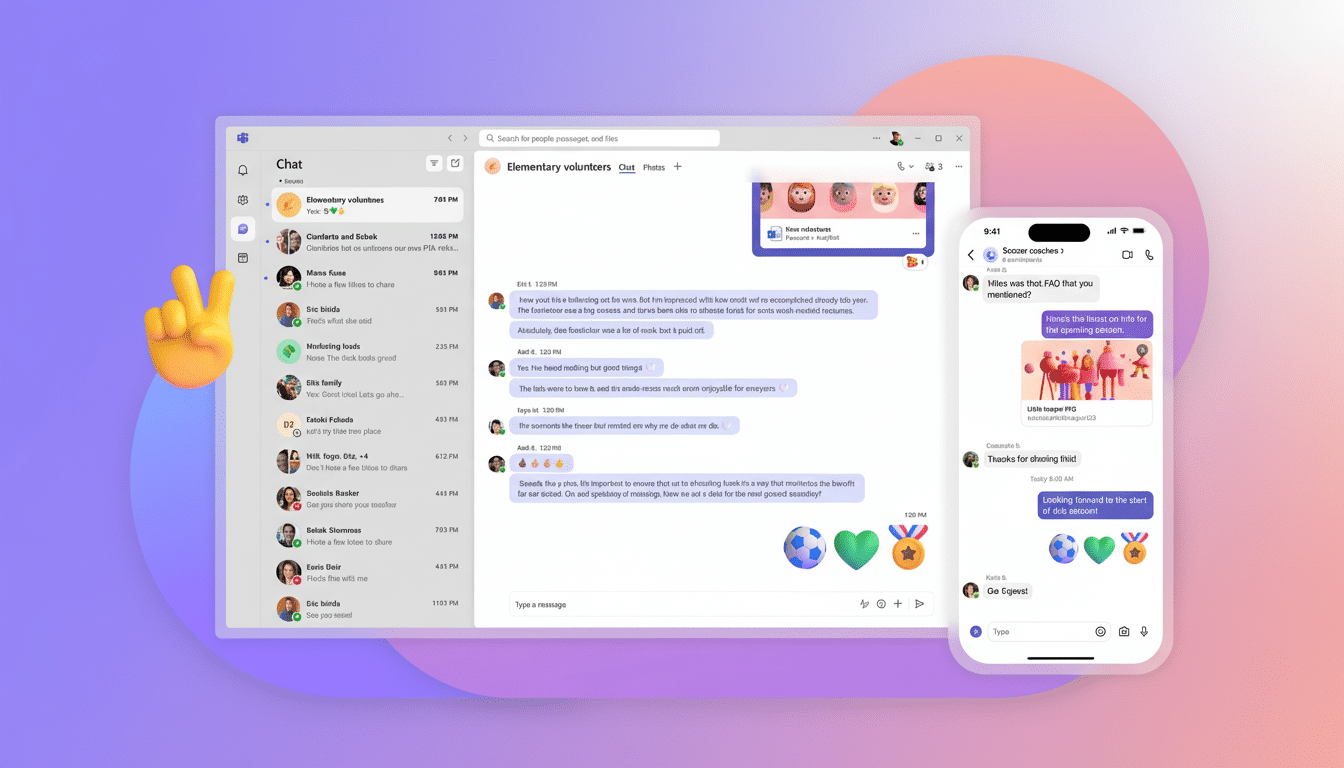

Teams’ deep integrations — click-to-meet right from Outlook calendars, real-time co-authoring through SharePoint, and embedded file access all came to mind — served as quiet moats. That made it easier for customers, but harder for other options like Slack, Zoom Team Chat, Webex or Google Chat to compete on even ground, at least in large businesses that tend to make buying decisions based on the vendor’s overall product suite.

The case follows earlier EU actions over software bundling that ended in billions of dollars in fines, including penalties imposed on Google for distributing its Android mobile software and historic judgments against Microsoft’s browser and media player tie-ins. The commonality: Defaults and distribution are just as important as stand-alone product quality in these winner-take-most digital markets.

Rivals and customers may gain

Slack, whose complaint was one of those that prompted the inquiry and which is now owned by Salesforce, and video-conferencing provider Alfaview both dropped their complaints after the Commission market-tested Microsoft’s proposal. That would imply that the remedies matter to companies in need of both commercial access and technical terms that will allow them to compete.

For CIOs, the unbundling and explicit data export rights might decrease lock-in and make multi-homing — employing more than one collaboration tool — more practical. Cheaper, Teams-free suites make a cleaner price signal: companies can consider other chat and meeting options without feeling like they are paying twice.

Of importance, the interoperability commitments go beyond the generic API. But if Microsoft does build trustworthy calendar hooks, messaging bridges and file-sharing integrations at scale, competitors will be able to tap into Microsoft 365 in ways that have thus far entailed brittle workarounds. And that not only helps competition, it reduces customers’ costs of integrating.

What we don’t know yet

The big test is execution. The Commission is going to keep an eye on whether unbundled SKUs are genuinely available and fairly marketed, not hidden behind sales friction. It will also examine whether the promised APIs provide feature parity — such as presence, messaging, meetings and file operations — not just a more limited set that would maintain Teams’ advantage.

Data portability is another sticking point. “Real” exportability means customers can move chat histories, channels, recordings and metadata in usable ways! If either exports are lossy or throttled, deploying doesn’t get you the right to move in reality.

Finally, pricing must remain transparent. A token discount on a suite without Teams will not in fact incentivize competitive choice if the discounts for bundled plans are more substantial in the real world. The commission has mechanisms to re-examine commitments should results deviate from what is intended, a position that is buttressed by its track record in enforcement of digital platforms.

A pragmatic victory, with guardrails

Microsoft avoids the black eye — and dollar hit — of a formal infringement decision, something that can be significant considering EU fines can amount to a double-digit percentage of global sales, while regulators score an actual remedy without the years of litigation. If unbundling and interoperability gain traction, the collaboration market ought to increasingly resemble head-to-head competition on features, security and total cost of ownership not defaults.

The message to the broader industry is: bundle power carefully, build open interfaces and allow customers choice. In Europe’s playbook, that is now the price of entry for platforms deeply embedded inside enterprise workflows.