One of the first high-profile alternative app marketplaces allowed under Europe’s Digital Markets Act is closing. Setapp Mobile, the iOS app store built by Ukrainian developer MacPaw, is winding down operations after less than two years, citing “still-evolving and complex business terms” that no longer fit its model. The decision underscores just how difficult it is to make a third-party iOS marketplace pencil out under Apple’s EU-specific rules.

Why Setapp Mobile Is Closing Under Apple’s EU Terms

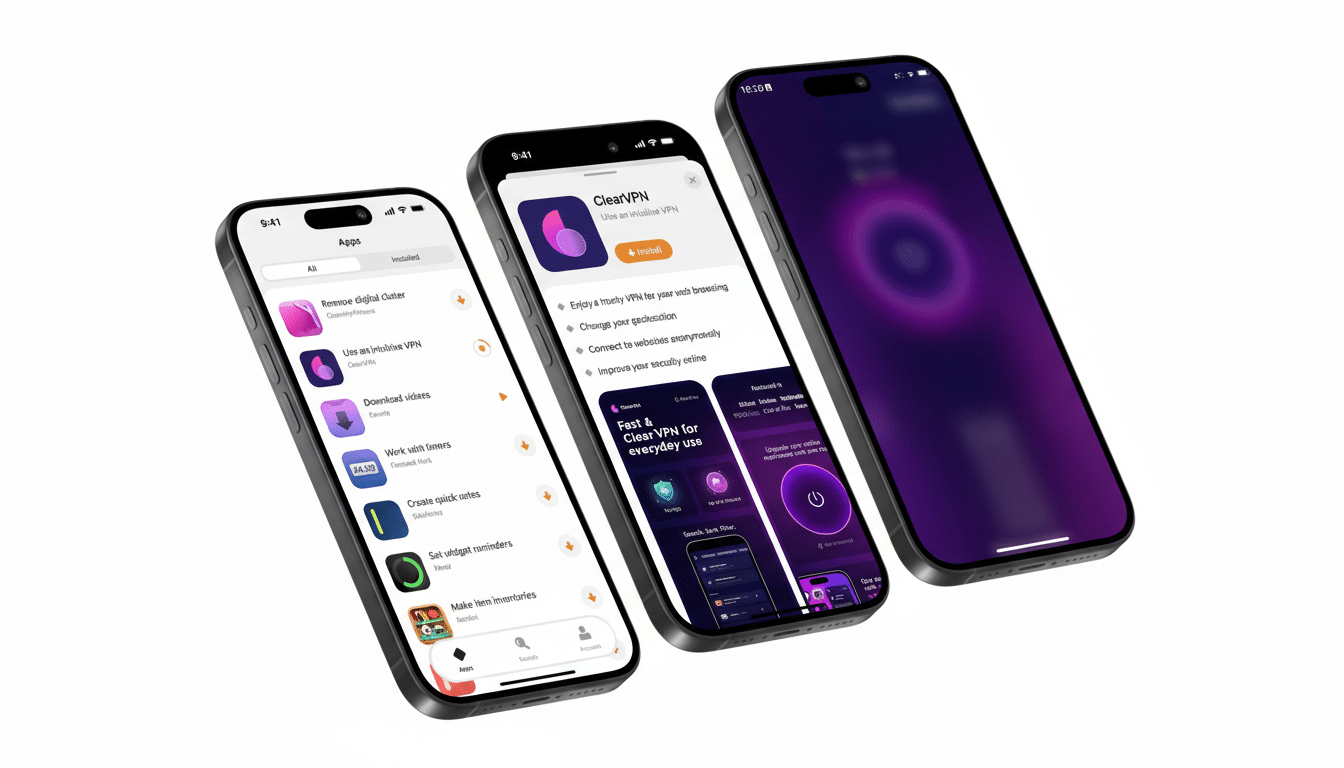

Setapp Mobile launched in September 2024 with a straightforward proposition: one €9.99 monthly subscription for access to a curated catalog spanning productivity, finance, and creative tools, available to users whose Apple ID was tied to an EU country. The marketplace served as a bundle, paying participating developers from subscription revenue rather than relying on per-app purchases.

But the economics changed quickly. Apple’s EU terms include a layered mix of commissions, payment processing fees, and a Core Technology Fee that charges €0.50 for each first annual install over 1 million across the prior 12 months. Those costs apply to marketplace apps themselves and to the apps distributed through them, creating compounding charges that are particularly tough for a subscription bundle with tight margins.

MacPaw’s statement, first surfaced by MacRumors, points squarely at that complexity. In plain terms, when fees are both significant and fluid, it’s hard to plan a multi-year marketplace business, set predictable pricing, or guarantee fair developer payouts.

The DMA Context And Apple’s Fee Structure

The Digital Markets Act requires designated “gatekeepers” to allow rival app distribution and alternative payments. Apple complied by opening the door to third-party iOS marketplaces in the EU in 2024, but it paired that with new terms: a 10% commission for most transactions (or 17% for digital goods and services outside the small business/long-term subscription tiers), an optional 3% fee when using Apple’s in-app payments, and the Core Technology Fee.

Developer groups such as the Coalition for App Fairness have criticized the CTF as a de facto access toll that blunts the DMA’s intent. The European Commission has kept active noncompliance probes into platforms’ DMA implementations, signaling that fee design and steering rules remain under scrutiny. Until there is regulatory clarity, alternative stores must operate amid uncertainty—an acute risk for a marketplace whose cost base scales with installs, not revenues.

The Business Math Problem Facing Subscription Marketplaces

The arithmetic tells the story. Imagine a marketplace app crosses 2 million first annual installs: the CTF alone adds roughly €500,000 for that year on top of commissions and payment costs. If the store distributes dozens of popular apps, each of those titles can independently hit their own install thresholds, multiplying fees further. For a subscription bundle at €9.99 per month that also shares revenue with developers, the margin stack can become untenable fast.

Subscription marketplaces also shoulder discovery, support, and compliance overhead that single-app developers don’t. When rules and rates shift—Apple adjusted its EU terms multiple times after launch—financial models that looked workable on paper can quickly move into the red.

What EU Users and Developers Should Expect Next

EU iPhone users lose a curated, subscription-based alternative to Apple’s App Store. Setapp Mobile’s catalog offered a streamlined way to try and rotate through premium utilities, a value proposition that resonated with power users. For developers, the closure removes a distribution channel that promised a different revenue mix and editorial curation.

Other EU marketplaces remain, notably the Epic Games Store for iOS and the open source AltStore. But the bar for viability looks higher than many anticipated when the DMA first took effect. With iOS representing roughly one-third of the European smartphone OS market according to StatCounter estimates, even strong adoption may not offset the structural costs unless fee policies evolve or stores focus on narrow, high-ARPU niches.

What This Signals for the DMA Experiment in Europe

Setapp Mobile’s exit doesn’t end the experiment, but it does sharpen the debate over whether Apple’s EU terms meaningfully enable competition. If regulators push for simpler, more predictable pricing—and especially if they revisit how the CTF applies to marketplace distribution—the economics could shift. Until then, expect cautious rollouts, selective catalogs, and marketplaces targeting gamers, enterprise tools, or specialty software where lifetime value is high.

For now, one of the DMA’s earliest test cases has blinked, not because users lacked interest, but because the rulebook made certainty too expensive. The next few enforcement steps by the European Commission will likely determine whether Setapp Mobile is an outlier—or the first in a line of retreats.