Elon Musk is framing Macrohard, his freshly teased xAI gambit, as more than a software play. In X posts, he hinted that the effort would create core software driving physical products — perhaps an operating system and services stack that third-party manufacturers can build for — indicating a vision of cloud-scale A.I. coupled with consumer and enterprise hardware.

From Software Platform To Hardware Catalyst

Musk has presented Macrohard as a Microsoft-size rival, but with one important twist: Instead of actually putting devices together itself, the company would facilitate that. Think of Apple’s use of contract manufacturers combined with Windows’ licensing reach. In practice, that could mean the likes of Foxconn and Pegatron or tier-one PC OEMs design, build, and distribute everything needed to make xAI work (the OS, model runtime, the agent frameworks, etc.).

The approach would neatly fit into the industry’s push for “AI PCs” and edge AI devices. We expect hundreds of millions of PCs across the installed base to refresh over this cycle as on-device inference becomes standard. If Macrohard ships a model-optimized OS or middleware with a lower latency and cost per inference at the edge, OEMs have features and developers get a uniform target to develop against.

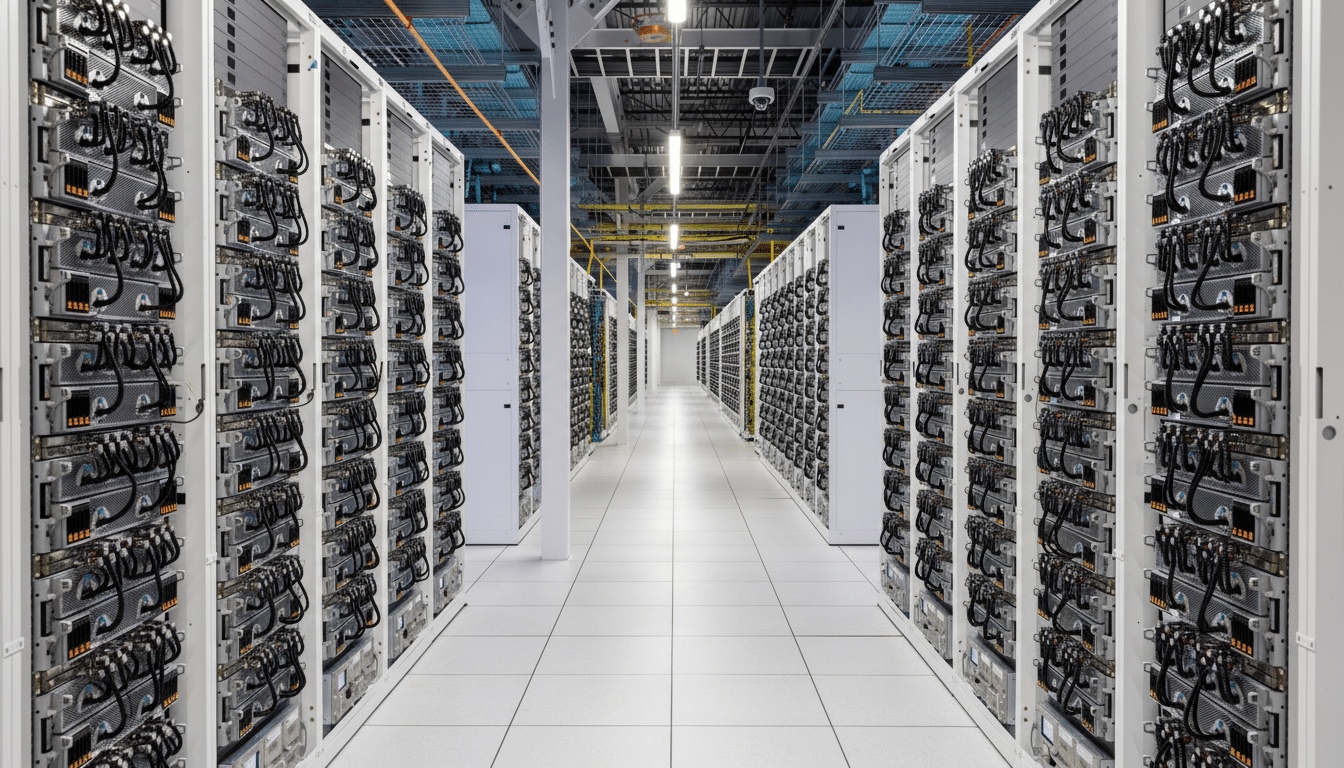

Colossus compute as the engine for Macrohard

And the hardware aspirations are buoyed by xAI’s growing compute footprint. A photo Musk posted suggested that a Macrohard logo was being painted on the company’s next-generation Colossus supercomputer in Memphis. Colossus 2 is intended to be more than twice the size of Colossus, with The Wall Street Journal reporting that it’s set to exceed 550,000 GPUs and will cost tens of billions of dollars. The first Colossus already encompasses over 200,000 GPUs.

At that scale, xAI falls in among the largest AI training clusters in the world. Meta has outlined in public plans that put it in the realm of hundreds of thousands of high-end GPUs, and hyperscalers including the likes of Microsoft and Google are dashing on towards similar orders. This kind of capability enables fast iteration on highly complex multimodal models and agent frameworks — both attributes that could determine Macrohard’s software layer for PCs, phones, robots or entirely new types of connected devices.

Compute is only half of the equation. Power delivery, cooling and networking for a 500k+ GPU installation are utility-scale infrastructure. Engineers in the industry estimate that such a cluster could require hundreds of megawatts, requiring close coordination with regional grid operators as well as advanced optical interconnects to maintain training throughput. That investment is a signal xAI plans to be a first-tier model supplier, not a follower.

A Playbook for Partners and Developers to Engage

So far xAI has listed only a limited number of Macrohard-linked roles; however, Musk has indicated that AI agents will speed up software development internally. If those agents succeed in contributing to a solid OS, SDKs, and device reference designs, then Macrohard could be fully formed with a reasonable partner pitch: lower bill of materials through efficient on-device inference, plus a storefront (and monetization path) for AI-native apps.

Real-world analogs abound. Google’s Android triumphed by providing phone makers with a full stack and strong developer network. Microsoft’s Windows remains the foundation of most PCs, still via licensing and ISV support. Valve’s partnership with AMD for the Steam Deck demonstrates how hardware that is precisely tuned to software can enable a new kind of device. Macrohard will require the same triangle — ISVs, OEMs and silicon partners — to go from concept to shelf.

There may even be a consumer on-ramp through gaming. Musk has even mused about an AI-designed game, which would serve as a showcase for Macrohard’s real-time agents and toolchains. And if the game comes with an SDK that allows creators to mod or train in-world agents, it could seed a developer community before larger device partnerships are rolled out.

The hurdles to scale for Macrohard’s hardware vision

Turning platform rhetoric into hardware shipments is notoriously challenging. Cutting-edge device supply chains are constrained by advanced packaging capacity at TSMC and sustained top-end GPU demand. Export controls blur sourcing and selling across borders. And that necessarily involves the displacement of entrenched ecosystems — Windows for productivity, Android for mobile, CUDA for accelerated compute — which needs there to be a clear technical and economic advantage.

There will be a headwind of cost… Tens of billions’ worth of training infrastructure has to be written down using services, licensing and revenue sharing with partners. Analysts at Gartner and Bernstein have cautioned that if models are not ruthlessly optimized for efficiency, and workloads can’t be offloaded to less expensive edge devices, inference costs can end up outstripping revenue. Macrohard’s promise is to solve that very equation.

What to watch next for Macrohard’s evolving roadmap

Some clear signals will be these:

- named OEM or contract manufacturing partners

- a published roadmap for a Macrohard OS and SDK

- demos of on-device agents running without hyperscaler reliance

- commissioning milestones for Colossus 2

Reveals in regulatory filings, utility deals or supplier earnings calls could support timelines before seeing consumer products.

The footprint is ambitious and uncharacteristically comprehensive — supercomputer-grade training that flows into a platform constructed for hardware allies. If Macrohard ships the stack, and the partners materialize, Musk’s new venture could change how AI-era devices get made. If not, it will be a stark reminder that in technology, distribution and ecosystems are as important as algorithms.