Einride, the Swedish maker of electric and autonomously driven freight technology, said it planned to list its shares in a deal that would merge it with Legato Merger Corp., a special-purpose acquisition company. The deal values Einride’s pre-money equity at $1.8 billion and is expected to generate about $219 million in gross proceeds, before any redemptions, and includes an additional PIPE of up to $100 million being negotiated. The combined company expects to list its shares on the New York Stock Exchange.

Deal Terms, Funding Structure, Timeline and Approvals

The proposed transaction provides Einride with a route to public markets while maintaining its operational momentum. Like all SPACs, public shareholder redemptions can have a material impact on net cash on the balance sheet, serving as an important swing factor. For now, that is placeholder language for what needs to be the size and quality of the PIPE. Management anticipates that the transaction will close following customary regulatory and stockholder approvals.

- Deal Terms, Funding Structure, Timeline and Approvals

- What Einride Brings to Market in Autonomy and Electrification

- Revenue trends and global operating footprint overview

- Capital backing, investors, and strategic signals to note

- SPAC landscape and current competitive dynamics

- Key milestones to watch after Einride’s SPAC merger plans

Central to Einride, at least to pitch its funders’ investors, is the capital-light model relative to legacy OEMs: Fernando argues that it can put electric heavy-duty trucks in customers’ hands today, add on autonomous “pods” running on fixed routes as regulations and safety cases evolve over time, and sell planning and optimization software that cranks up fleet utilization.

What Einride Brings to Market in Autonomy and Electrification

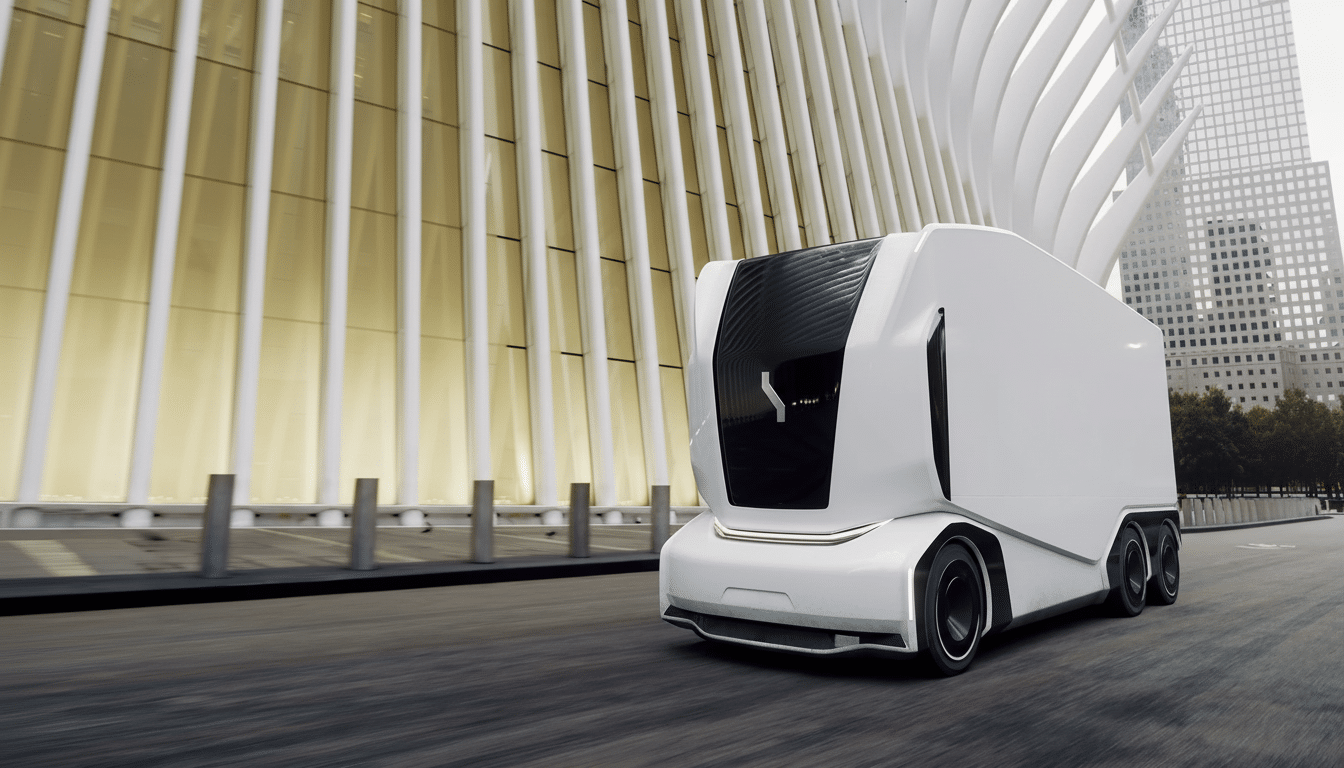

Founded to decarbonize and automate freight, Einride runs three lines: battery-electric big rigs and charging; autonomous electric pods, engineered without a steering wheel or pedals for geofenced routes; as well as software for shippers to plan, dispatch, and optimize movements. The company has been focused on remote supervision for autonomy, a model that can scale on redundant lanes in yards, ports, and factory campuses before expanding to certain public-road corridors.

Einride has roughly 200 heavy-duty electric trucks on the road in Europe, North America, and the Middle East that are working with companies including Heineken, PepsiCo, Carlsberg Sweden, and DP World. Its autonomous pods operated commercial pilots with Apotea in Sweden and GE Appliances in the United States, showcasing how driverless freight can function on fixed routes with teleoperation assistance. With a U.S. headquarters in Austin, the company can connect to key logistics corridors and enterprise customers.

Revenue trends and global operating footprint overview

Einride reported an annual recurring revenue run rate of approximately $45 million, including $65 million in contracted ARR from signed customers. In freight tech, ARR is a multi-year service commitment rather than a one-off truck sale, a structure that may offer improved visibility and gross margin as software and services scale. The company has been increasingly deploying charging infrastructure to convert contracted backlog into systems operating live.

The gradualist path to autonomy depends on tightly defined use cases that can clear safety, regulatory, and insurance obstacles sooner than fully general-purpose robo-trucking. Public-road demonstrations with remote oversight have already shown reduced yard congestion and better dock turnaround times, so even before you get to wide-area autonomy there’s a business case right now.

Capital backing, investors, and strategic signals to note

Einride earlier raised a $500 million financing package in a Series C round of equity and asset-backed debt. Equity investors are Northzone, EQT Ventures, Temasek, AMF, Polar Structure, and Norrsken VC, and leading a significant debt facility is Barclays Europe. A $100 million raise not long ago added cash to the runway as well and included existing backers as well as strategic investors like IonQ, an indication perhaps of growing interest in AI- and quantum-enabled logistics optimization.

For shippers, the appeal is obvious: Battery-electric tractors can slash fuel and maintenance costs on low-hanging, more repeatable fruit, and automated pods can eliminate choke points in contained environments. Even as, per the American Trucking Associations, freight demand is structurally robust and capacity constricted (thanks to driver shortages and duty-hour restrictions), enough to lend credence to those who advocate electrification, routing software, and targeted autonomy. The International Energy Agency has likewise identified road freight as a major contributor to transport emissions, with zero-emission heavy vehicles seen as a policy priority in multiple jurisdictions.

SPAC landscape and current competitive dynamics

Autonomous trucking peers have, however, gone the SPAC route to expand, most notably Aurora (which came public at a double-digit billion valuation) and Kodiak Robotics, which also opted for the SPAC tack.

Others have fallen flat as timelines slipped, highlighting market skepticism around capital requirements, technical risk, and the pace of commercialization. Redemption levels within SPACs have been high, and many sponsors have been forced to line up strong PIPEs or strategic anchors to guarantee strong proceeds at close.

Einride’s uniqueness is a combination of today’s revenue from electric trucks and software with near-term autonomous logistics in limited domains. Should the company be able to turn contracted ARR into revenue, expand hub-to-hub electric lanes, and show progress on cost-per-mile improvements with pods, it can build a path for durable margins that pure-play autonomy companies have failed to demonstrate.

Key milestones to watch after Einride’s SPAC merger plans

Key milestones include the result of the PIPE and redemption levels in the SPAC, the NYSE opening, and news from autonomous commercial operations (not pilots). Investors also will be scanning the horizon for signs of unit economics solidifying around electric routes, software attachment rates per truck, and regulatory clearances that allow driverless operations on more lanes. Winning more enterprise shippers and expanding in United States ports and manufacturing hubs could lend credibility to Einride’s hybrid model of electrification plus targeted autonomy.