Einride, the Swedish startup building electric and autonomous freight systems, announced today it has raised $100 million to expand its operations in Europe and into the United States — becoming another high-profile challenger to Tesla’s larger electric truck strategy.

EQT Ventures took part, and quantum computing company IonQ came on board as a strategic investor. The company did not announce a valuation.

The capital will be put to use growing Einride’s three-part platform: human-driven battery-electric heavy trucks, purpose-built autonomous pods that run on pre-established routes, and shipper software for planning and orchestration. The raise, the company says, now prepares it to scale growth with enterprise customers and push forward the deployment of autonomous freight technology.

What This Round Means for Autonomous Freight

It has been a brutal run for autonomy. Embark shut down, TuSimple withdrew from the United States and Waymo hit the brakes on its trucking program, while Aurora and Kodiak carried on with pilots. That context makes a nine-figure round for a company operating in the freight space, and doing so around both electric and autonomous vehicles, noteworthy.

The timing also coincides with a rise in regulatory and corporate decarbonization demands. According to the International Energy Agency, heavy-duty trucks disproportionately contribute to road-transport emissions, and the European Union has imposed a series of ever-tighter CO2 limits for the segment in two decades. Those targets favor return-to-base, short-haul duty cycles where electric trucks already show competitive total cost of ownership, according to calculations by the National Renewable Energy Laboratory.

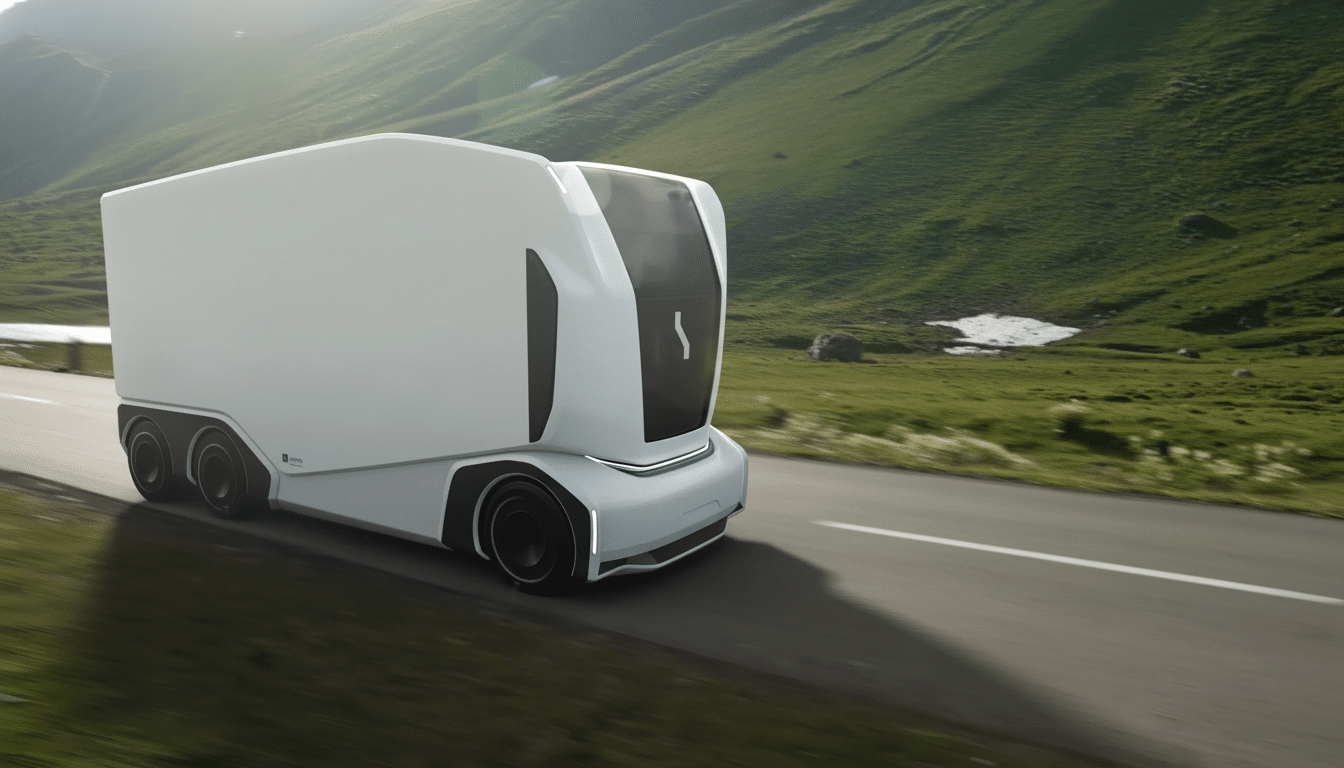

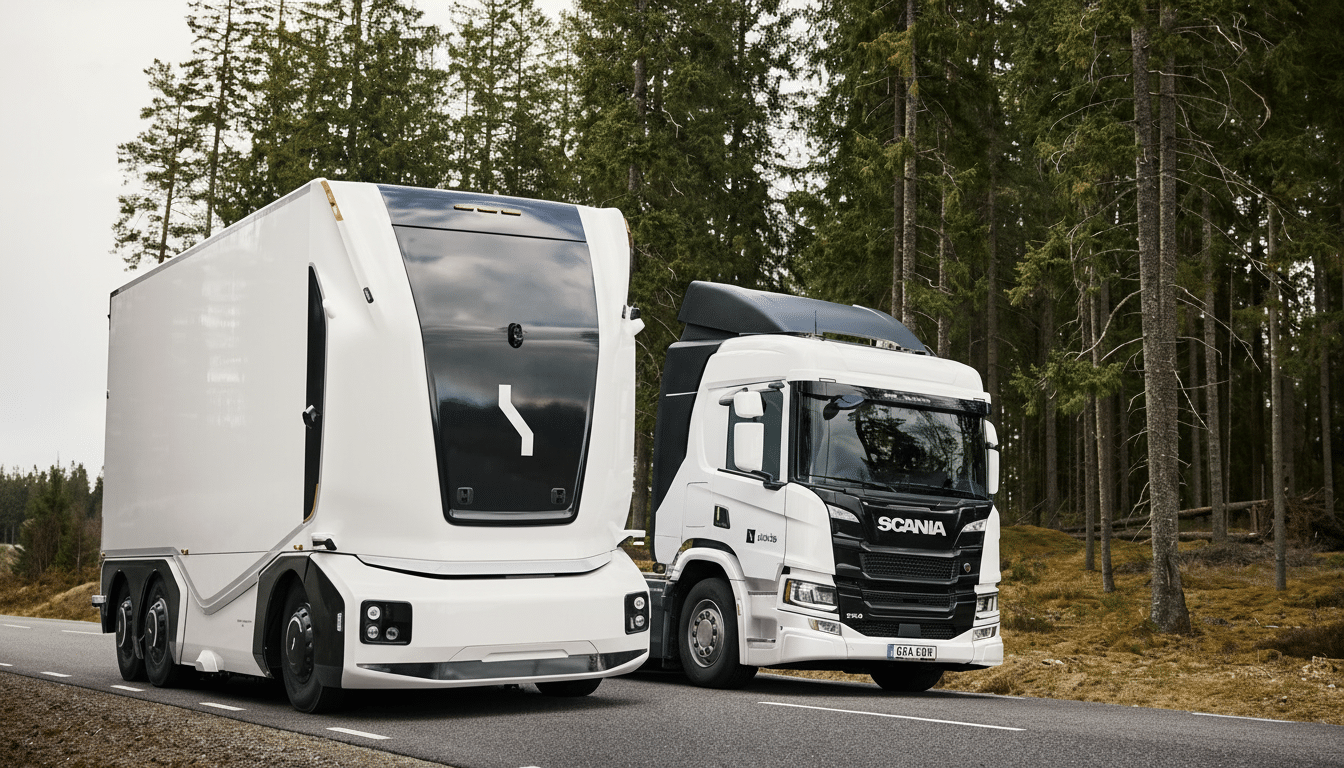

Einride’s strategy is built for that world. The company began with electric big rigs to lower emissions today, then is adding autonomy on top in controlled corridors where speed, payload and charging can be closely controlled. It’s less about an invasion of robo-trucks on the wide-open highway and more about knitting together a scalable, geofenced logistics system.

A Three-Layer Stack from Trucks to Software

On the human-driven side, Einride is running battery-electric Class 8s in Europe, North America and the UAE for companies like PepsiCo, Carlsberg Sweden and DP World. The model is freight-as-a-service: Customers purchase predictable capacity and emissions reductions, and Einride manages vehicles, charging and operations.

The company’s cabless, low-slung vehicles built without steering wheels or pedals run on tightly defined routes under remote supervision. Early programs with Apotea in Sweden and GE Appliances in the United States show the approach: private or semi-private roads, depot-to-depot runs — and strict procedures that can make safety verification addressable in a way it’s not if you’re taking on a stretch of highway.

That is served by a planning and control tier that takes in telematics, energy use and yard operations to optimize dispatching, charging and routing. For shippers, that means a single pane of glass to manage electric fleets and, in the future, blend in autonomy where it pencils out. All of the new stuff is software — which in practice is just as important not only for utilization and charger dwell time, but also for $/ton-mile.

The IonQ Angle and the Physics of Freight

IonQ’s involvement suggests a further partnership around optimization.

Freight operations are filled with combinatorial challenges: Which trailer to move when, at what state of charge and to which dock door, on which routings to avoid traffic while minimizing battery use? Current industry practices involve heuristics and mixed-integer programming; quantum and quantum-inspired techniques hold the promise of speed-ups on certain formulations as hardware and algorithms evolve.

(And lastly, more complex optimizations matter without quantum speed-up at all. NREL’s work indicates that depot charging is the best economic strategy for early heavy-duty electrification, but it can be constrained by grid capacity and charger throughput. Synchronizing charge windows with pickup and delivery schedules, particularly in multi-tenant logistics parks, delivers there-and-then savings. That is where the software, supplemented by new optimization methods, of Einride could make a difference.)

Growth governance and capital needs for scaling operations

Einride recently formalized a transition at the top: Co-founder Robert Falck took on the role of executive chairman, where he could focus on longer-term strategy, and former CFO Roozbeh Charli became CEO. The shift emphasizes a familiar issue in autonomy and electrification — matching capital efficiency with the requirement to finance vehicles, chargers, plus the engineering that will operate them as a network.

The company’s last $500 million raise in 2020 was a mix of $200 million in equity from investors like Northzone, EQT Ventures, Temasek, AMF and founders of firms such as Spotify, Sequoia Capital India and Just Eat (all returning backers) combined with $300 million in debt from Barclays Europe. Pioneers in asset-heavy logistics need to find creative financing; more structured debt and customer-backed facilities are on the way as deployments pick up.

There are execution risks that remain: regulatory approvals for autonomous operations, supply chain bottlenecks for batteries and chargers, and the human portion of remote supervision. Yet macro forces are tailwinds. The American Trucking Associations has been warning about an ongoing U.S. shortage of tens of thousands of drivers, a deficit that automation and more strategically deployed electric vehicle fleets can begin to address while also helping shippers to meet emissions goals.

What to watch next as Einride scales autonomous freight

Encouraging signs over the next year will be new autonomous corridors beyond fenced pilots, fleet utilization above 60–70% on electric routes, and consistent energy costs per ton-mile that are cheaper than diesel on short-haul lanes. Announcements with utilities on depot electrification and with the vehicle OEMs about supply will also tell.

If Einride can provide dependable service at per-mile costs that are indeed competitive, with emissions reductions big enough to matter, it will have done more than raise a round — it will establish a new blueprint for how autonomy and electrification can scale together in freight.