The world’s most famous drone maker is facing a US market freeze, not because regulators have found it guilty with a smoking gun, but because no agency in Washington wants to have jurisdiction over the case. DJI claims its future in America depends on a government security audit required by law. And at the 11th hour, with no audit in sight, it could be thrown onto the Federal Communications Commission’s Covered List, which would suffocate new sales and approvals across its drones, cameras and gimbals.

It ends several months of turmoil at the border. US Customs and Border Protection has delayed DJI shipments multiple times under suspicion originating from the Uyghur Forced Labor Prevention Act. DJI has denied the violations, but product launches for US buyers have been postponed or are infrequent or nonexistent. For content creators and professional flyers, the discussion is now a matter of whether the most capable consumer and prosumer platforms will be available at all.

- What Is Really at Stake for DJI and the United States Market

- How the Required Security Audit Became a Hot Potato

- Why DJI Is in Top Place and Why It Matters

- Alternatives and Workarounds for Consumers and Pros

- What Owners Can Do Now to Prepare for Uncertainty

- The Policy Gap We Must Close to Resolve the Impasse

What Is Really at Stake for DJI and the United States Market

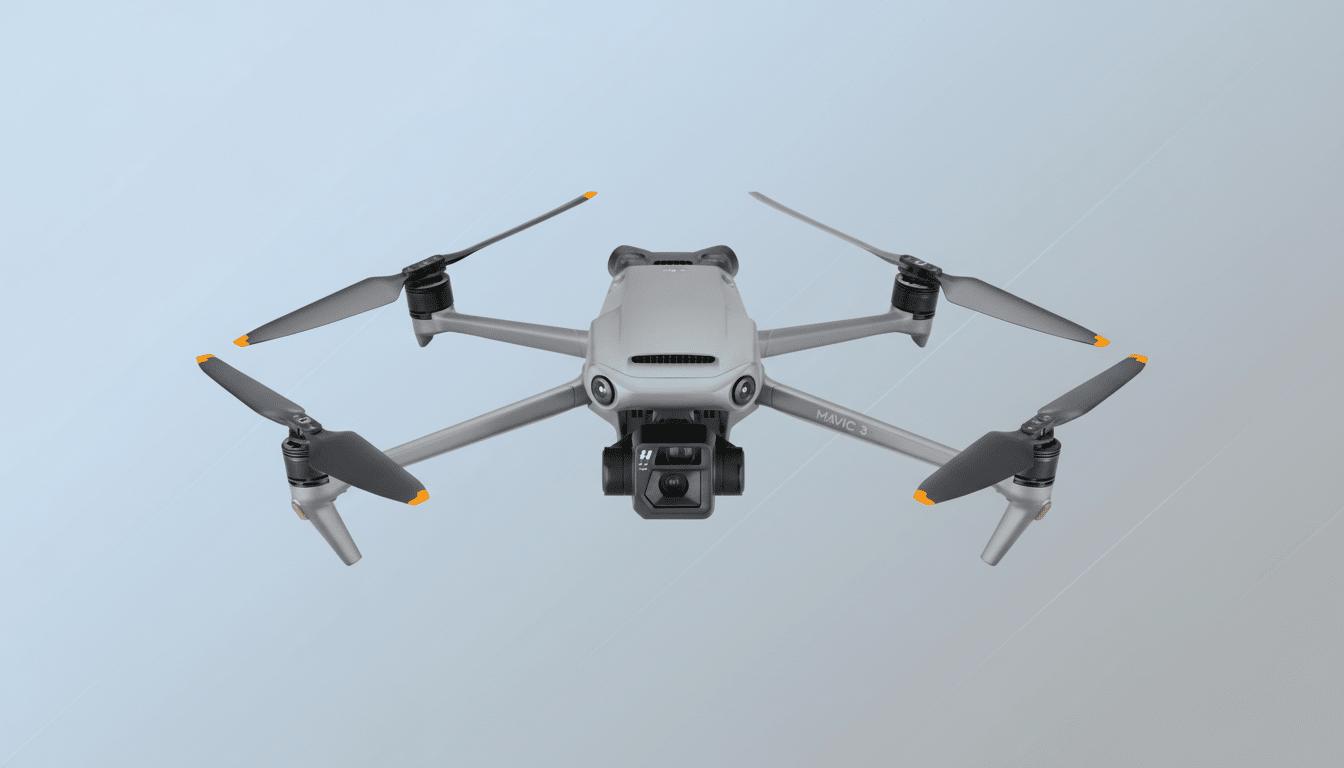

Placement on the FCC Covered List would effectively block new DJI products from reaching the US market. Equipment authorization for anything that uses radios is regulated by the FCC. And most DJI products — from Mavic and Mini to Osmo and Ronin gear — rely on that permission. The commission has also granted itself authority to rescind such existing authorizations, one by one, opening up a potential path to pull models off shelves if concrete risks are established.

Crucially, this is about sale and authorization, not use. That would allow owners to continue flying the planes they currently own under FAA rules, but access to parts, warranty support and official repairs might tighten significantly. For professionals, that adds operational risk even if fleets remain in the air.

How the Required Security Audit Became a Hot Potato

DJI’s products must now undergo a security review, per the latest National Defense Authorization Act, in order to remain on sale in the US. The legislation identifies any one of a number of agencies — such as the Department of Defense, Department of Homeland Security, Office of the Director of National Intelligence, FBI or NSA — as capable administrators. DJI’s policy team said it reached out to every one of them. None of them has come forward, leaving the clear mandate mired in bureaucratic limbo.

The scrutiny didn’t come from nowhere. The Pentagon had previously advised service members not to use off-the-shelf drones made by DJI on bases. DJI was later added to the Commerce Department’s Entity List on allegations that it abused human rights, which the company has denied. More recently, CBP has seized shipments through forced-labor rules. Each thread leads to a larger potential perception of risk, while no overall product-by-product accounting has yet been completed.

Meanwhile, DJI has been inconsistent in releasing products for US customers. High-end devices like the Neo 2 and Mini 5 Pro emerged overseas without making their way into the American market — a development that further solidified the idea of an already narrowed pipeline.

Why DJI Is in Top Place and Why It Matters

It’s no accident that DJI finds itself in this enviable position. The firm’s market share — repeatedly, as established by industry researchers such as DroneAnalyst — sits at more than 70% in the amateur and prosumer categories due in large part to class-leading imaging specs, flight stability, and safety apparatus. Public safety agencies and industrial operators have also relied on DJI because it has been hard to beat its price-to-capability ratio.

The stakes are measurable. DJI thinks there are around 450,000 Americans who rely on its aircraft to conduct business. Industry groups point to a drone economy with more than $100B in impact, and a survey conducted by the industry group Drone Service Providers Alliance found that about two-thirds of respondents say they would be forced to close without DJI platforms. This isn’t just aerial cinematography — it’s construction progress tracking, crop scouting, power line inspection, and search and rescue.

Alternatives and Workarounds for Consumers and Pros

There are alternatives, but they entail trade-offs. US and allied options on programs such as DoD’s Defense Innovation Unit Blue UAS list tend to serve government, enterprise or other such use cases at a sometimes higher cost. Skydio’s new enterprise systems, Teal, and other Blue UAS vendors provide secure pipelines and robust autonomy but do not cover the breadth of consumer use cases.

Potensic has solid options on the consumer side of things, with models like the Atom 2 as a good entry-level choice, and Insta360 is partnering for new aerial concepts. For handhelds, GoPro and Insta360 compete with DJI’s action cameras; as for cinema gimbals, Zhiyun is the obvious fallback. Yet no single rival can match DJI’s reach.

What Owners Can Do Now to Prepare for Uncertainty

- Keep records of the firmware versions on your current flights.

- Try Local Data Mode or offline workflows if security ranks high on your list.

- Identify third-party repair options in case official channels close.

- For organizations, map critical missions to backup platforms.

- Ensure your insurance, waivers and standard operating procedures hold up if supply becomes tight.

As you shop, know the risk profile: availability may fluctuate; new releases could be blocked, and resale value might swing. Enterprise purchasers with compliance requirements should consider Blue UAS offerings or OEMs scrutinized for transparent supply chain.

The Policy Gap We Must Close to Resolve the Impasse

Security and supply-chain integrity are valid concerns, but the process matters. The current pass-the-buck process leaves pilots, agencies and businesses marooned between rhetoric and regulation. A time-bound, technically rigorous audit by a designated lead agency — with the use of standards from organizations like NIST and independent code and data-flow testing — would supplant guesswork with evidence.

Until it does, the US drone market faces a replay of the Huawei and ZTE playbook: broad restrictions that are far from clear. DJI’s fate in the United States may rely less on engineering than whether Washington can transcend playing the blame game and provide a clear answer.