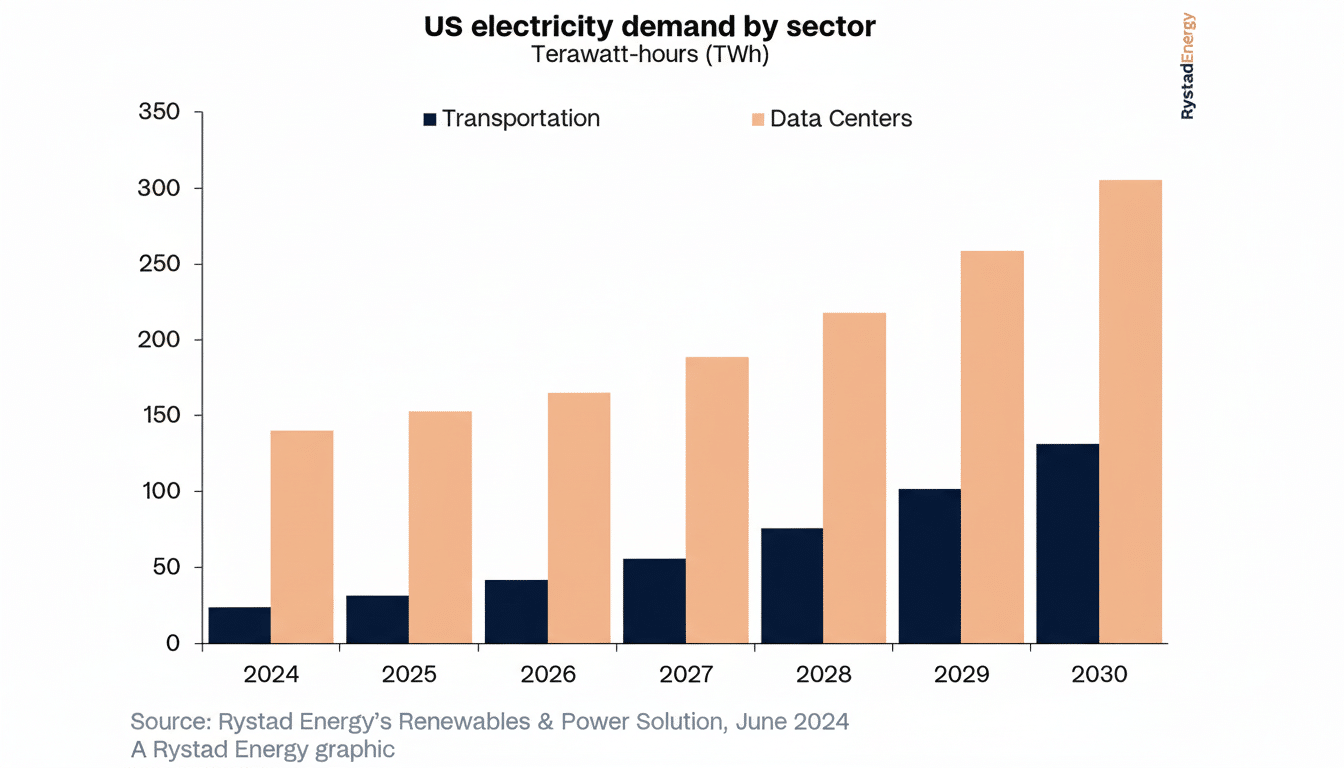

Data centers are on pace to use 2.7x more electricity by the year 2035, nearly tripling demand in what will test power grids and corporate sustainability ambitions alike, new estimates from BloombergNEF indicate. The research group projects that demand in the sector will rise to 106 gigawatts from about 40 today, fueled by what it described as an “unprecedented wave of hyperscale buildouts and AI-heavy workloads.”

The growth is not only fast, but confirmed. The average capacity of planned construction is well over 100 megawatts — with current norms showing that just one out of every 10 projects tops 50 megawatts. Almost a quarter of future campuses are projected to exceed 500 megawatts, with a few surpassing 1 gigawatt — power levels that used to be more typical for industrial parks and entire cities.

AI Turns Up the Meter on Data Center Power Use

AI is the tipping point. BloombergNEF forecasts that data center utilization will grow from around 59% to 69% this decade as the demand for AI training and inference grows to nearly 40% of total compute. High-density GPU clusters may consume tens of megawatts per hall — far beyond the power and cooling required for traditional web and enterprise workloads.

The International Energy Agency has issued an alert that world data center electricity consumption could exceed 1,000 terawatt-hours in the coming years, led by AI as a driving force. And while operators have wrung inefficiencies out of their systems (hyperscalers now routinely aim power usage effectiveness ratios at 1.1), gains are being overwhelmed by sheer scale. Even cooling the machines with liquids, which is making its way from pilot programs to production for AI racks, might help control thermals but does not erase the underlying power draw.

Capital tells the same story. Sector investment has surged to the hundreds of billions annually as cloud providers and AI companies have rushed to lock down land, power, and chips. According to BloombergNEF, the early-stage project pipeline more than doubled between early 2024 and early 2025 — a swing big enough for it to do an about-face on its forecast.

Where the Load Will Hit Power Grids and Markets

Geography is in motion as metro sites reach capacity on land and for interconnection. A good chunk of the new footprint is aiming for parts within PJM Interconnection, which includes portions of Virginia, Pennsylvania, Ohio, Illinois, and New Jersey, as well as Texas’s ERCOT grid. Rural and exurban zones are desirable because they offer access to high-voltage lines, water, and large contiguous parcels.

The pivot has even begun to provoke a regulatory response. PJM’s independent market monitor, called Monitoring Analytics, has petitioned the Federal Energy Regulatory Commission to affirm that PJM does have that right and that this C&I category be forced to queue up — quite literally creating a formal “load queue” like the ones that policymakers established for many forms of generation. The watchdog also contends that data centers are a factor behind higher regional power prices — a sore subject as utilities line up transmission upgrades and generation additions.

Timelines are another choke point. BloombergNEF describes an average seven-year timeline between announcement and energization, due to limited grid capacity, bottlenecks in transformers and switchgear, and time-consuming permitting. Those facts force operators to hedge with on-site generation, behind-the-meter storage, and multi-utility power purchase strategies to de-risk schedules.

Can Efficiency and Clean Power Bridge the Gap

Efficiency will certainly help — but it won’t be enough on its own. Low-hanging fruit has dwindled after a decade of PUE improvements. AI-era densities are exacerbating some of these efforts by requiring more cooling and power distribution overhead. Data center-scale waste-heat reuse and direct-to-chip liquid cooling can help reduce operational loads, but the GPU-capacity arms race keeps outpacing those savings.

On the supply side, hyperscalers are placing long-term bets on clean power, storage hybrids, and 24/7 carbon-free energy procurement. The IEA and industry trackers note a strong price on corporate renewables deals, but siting new projects near load is hard without building more transmission. Nuclear-adjacent strategies are also making a comeback: data center campuses sited near existing reactors and early-stage research on small modular reactors have re-entered boardroom discussions, showcasing the premium placed on steady, round-the-clock power.

What It Means for Operators and Power Grids

Power is now the gating asset for operators. Site selection is becoming more of a power-first exercise, with developers building projects around substation upgrades and multi-phase interconnections. Look for increased joint planning with utilities, prepayments to speed grid work, and creative load flexibility agreements that permit phased ramp-ups.

For grid planners and regulators, the question is how to allow concentrated, long-duration loads like bitcoin miners without disrupting reliability or sending prices spiking. On the table, tools range from dedicated load queues and interconnection benchmarks based on performance to targeted transmission expansions to large demand centers and incentives that push campuses toward resource-constrained designs (e.g., water-efficient cooling in drought-prone regions).

The bottom line: BloombergNEF’s nearly 300% explosion won’t, in fact, be some far-off dream, but a pipeline well underway. If trends continue, and the rollout of AI and hyperscale expansion maintains its pace over the coming years, the limiting factor won’t be server supply — it will be who can get hold of clean, reliable megawatts quickly.