OpenAI is opening access to ChatGPT Go, keeping the price at $4.50 as the entry plan expands beyond its original market.

The company is expanding its availability into more markets starting with Indonesia, following a strong pilot in the country earlier this year and signaling that other parts of Asia may be on the roadmap.

The playbook is simple: meet users where cost is impactful without gutting the product. Early signals suggest it’s working. OpenAI executives say the Go tier in particular has seen a steep rise in paid adoption in India, with the total number of ChatGPT subscribers more than doubling since launch there, says Nick Turley, VP and Head of the ChatGPT app.

Why price-sensitive markets are well suited to a $4.50 tier

India and Indonesia are two of the world’s largest mobile-first internet economies, with hundreds of millions of users who value utility and affordability. India has well over 600 million internet users, and Indonesia more than 200 million, according to estimates from the World Bank and regional digital economy reports. In both markets, consumer spending around subscriptions is concentrated toward the lower-to-mid end.

That backdrop makes a $4.50 plan strategically powerful. It undercuts traditional AI subscriptions, which are often $20 a month, while still offering some premium features. The playbook mirrors strategic shifts made in streaming and music, for example, where low-price tiers and mobile-first bundles tied to India and Southeast Asia have driven up subscriber numbers and churned out premium customers who either change their habits or sign up for something better again, according to the financial-analysis wonks at GSMA Intelligence and the e-Conomy SEA report by Google, Temasek, and Bain.

What ChatGPT Go includes at the entry-level $4.50 price

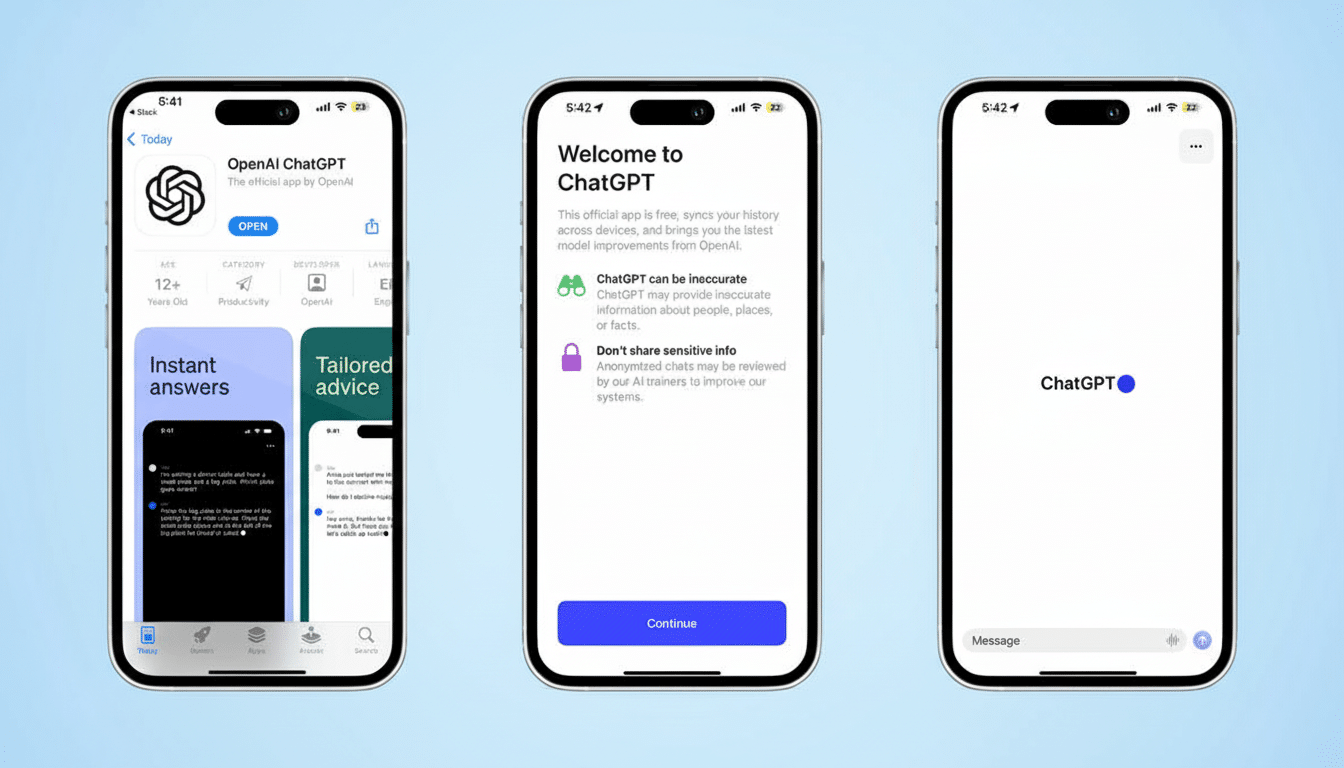

ChatGPT Go is essentially the step up from free. The Go plan allows more people access to its advanced models and tools, such as image generation, larger file uploads, and more powerful data analysis features beyond the limits of the free plan, OpenAI says. It also integrates with persistent memory for more personalized responses over time, and provides access to projects, tasks, and custom GPTs.

Exact rate limits and available features can vary depending on region and platform, but it’s a bid to provide most of the day-to-day capability users want without the full price that flagship subscriptions command. This mix is an appealing one for students, freelancers, and small teams in particular—especially where purchasing power parity is strong when considering what a monthly fee represents.

Payments policy and rollout realities in new markets

Growing a consumer subscription in emerging markets is just as much about payments and policy as it is about price. In India, rampant UPI and prepaid card usage reduces purchase friction. In Indonesia, microtransactions are dominated by e-wallets such as GoPay, OVO, and DANA. Localization of checkout flows and support for the popular rails can have a material effect on conversion rates, a theme echoed in both central bank studies and findings published by fintech industry groups.

Regulatory compliance also matters. There are various measures to ensure data protection, content control, and age-appropriate access by country. OpenAI has expressed plans to expand access, but hasn’t made a hard timeline globally—hinting at the company rolling out support to markets where product maturity, compliance, and monetization conditions match up.

Signals to watch next for the future of ChatGPT Go

Two signals will determine whether the Go tier is here to stay: sustained conversion and engagement. If the India pattern repeats—strong uptake without cannibalizing higher tiers—anticipate a faster pace for country launches. Look for localized student pricing, carrier billing partnerships, or bundled offers with device makers, strategies that have sped up AI and app subscriptions in Asia before.

The calculus for OpenAI is scale plus stickiness. A low-friction, low-cost plan that allows some access to premium tools can set a spacious paid floor and allow for easy upselling on pro or enterprise features later. For users, the story is simpler: more capability than the free tier, priced for everyday usage, now showing up in more places without a markup.