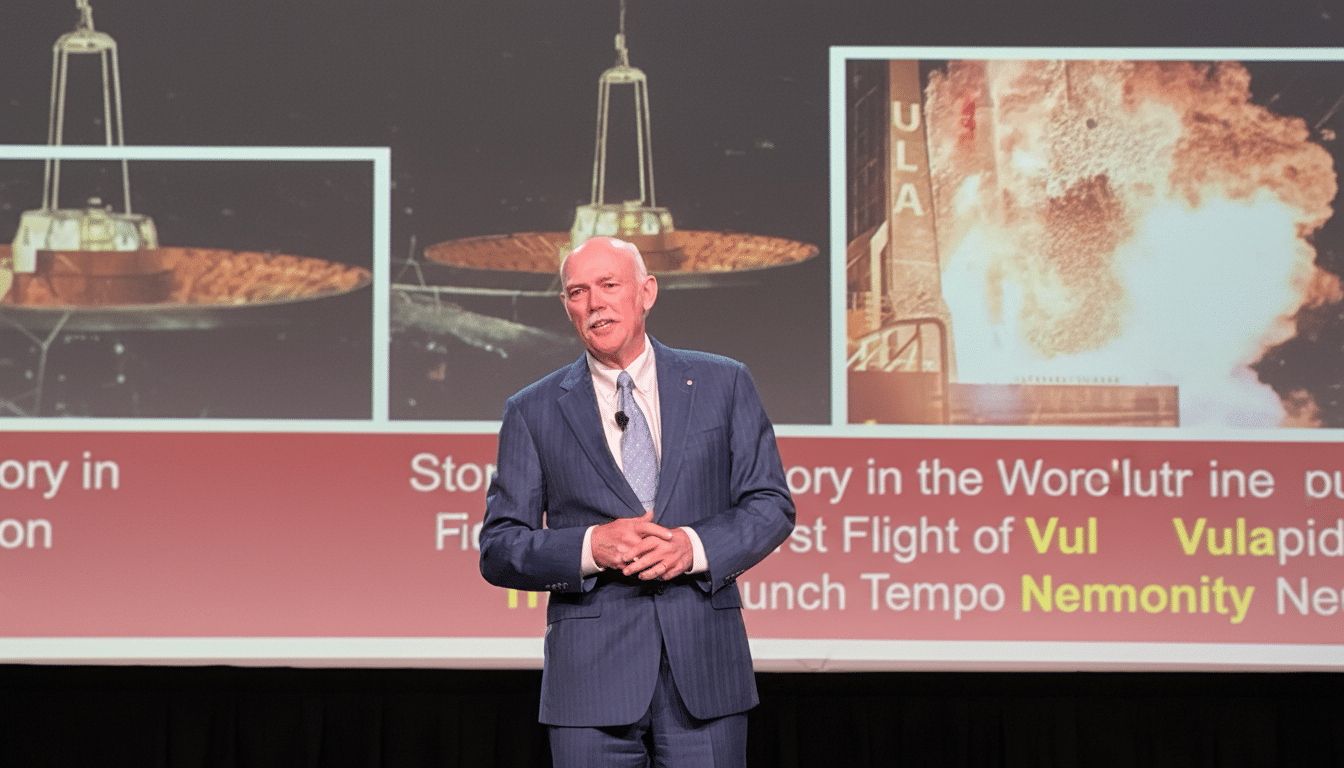

Tory Bruno, longtime chief executive of United Launch Alliance, has stepped down after a 12-year run leading the Boeing–Lockheed Martin joint venture that had solid dominance in America’s launch market and now faces increased pressure from SpaceX and a resurgent Blue Origin.

The company said Bruno is leaving to accept another opportunity and that it named Chief Operating Officer John Elbon as acting CEO while it looks for a permanent replacement. ULA’s board thanked Bruno for guiding the company into a fleet transition and larger market reset.

Leadership Shift at a Crucial Time for ULA’s Future

Bruno’s tenure included ULA’s pivot from its Atlas and Delta workhorses to Vulcan, the next-generation rocket designed to be competitive on price and cadence while breaking America’s dependence on Russian engines. During his tenure, ULA protected its national security franchise — taking the majority of the U.S. Space Force’s Phase 2 launches even as SpaceX recast industry economics with ultrafast reusability.

ULA’s reliability and repute remain its calling card. The company has racked up more than 150 missions with mission success, carrying everything from NASA science payloads to intelligence satellites. The strategic question now is if that gold-standard reliability can be combined with the lower costs and quicker tempo needed to satisfy commercial as well as government demand.

Vulcan’s Stakes And The Backlog To Come

The success of Vulcan’s first flight demonstrated the correctness of ULA’s design philosophy following a drawn-out development, delayed in part because of Blue Origin’s BE-4 engines. The rocket’s inaugural flight flew as planned, a requirement for full certification on top-tier national security missions watched over by the U.S. Space Force and Aerospace Corporation.

Commercially, ULA has a strong book of business with payloads starting with Amazon’s Project Kuiper having up to 38 launches on its books and missions for lunar services provider Astrobotic. The company is also examining partial reuse through its SMART concept, which involves the recovery and refurbishment of engines, as a way to lower the recurring cost without full first-stage recovery.

Execution is everything. A successful ramp-up and certification for Vulcan would make it the only alternative to Atlas V and Delta IV Heavy for U.S. government users, providing a credible complement to SpaceX on medium- and heavy-class missions.

SpaceX And Blue Origin Are Shifting The Field

SpaceX now also conducts a majority of U.S. orbital flights, as FAA commercial space reports have shown, and it is borne out by the pace at which Falcon 9 boosters are used repeatedly.

Reusability has helped reduce unit costs and increase availability, especially when it comes to LEO constellation deployment and rapid rideshare.

Blue Origin, on the other hand, is establishing itself as a heavy-lift player with New Glenn’s first missions and a propulsion provider to ULA. If New Glenn scales successfully, competition for national security and heavy commercial payloads is expected to deepen, particularly under the U.S. Space Force’s Phase 3 procurement objective to open provider access in mission lines.

National Security and NASA Implications for ULA

ULA’s responsibility as a reliable conveyance for the intelligence community and Department of Defense is key to U.S. assured access to space. With Atlas V on the downhill slope and Delta already retired, Vulcan has to step up for high-energy orbits and precious payloads with slim performance margins and schedule certainty.

Both NASA and a robust, multi-provider ecosystem usher in competition. A more competitive ULA working with SpaceX and others brings pricing pressure and mission flexibility for science probes, planetary missions, and logistics in cislunar space.

Elbon as Interim CEO and the Way Forward

Elbon, a veteran who previously ran Boeing’s space exploration business before joining ULA, takes over with a clear set of marching orders: keep Vulcan’s certification and production ramp on track, protect key national security milestones and convert backlog into a predictable launch cadence. Customers and the Space Force will be closely monitoring supply chain and engine deliveries from Blue Origin.

Industry analysts will also be looking for signs on ownership and capital strategy. Rumors of a possible sale of ULA have swirled in recent years, and any changes there could affect long-term investment in reuse technologies, upper-stage upgrades and factory throughput.

What to Watch Next as ULA Navigates Leadership Change

- The timing and result of Vulcan’s remaining certification flights, which open up access to the highest-value national security manifest.

- Whether ULA can maintain a double-digit annual launch cadence to whittle away Kuiper commitments without missing government windows.

- Pricing: with the SMART engine recovery maturing, ULA could close the cost gap that SpaceX’s reusability has opened up.

Bruno is leaving with Vulcan in development and ULA’s competitive identity in turmoil. The next chief executive will be judged as much on operational execution as strategy — not only because reliability is a prerequisite in today’s launch market, but also because it isn’t enough.