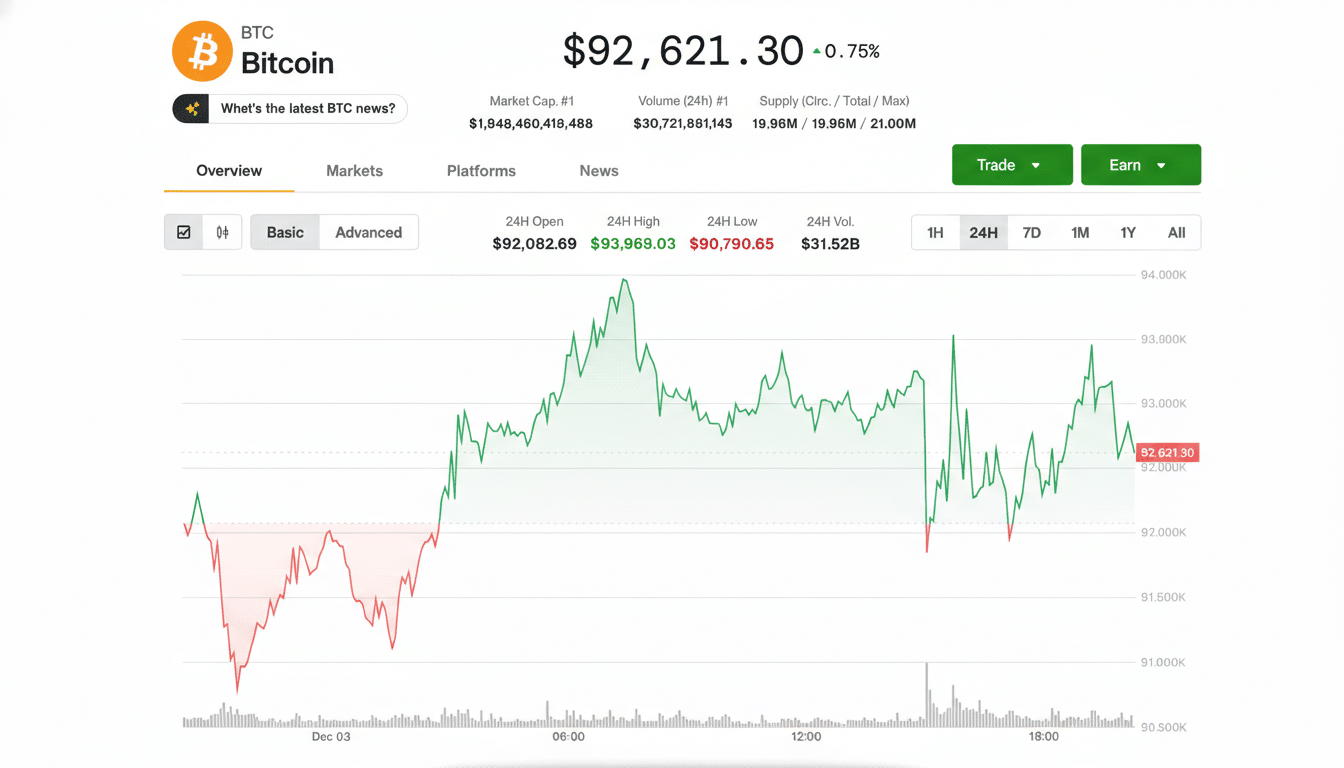

Bitcoin snapped higher on Friday after a bruising slide, reigniting the perennial question for crypto traders: is this a durable rebound or just another relief pop before the next leg down?

The bounce pushed prices back above the $70,000 mark intraday, clawing back a chunk of this week’s losses. Momentum, however, remains fragile, and several closely watched indicators argue for caution rather than celebration.

Market Snapshot and Key Levels for Bitcoin’s Rebound

Short-term bulls are eyeing a push toward the $80,000 region, a zone that has repeatedly flipped from support to resistance. Market veteran Michael Terpin told us he expects any near-term strength could still give way to a deeper washout, with $65,000 and $60,000 flagged as pivotal floors. A decisive break below those levels risks opening a path toward the mid-$40,000s, a scenario other analysts have also floated with some projecting downside potential to the low-$40,000s if risk aversion accelerates.

What would invalidate the bearish setup? A sustained reclaim above recent range highs on strong spot volume and improving breadth across large-cap tokens—not just a quick squeeze in derivatives—would signal healthier demand.

Whale Activity on Exchanges Flags Near-Term Caution

Blockchain data points to unusual traffic from big wallets. CryptoQuant notes that large holders account for an outsized share of exchange deposits, a pattern that frequently precedes heavy selling or hedging. When whales move coins onto exchanges, it typically means they’re positioning to sell into strength or protect downside, both of which can cap rallies and amplify swings.

That backdrop aligns with a market still digesting leverage. Kaiko has previously highlighted how liquidity pockets thin out during stress, making order books more sensitive to large flows. In such conditions, intraday moves can overshoot in both directions.

Miners Under Pressure as Costs Outpace Revenues

Another headwind comes from the mining sector. According to reporting from CoinDesk, current prices sit below an estimated average production cost near $87,000 per coin. While that figure varies widely by operator, geography, and energy contracts, prolonged trading under aggregate costs has historically aligned with late-stage bear conditions. When margins compress, miners may sell more of their treasuries to cover operating expenses or debt, adding incremental supply to the market.

Watch hash rate stability and public miner disclosures for clues. If weaker miners curtail operations or raise capital, that can temporarily weigh on sentiment even as it eventually improves industry efficiency.

ETFs and Derivatives Likely to Set the Market Tone

Spot Bitcoin ETFs have become a daily barometer for mainstream demand. Analysts at Bloomberg Intelligence and Farside Investors track net creations and redemptions closely; persistent outflows tend to sap momentum, while steady inflows can underpin price during shaky periods. If this rebound is to stick, constructive ETF flow will likely need to reappear.

On the futures side, stretches of negative funding and falling open interest often mark cleaner resets. Glassnode has documented in prior cycles that durable bottoms usually coincide with derivatives de-risking and stronger spot-led buying. A rally powered mainly by short liquidations tends to fade once the squeeze runs its course.

What Could Keep the Bitcoin Rally Alive Now

Three ingredients would help:

- Improving spot demand (including ETF inflows)

- A cooldown in whale deposits to exchanges

- Stabilization in miner selling

Add in a benign macro backdrop—softer dollar, calmer rates—and risk assets generally breathe easier.

Technically, reclaiming and holding above $80,000 with rising volume would suggest buyers are regaining control. Conversely, a swift rejection near that zone followed by a slide through $65,000 increases the odds of another leg lower into the high-$50,000s or worse.

Bottom line: Friday’s pop is encouraging, but evidence of a trend change is still incomplete. Until whales step back, miners catch a break, and spot-led flows strengthen, this market remains vulnerable to sharp reversals. Traders may find prudence in managing risk tightly while letting price confirm the next decisive move.