Are you struggling to understand how much you will take home after taxes from your paycheck? The US Pay Calculator can make this easier, providing you with the correct information about your earnings. Whether you are a salaried employee or a contractor, with Pay Calculator, you are the one in charge of calculating your net pay according to federal, state, and local taxation.

This article will describe the main advantages of a US pay calculator, its functionality, and the need to use it, as it is a tool everyone should have to get to know their paycheck much better.

- What Is A US Pay Calculator?

- Advantages of a Pay Calculator in the US

- Fast and Precise Payments Calculations

- Get Knowledge on Your Tax Deductions

- Calculate Your Annual Take-Home Pay

- Use for Different Filing Statuses

- Keeping Current with Tax Changes

- Plan for Financial Goals

- Key Takeaways

- Sample Salary Breakdown Using the US Pay Calculator

- Start Calculating Your Pay In a Minute Today

- Best Tools for Efficient Salary Calculation in Payroll

- FAQs:

What Is A US Pay Calculator?

A US pay calculator is an internet-based tool that is used to compute your take-home pay, taking into account lots of deductions like federal tax, state income tax, and other deductions. Be it calculating your salary following a salary increase, being able to determine the approximate amount of taxes you are to pay within a given year, or simply deductions on your paycheck, the Pay Calculator makes this easier.

The calculator can calculate the net amount in seconds that you will get by simply entering information about your gross salary, filing, and the state in which you are living.

Advantages of a Pay Calculator in the US

Fast and Precise Payments Calculations

The speed and accuracy of a US Pay calculator are two of the main strong points of using it. To calculate the taxes and deductions by hand may be complicated, yet the tools are efficient and fast to obtain the results. As an illustration, our free net pay calculator will immediately supply you with a precise growth by taking into account the latest tax-related details, which will help you save precious time.

Get Knowledge on Your Tax Deductions

The US pay calculator assists you in dissecting your salary budget. You will have a clear picture of the federal charge of taxes, state taxes, local taxes, Social Security, and Medicare deductions. This visibility makes you know how your money is spent and eliminates the unexpectedness of making an appearance at the end of the week with your paycheck. Using a FICA calculator can further clarify how Social Security and Medicare specifically impact your bottom line.

Calculate Your Annual Take-Home Pay

With the help of the gross-to-net pay US calculator, one can easily estimate how much money you take home at the year. This option is particularly useful when you are creating your budget because it takes into account all the taxes and deductions that you will enjoy every year.

Use for Different Filing Statuses

No matter whether you are filing as an individual, married, or head of household, a US pay calculator lets you enter the type of filer you are and calculates exactly the amount withheld depending on your situation. The W-4 Withholding Calculator is specifically applicable when you want to know the amount of federal tax to be deducted from your paycheck.

Keeping Current with Tax Changes

Taxes are regulated regularly, and depending on the changes, they will affect your paycheck. The Federal Income Tax Calculator for 2026 will constantly be updated, so you will always keep the latest data and will be able to use tax brackets and tax rates available in 2026. The Pay Calculator will show the adjustment to any changes in the Pay Calculator, regardless of the presence of fresh tax policies or changes to the FICA rates. For region-specific accuracy, a US state tax calculator ensures your local obligations are accounted for correctly.

Plan for Financial Goals

With advance knowledge of your take-home pay, you can be in a better position to plan your financial objectives, like retirement savings, an emergency fund, or large expenditure plans. The US pay calculator assists you in setting realistic goals for saving amounts by providing you with an accurate idea of the amount of money you have.

Key Takeaways

- Calculating salaries in the US is a very necessary tool that you can use to calculate your take-home pay.

- Such calculators consider some such factors, such as the state income taxes, federal taxes, and FICA deductions.

- They will enable a smoother way of calculating your financial situation by providing you with clarity on the deductions and how you would be affected by altering the rates of taxation.

- A pay calculator will keep you on the cutting edge of the most recent tax legislation, allowing you to get your financial life and matters under control.

Sample Salary Breakdown Using the US Pay Calculator

| Gross Salary | Federal Tax (12%) | State Tax (5%) | Social Security (6.2%) | Medicare (1.45%) | Net Pay (After Taxes) |

|---|---|---|---|---|---|

| $50,000 | $6,000 | $2,500 | $3,100 | $725 | $37,675 |

| $60,000 | $7,200 | $3,000 | $3,720 | $870 | $45,210 |

| $80,000 | $9,600 | $4,000 | $4,960 | $1,160 | $60,240 |

| $100,000 | $12,000 | $5,000 | $6,200 | $1,450 | $75,350 |

| $120,000 | $14,400 | $6,000 | $7,440 | $1,740 | $91,420 |

Start Calculating Your Pay In a Minute Today

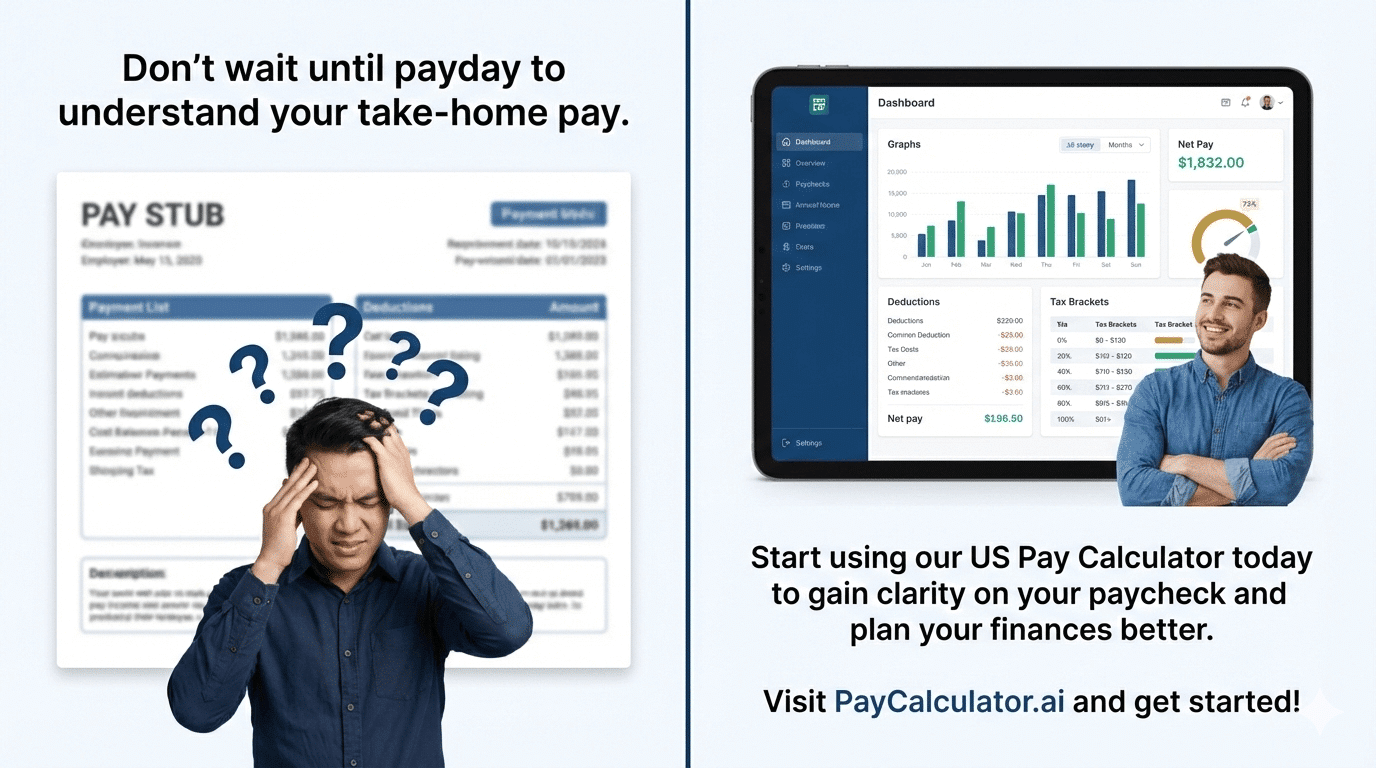

Do not find out on payday how much you take home. You can use our US Pay Calculator and start receiving a clear picture of your earnings and spending them more wisely today. Calculate your visit to PayCalculator.ai and start it!

Best Tools for Efficient Salary Calculation in Payroll

Paycalculator provides you with the transparency of your earnings since, using a US Pay Calculator, you know exactly how much to take home after tax. It makes it easy to plan your financial activities and have everything under your control in case there is a change in the tax laws. The complications of calculating your pay and budget have never been uncomplicated because, with tools such as the W-4 withholding calculator and the gross-to-net pay US calculator, it has never been simpler to do so. You can manage your money today with the help of a good pay calculator.

FAQs:

Q1: What is the gross and net salary difference?

Your gross salary is the sum of money that you get before deductions, and your net salary will be the net sum of money that you take home after tax deductions, as well as any other deductions. The fact that a gross-to-net salary US calculator will be of help in your understanding of this difference, and give you the right calculations for your net income.

Q2: What is the W-4 withholding calculator?

To use the W-4 withholding calculator, you must enter your personal information, including the number of dependents, filing status, and any additional withholdings. The calculator will then help you determine how much to deduct from your paycheck so that you don’t end up paying more or less than what is necessary.

Q3: Will the US pay calculator help in filing taxes?

The US pay calculator can be used to give an estimate of what your net income is, though it does not take the place of filing taxes. You are, however, advised to visit a tax professional and get the tax filing done appropriately in case your taxes are a complicated case.

Q4: Is Pay Calculator free?

Yes, Pay Calculator is free to us. You can determine exactly what your take-home pay will be by simply beating the keyboard.