It’s official: The impact of skyrocketing RAM costs has hit Android gaming handhelds. AYN is delaying Odin 3 Ultra shipments. AYN has delayed shipments of its ultra-high-spec Android handheld, the Odin 3 Ultra, due to a spike in RAM pricing and a temporary supply issue. The decision, announced to backers on Indiegogo and Discord, is the latest evidence of how the volatile DRAM market is now impacting product roadmaps outside mainstream smartphones and PCs.

The Ultra variant, which features 24GB of LPDDR memory and 1TB of storage, is especially vulnerable since high-density packages have seen the largest increases. As vendors quoted higher prices and indicated limited availability, AYN offered buyers a way out of the bottleneck: switch to the Odin 3 Max and get refunded the price difference.

Why Memory Prices Spiked Across Mobile and Handhelds

Industry watchers at TrendForce have recorded a couple of quarters back-to-back where contract prices for mobile DRAM soared by double digits. The primary driver isn’t demand from handhelds or phones — it’s AI. Foundational model training has turbocharged demand for high-bandwidth memory, and makers are allocating capacity and capital to HBM at the expense of output for LPDDR5/LPDDR5X utilized in handsets.

SK hynix, Samsung, and Micron are all building out new HBM lines, but re-allocations require time. Until new capacity and yields are normalized, LPDDR supply is still tighter (and more expensive) than device makers had planned on. For 24GB modules especially, spot-market volatility is severe and small brands without fixed long-term contracts are most exposed.

Why Handhelds Get Socked by Volatile Memory Prices

Android handhelds rely on the same cutting-edge memory found in flagship phones, but without the purchasing power of leading OEMs. Memory is normally the second-highest-cost BOM line after the SoC. A 15–30% DRAM pricing swing might be a matter of tens of dollars, enough to eliminate margins in some markets or force a product-side change.

Major smartphone makers can cushion themselves from shocks with multi-quarter supply deals, wider product offerings, or discrete mid-cycle tweaks. Small-volume boutique handheld makers also buy in smaller lots and have thinner margins to play with, so they’re more apt to hang back on shipments or cut RAM to survive price stabilizations.

AYN’s Stopgap Option: Switching Customers to Odin 3 Max

AYN’s solution is simple: upgrading you to the Odin 3 Max and refunding the difference. The Max steps down to 16GB of RAM and 512GB of storage, and has been promoted at $449 vs. the Ultra’s $519 promotional price. That bypasses, for now, a premium placed on high-density LPDDR for buyers who are looking for something sooner and at lower cost.

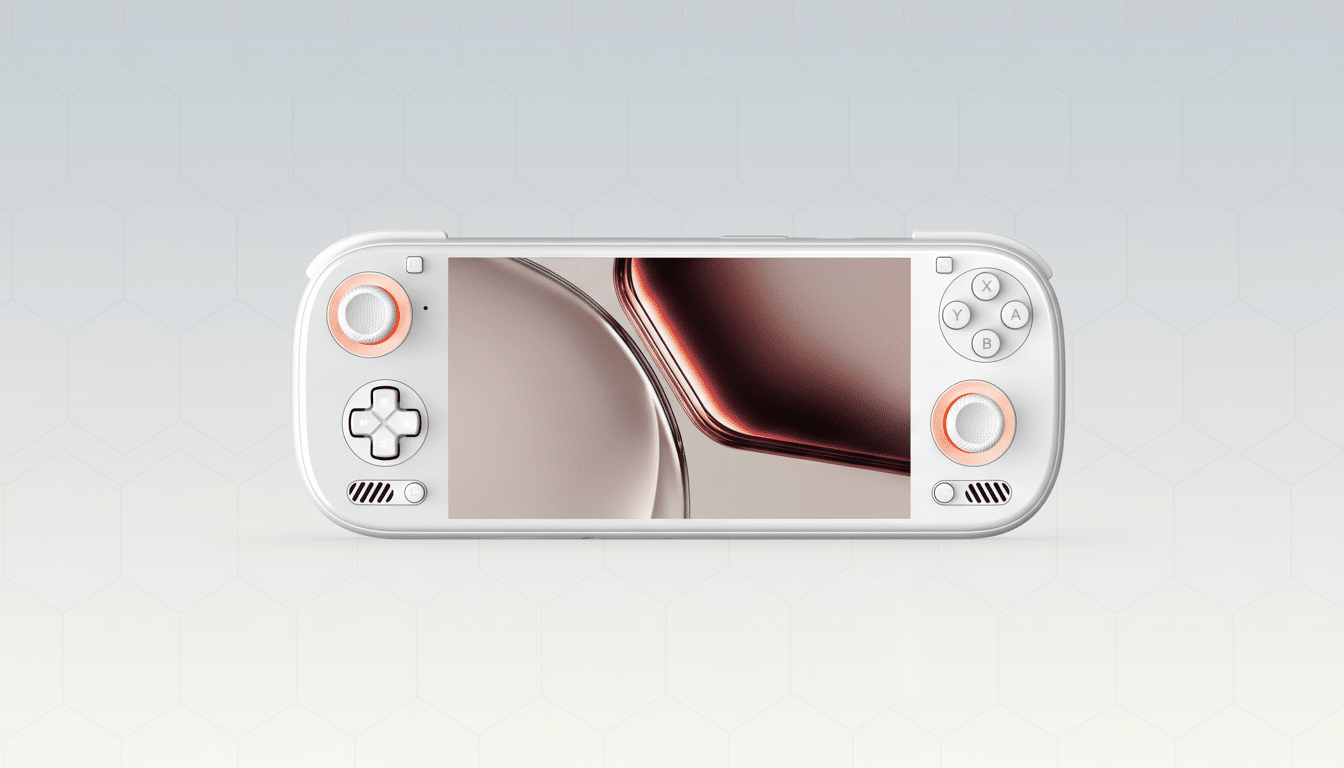

What is still there, however, is the rest of the experience. Both models have a top-end Snapdragon-type chipset with active cooling, a 6-inch 120Hz OLED display, an 8,000mAh battery featuring 60W charging, and both a memory card slot and a 3.5mm headphone jack, plus video output. The compromise is purely about headroom: RAM and storage.

Is 16GB of Memory Good Enough for Android Gaming Today?

For most Android titles and emulation up to and including more demanding 3D systems, 16GB is plenty. Additional RAM can aid heavy multitasking, because some advanced emulators have larger texture caches, and there could be platform updates down the road that widen memory footprints. If futureproofing and hardcore emulation are musts, then the Ultra’s 24GB of LPDDR still makes sense — once supply again becomes available and pricing settles.

If you’re prioritizing value and availability, though, the Max setup strikes a middle road that retains performance whilst sidestepping the ripple-endogenous RAM tax of its primes.

What Comes Next for Memory Pricing and Gaming Handhelds

Counterpoint Research and TrendForce analysts believe the tightness in DRAM will continue as AI accelerators absorb capacity for HBM. Suppliers are ramping investments, but normalization is dependent on both how fast production ramps and how demand for AI hardware trends. In the meantime, look for handheld makers to adapt by dragging launches out even longer, removing RAM from base specifications of some SKUs, or jacking up prices on higher-memory options.

The bottom line here is the same: the AI memory cycle has infected Android handheld gaming. Until the price of RAM cools down, devices that pursue laptop-like memory figures will ship later, cost more, or both — nudging buyers toward smarter-but-slimmer configurations in the interim.