Atlassian will acquire DX, a developer productivity insights platform, in a cash-and-restricted-stock deal valued at $1 billion. The acquisition, the largest in Atlassian’s history, highlights just how central engineering effectiveness has become to the company’s strategy across Jira, Confluence, Bitbucket, and its broader DevOps stack.

DX helps businesses measure and improve the performance of their software teams by identifying bottlenecks across code, review, deployment, and incident workflows. The company claims to have grown quickly out of the gate, tripling its customer base annually and now working with more than 350 enterprises including ADP, Adyen and GitHub — despite having raised less than $5 million in outside funding.

Atlassian co-CEO Mike Cannon-Brookes characterized the deal as a wager on transforming spotty engineering signals into actionable advice. With AI tooling budgets on the rise, he said, leaders need hard evidence that new investments really do speed delivery or simply move work elsewhere. DX’s combination of quantitative telemetry and qualitative team sentiment is an attempt to bring that clarity.

Why DX is a good fit for Atlassian’s developer cloud

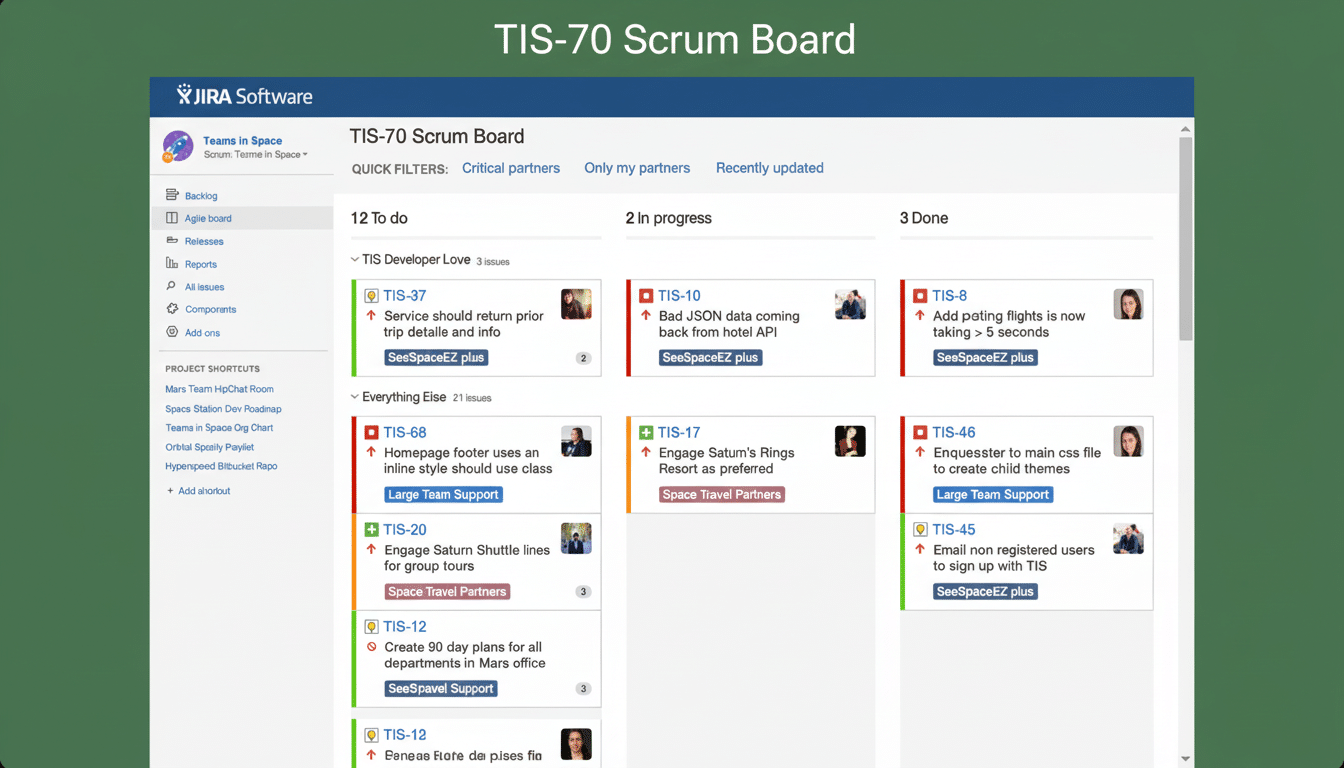

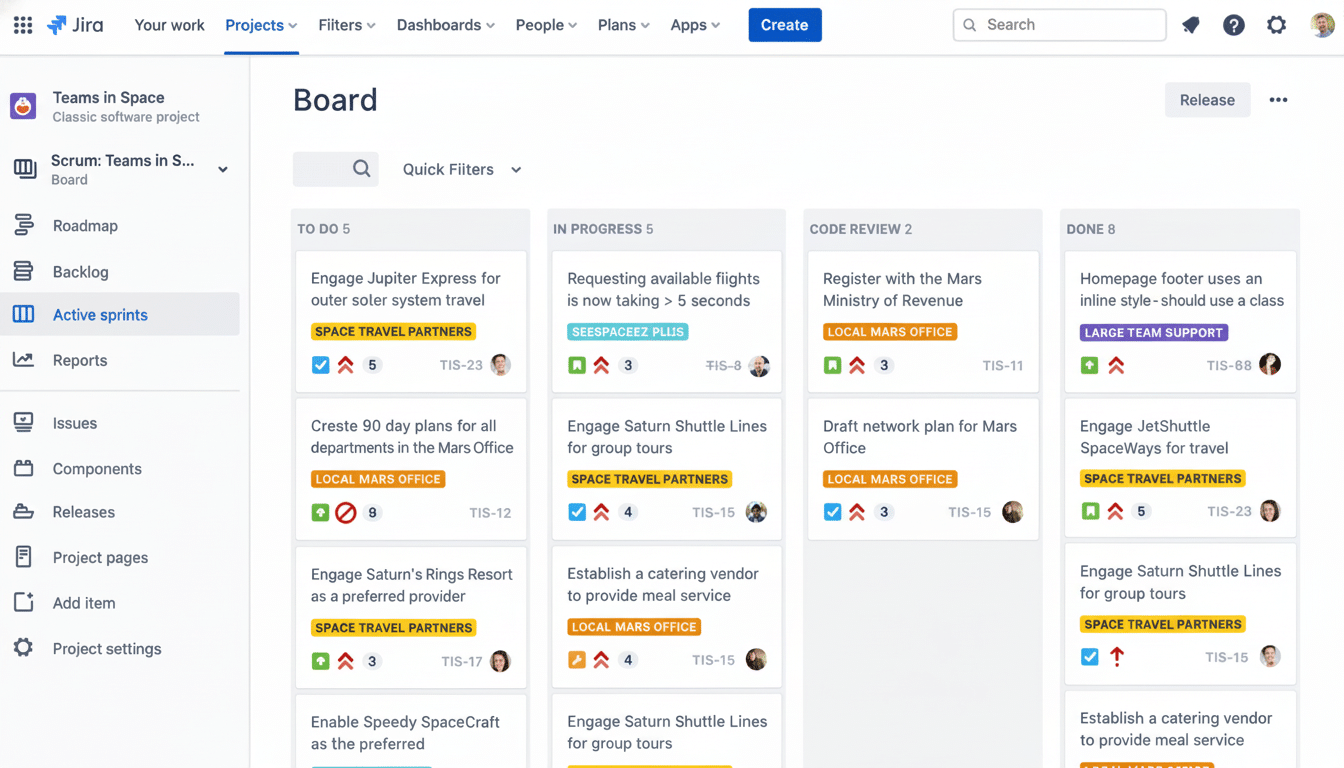

DX’s footprint already crosses over significantly with Atlassian’s customer base — by the companies’ estimates about 90 percent of its customers are using Atlassian tools. That opens up a direct line to DX in Jira Software and Jira Align for planning, Bitbucket for code, Compass for service catalogs, Opsgenie and Statuspage for reliability, and AI-assisted recommendations courtesy of Atlassian Intelligence.

In the real world, consider a payments team creating links between Jira epics and Bitbucket pull requests, release pipelines, and incident data. DX might reveal where work gets stuck — in the form of long lines waiting for review, flaky tests, or straining services — and poke teams (via Jira feedback) toward redistributing reviewers, re-running targeted checks, or shrinking their batches. By industry and by company size, DX benchmarks mean that leaders get to see whether their cycle time and change failure rate are lagging behind in comparison to their peers (not just last quarter’s baseline).

Watch Atlassian pop some DX-style dashboards right into Jira and Align for program managers’ faces so they can track the outcomes without having to hop around in tools. Now, through Atlassian’s new Intelligence platform — released today in Jira Software and coming soon to the rest of its products — these insights can be summarized for you automagically (think ‘PR wait time increased 18% WoW; reassign two reviewers; check this service’s ownership’).

What DX measures — and what it doesn’t measure

Developer productivity is classically easy to measure poorly. DX borrows from industry-sponsored methods such as DORA metrics (deployment frequency, lead time for changes, change failure rate, and restore time) but marries these with survey pulses and workflow analytics. That’s in keeping with the SPACE framework developed by research leaders in the field, which advises against reliance on vanity metrics like lines of code or hours online.

Evidence matters here: the Accelerate State of DevOps research and McKinsey’s Developer Velocity work connect healthier engineering flow to stronger business outcomes. The goal here isn’t to sort people; it’s to increase system throughput and developer happiness. Atlassian will be assessed on the degree it can keep its focus on team performance, and away from surveillance.

A billion-dollar exit on very little funding

DX’s Salt Lake City origins and capital-light path represent an amazing outcome: an over-$1-billion sale for under $5 million raised. It’s a sign that buyers will pay up for software that is central to day-to-day engineering activities and can produce immediate ROI within established toolchains, such as Jira.

The price tag overshadows Atlassian’s previous headline deals, which have included Loom at around $975 million and Trello at about $425 million, and follows earlier bets in incident response (Opsgenie) and service management. All of this aside, Atlassian also scooped up The Browser Company, whose product is an AI-first browser, suggesting that Atlassian now wants to stitch AI-native workflows across the developer lifecycle.

What changes for customers after Atlassian acquires DX

DX will be incorporated into Atlassian’s product offering, Atlassian says. Those in the industry will look for bundling with Jira Cloud Enterprise and Jira Align, one bill of materials for platform leaders, and migration tooling that can pull historical signals into new dashboards without losing data.

Enterprises will also scrutinize governance. Look out for questions on data residency and storage, SSO, role-based access and audit trails, and how DX will mesh with Atlassian Access and existing compliance regimes once the integration is done. The north star: provide executives with metrics they can trust and that consider the human side of productivity, while allowing teams to control how productivity signals are collected and shared.

For engineering leaders, the near-term wins should be better visibility across teams and fewer dueling dashboards. For developers, winning means fewer context switches and faster feedback in the tools they already use — without boiling productivity down to simplistic individual scores.

The competitive angle among developer analytics tools

DX either competes with or complements tools like LinearB, Jellyfish, Pluralsight Flow, Code Climate Velocity, and analytics built into GitHub and GitLab. If Atlassian acquires it, DX may become the default analytics layer for Jira-first companies and force competitors to focus on niche workflows, specialized data science, or deeper SCM/CI integrations.

If Atlassian delivers on integration and focuses on outcomes, the acquisition can move developer productivity work from a discrete category to a platform-level layer in software delivery’s toolchain — measured where the work is done and acted upon without leaving it.