Carriers have spent the past few years slimming down their brick-and-mortar footprints while pushing customers to apps and chatbots. In an increasingly store-optional world, the question is no longer provocative — it’s practical: Could Verizon and AT&T and T-Mobile be better off with no physical retail at all?

The cost case for going digital in carrier retail

Retail rent, headcount, commissions, training and shrink all add up. Some industry analysts estimate the fully loaded cost of a store visit in the tens of dollars per interaction, with acquisition costs for in-store activations being substantially higher than online because of commissions and accessory inventory. Company filings underscore the numbers: Verizon has reported about 1,500 company-operated locations in recent years, and AT&T lists more than 5,000 when counting authorized retailers, while T-Mobile and Metro by T-Mobile combined have several thousand doors, their 10-Ks show and investor presentations confirm.

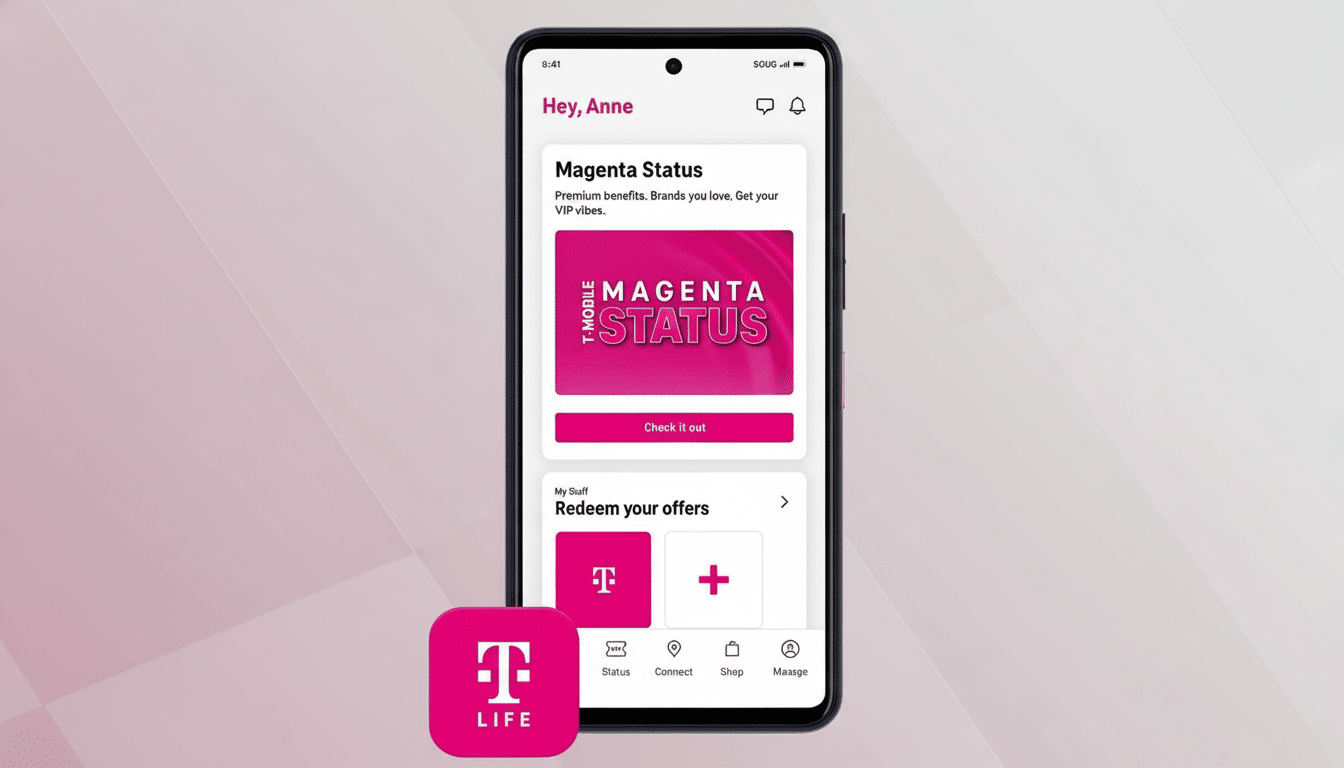

Digital journeys, in contrast, scale inexpensively. eSIM onboarding, automated identity checks and app-based device financing are some of the reasons activations can now be completed entirely online with new lines, porting numbers in and upgrading devices without stepping foot inside a store. Carriers have followed suit: T-Mobile has consolidated customer touchpoints with its T-Life app; Verizon embedded AI-empowered recommendations across channels; AT&T doubled down on self-service care and curbside or ship-to-home fulfillment. The math, for financiers at least, is persuasive.

Why physical stores still perform essential work

There is more to physical locations than ringing up new iPhones. They solve complicated problems, manage tricky device migrations and trade-ins, and offer fraud checks that are more difficult to replicate online. Older and less tech-confident customers — who remain a huge cohort in postpaid — appreciate the security of face-to-face support. J.D. Power’s wireless customer care studies have found time and again that assisted channels can provide greater satisfaction for complex issues, even as digital gets better.

Stores also drive profitable attach. In-person reps have historically outperformed digital flows in insurance, accessories and multi-line conversions. And as much as AI can suggest add-ons, conversion inside a store is hard to beat. That delta is significant: protection and device financing are sources of recurring margin, after all, and carriers pay close attention to attachment rate metrics during earnings calls.

How the wireless market is shifting around stores

Two shifts in our environment make a storeless world more problematic. For one thing, competitive pressure from low-cost and online-first providers is on the rise. Visible, Google Fi and US Mobile have demonstrated that the pure digital play can scale when pricing is sharp and support is reliable. Cable MVNOs such as Xfinity Mobile and Spectrum Mobile have fast-tracked share gains with a hybrid model that skews online while relying on existing stores mainly for pickup and service; their growth has been a music bed in analyst papers and CTIA industry updates.

The second is that prepaid and value brands are graduating into what’s effectively “not free” retail. Both Metro and Cricket continue to advertise the comfort of in-person assistance. Wave7 Research has been monitoring aggressive growth in big-box and dealer channels, and these brands advertise both same-day swaps and simple trade-ins — perks that strike a chord with consumers wary of troubleshooting over chat.

How much of the carrier journey can be digitized?

More than ever. eSIM has made immediate activation routine practice, and this is especially true now, as the most recent iPhones in the United States are eSIM-only. Meanwhile, photo ID verification and device diagnostics over the air, as well as door-to-door trade-in logistics, have moved to scale. Carriers can send a phone, provision service, and credit a trade-in without the customer ever having to visit a store. Both Deloitte and Accenture have observed how end-to-end digital journeys are climbing in the telecom sector, with a majority of customers now beginning — and many completing — their journeys online.

But edge cases remain: multi-line migrations for family plans, rural customers with patchy delivery infrastructure, enterprise account changes and fraud-sensitive use cases such as SIM swaps frequently require managed, in-person processes. Removing stores completely would just as well shove these into call centers or third parties, increase risk and potentially inflate churn if resolution times sag. J.D. Power’s research on purchase experience also suggests that when things go wrong, consumers want a human path to resolution.

The likely endgame: fewer, smarter, smaller

Instead of a hard pivot to zero stores, anticipate something more like a thinner, reconfigured fleet. Think appointment-based service hubs, smaller footprint “studio” locations devoted to troubleshooting and pickups, and lockers or kiosks for instant fulfillment. Buy online, pick up at store — already standard for launches — becomes the default option for upgrades and warranty swaps. Carriers can centralize complex care in regional hubs and use apps and AI to handle routine needs.

This model delivers most of the cost benefit — reduced rent and staffing, more efficient traffic management, lower return rates — without losing the high-stakes interactions that keep churn at bay and attachments high. It also offers carriers the flexibility to ramp capacity during launches or network outages without incurring permanent overhead.

Would they be better off going all-digital?

On a spreadsheet, the pure online model looks wonderful financially. But it threatens revenue leakage from reduced attach, drives complex care into channels that all too often leave customers angry, and blurs the line between premium postpaid and value offerings. Cable MVNOs and digital brands are on the rise, and moving away from the only brand with premium service would be an ill-advised move in a market shifting towards OTT.

The wiser course is disciplined pruning — not abandonment. Keep enough physical touchpoints to win high-value moments and solve difficult problems, and use apps, eSIM and automation for everything else. But the big carriers don’t have to eliminate stores altogether to gain most of those savings. They just need fewer of them — and more of a point.