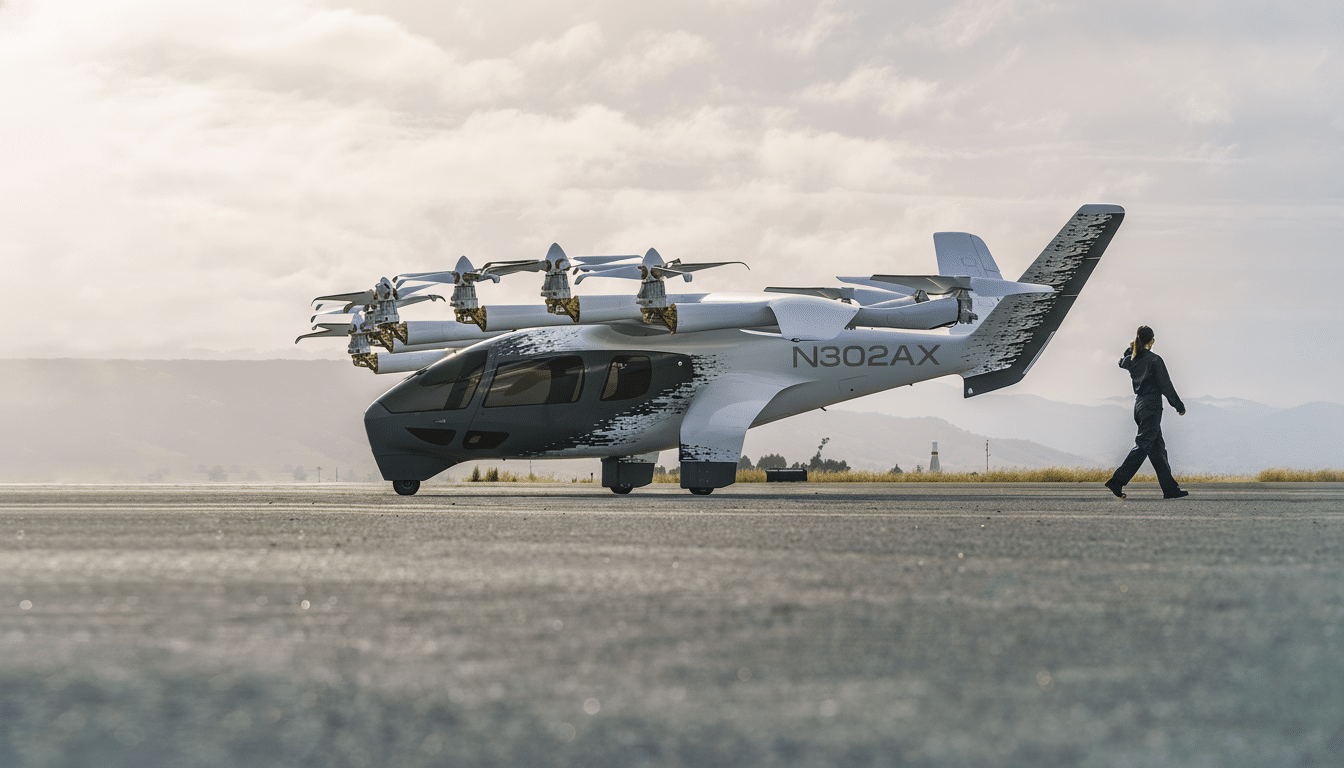

Archer Aviation laid out its plans for a regional electric air-taxi network that would crisscross Greater Miami, with a web of vertiports and upgraded helipads to shuttle Miamians to Boca Raton, Fort Lauderdale, and West Palm Beach. The company aims to whisk travelers above South Florida’s gridlock in its four-passenger Midnight eVTOL (electric vertical takeoff and landing) aircraft, connecting downtowns with major airports and important destinations.

The blueprint prioritizes infrastructure, with new and refurbished takeoff points and a route that bites into some of the area’s worst travel choke points. What Archer did not offer is the information most prospective riders are seeking: a date for launch and pricing.

What Archer Announced About Its Miami Air Taxi Plan

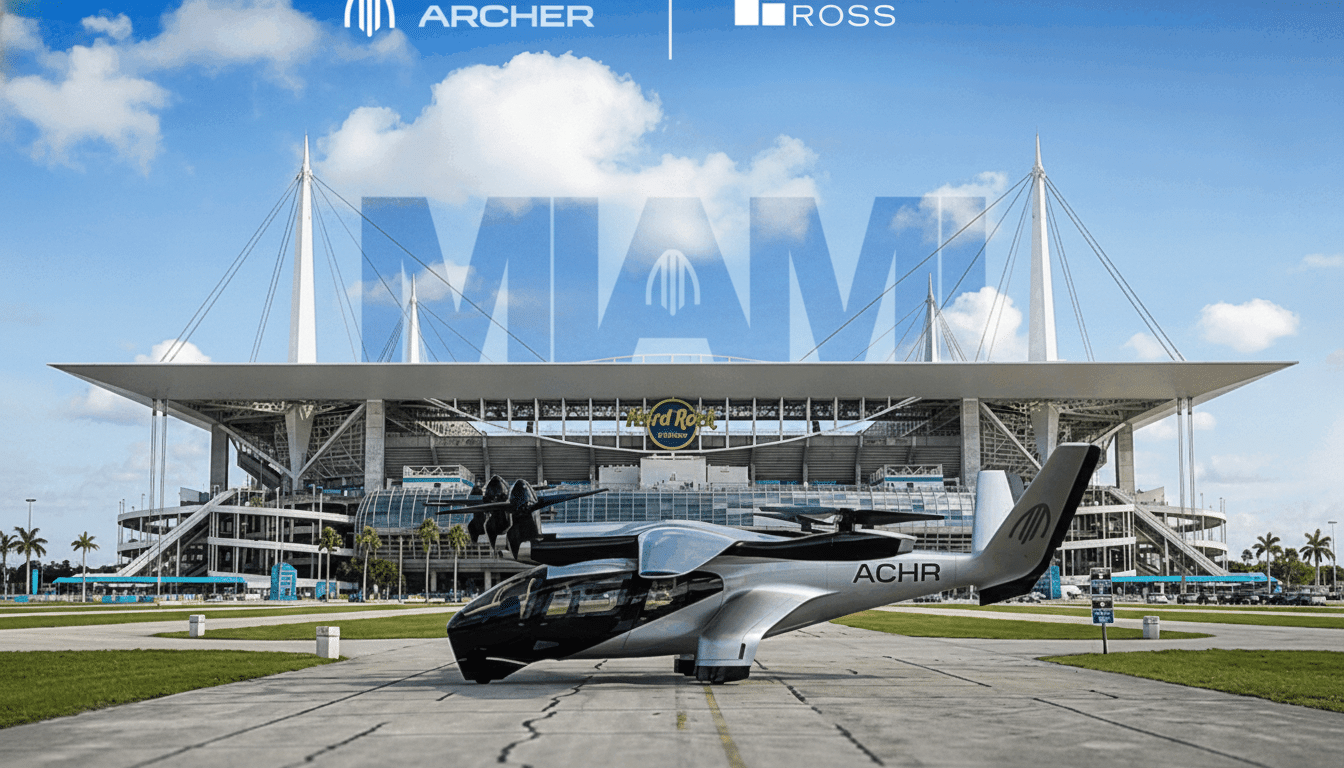

The San Jose-based startup said it hopes to have new vertiports in West Palm Beach and Miami’s Little Haiti and upgraded helipads at Hard Rock Stadium and the Apogee Golf Club northwest of Palm Beach. Archer also detailed service areas linking five area general aviation airports to be announced as sites are finalized with Miami International, Fort Lauderdale-Hollywood International and Palm Beach International.

Archer has worked on site acquisition and co-development of facilities with major real estate developers, including Related. The network is intended to make short, repeating leaps along dense corridors — which correspond to exactly where highway congestion can be at its most profound and existing transit options are often scarce.

Timelines and Fares for Miami Air Taxis Remain Unclear

The company did not announce a launch date or provide fare guidance. The Wall Street Journal reported the first flights could land as soon as next year, and a 30-minute ride from Miami to West Palm Beach might cost around $200, putting it in premium ride-hailing territory rather than private-aviation pricing. That would initially be for business travelers and wealthy commuters, with wider adoption depending on scale, as well as cost to operate.

South Florida’s congestion is understandable: the Miami metro area consistently scores among the most congested in the U.S. on independent mobility studies, and rail links do not reach many work and tourist destinations. Where they could save travelers time in hops between airports and commuting cross-county — air taxis would cut 45-to-90-minute car commutes down to sub-20-minute flights on favorable routes, given efficient ground access to vertiports.

Certification Barriers and Regulatory Route

Archer’s ability to meet ambitious timelines rests on the F.A.A. The Midnight has to first obtain type certification, which is a multiyear process that the F.A.A. says can last 5 to 9 years for new designs. Archer applied in 2022 and said it is in late-stage review, but final approvals and pilot training standards, maintenance requirements and operating rules will determine how commercial service can scale.

The company and its rivals could also join a federal pilot program that would allow for a handful of advanced air mobility projects to use precertification aircraft, but under strict supervision. Those will also be the kinds of efforts (in addition to work such as updating vertiport standards, noise tests and engaging communities) that are essential in the transition from demonstration flights to daily operations.

Rivals, Partnerships and Legal Crosswinds

Archer is moving forward alongside competitors such as Joby Aviation and Eve Air Mobility, both of which are wooing cities and airports with their own launch plans. Joby has also sued Archer in recent weeks, accusing the company of poaching an executive for trade secrets and attempting to disrupt a pending real estate deal that was exclusive to Joby; Archer disputes those claims. The legal wrangling underscores the value of vertiport locations and municipal agreements.

Archer’s commercial plans extend well beyond Miami. The company has also announced plans in the Middle East — in Saudi Arabia and the United Arab Emirates. In the U.S., Archer has a deal to provide air-taxi service for the 2028 Olympic Games in Los Angeles, and has already announced a partnership with United Airlines for routes connecting Manhattan with area airports and downtown Chicago with O’Hare. Those projects are still under way, a sign of how much infrastructure, regulation and economics must line up before passenger service can start.

What It Means for Miami’s Commuters and Travelers

For Miami, the proposed system could essentially weave airports, sports centers and affluent neighborhoods with predictable flight times that are not contingent on road congestion. City officials have pitched the plan as an innovation play and a mobility upgrade, though local acceptance will depend on how noisy the vehicles are and on whether it feels safe to share streets and what role class may play in determining who has access to them. Early pricing signals indicate that the initial focus will be on premium travelers, with costs possibly becoming more affordable as fleets expand and utilization increases.

Investors and policy makers will be watching three milestones closely: progress on F.A.A. certification, construction that starts at priority vertiport sites and any limited trial operations proving that the service is reliable (service must be prompt) and aircraft can turn around quickly.

In its 2025 Q3 results, Archer reported a net loss of $130 million on just $45 million in income, underscoring the capital-intensive nature of scaling aircraft production and ground infrastructure. The challenges in securing long-term funding and local permits will be just as critical as the technology.

Assuming Archer indeed meets its regulatory and build-out goals, Miami could be one of the first U.S. locations with a functioning first-gen eVTOL corridor network. If not, the plan will join an ever-expanding list of ambitious air-mobility announcements waiting for the all-clear from safety watchdogs, site planners and the court of public opinion.