Apeiron Labs has secured $9.5 million in new funding to deploy fleets of autonomous underwater vehicles designed to gather subsurface ocean data at scale. The startup’s pitch is straightforward: make high-quality ocean measurements cheap and continuous, then sell the resulting data and services to customers that range from fisheries and offshore wind developers to defense and weather agencies.

An Ocean Data Gap Big Enough To Navigate

Despite the oceans covering most of the planet, the world still lacks reliable, high-resolution measurements below the surface. Satellites provide an exceptional view of sea-surface temperature, height, and color, but they cannot see what’s happening throughout the water column. NOAA and the U.S. National Academies have repeatedly noted that the majority of the global ocean remains unmapped, unobserved, or poorly observed beneath the top layer.

Existing networks help, but they leave gaps. The international Argo program operates thousands of profiling floats that typically dive to 2,000 meters and surface approximately every 10 days, providing invaluable climate-quality data. For operational needs like daily fisheries guidance, tactical maritime awareness, or near-term wind farm planning, however, the cadence and spatial resolution can be too coarse.

How the Autonomous Ocean Robots Operate and Communicate

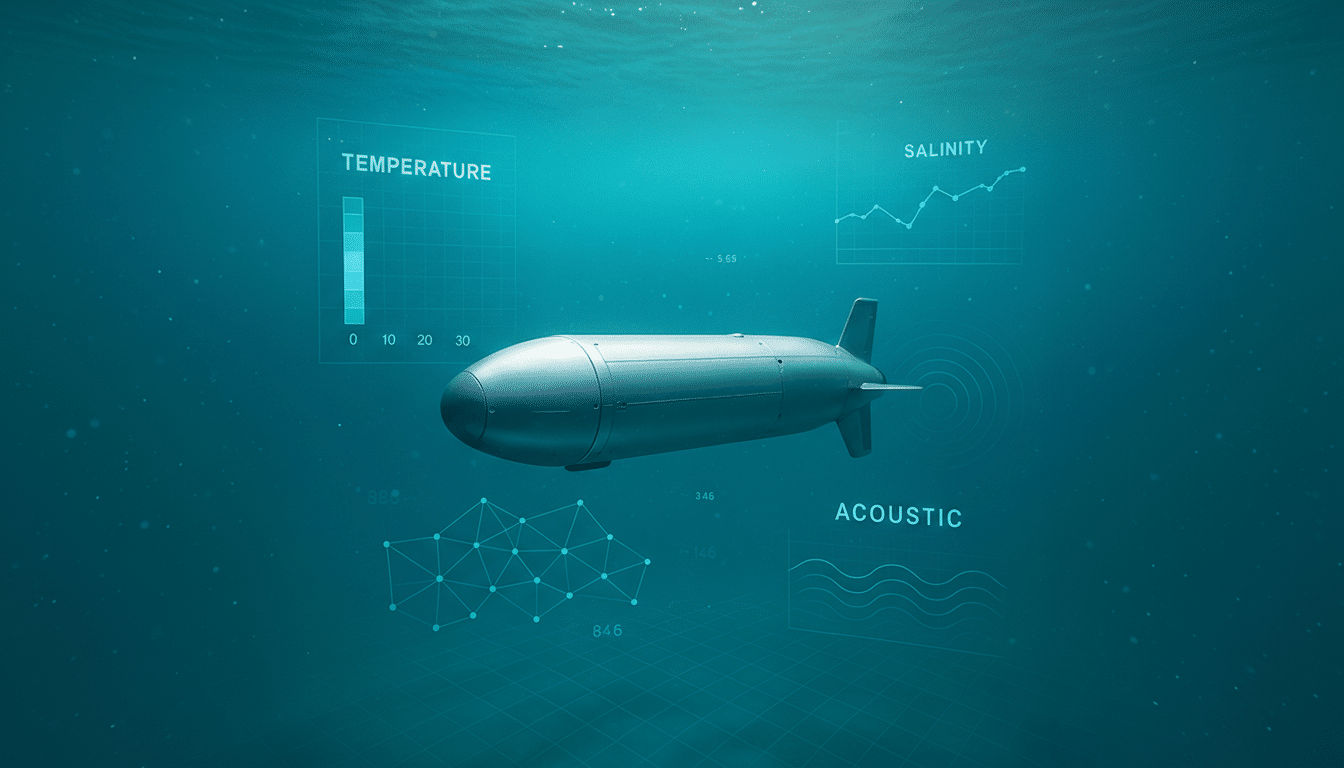

Apeiron’s vehicles are compact profiling AUVs, roughly three feet long and five inches in diameter, weighing just over 20 pounds. They ride the water column to around 400 meters and back, sampling temperature, salinity, and acoustics once or twice a day. The units can be launched from small boats or aircraft, an approach meant to reduce logistics overhead and speed deployment.

Once in the water, each robot connects to a cloud operating system that sets a mission plan, predicts surfacing locations using ocean models, and ingests data when the vehicle re-establishes a link at the surface. Place them 10 to 20 kilometers apart and they behave like a virtual moored array, capturing mesoscale features—fronts, eddies, and sound channels—that ships and sparse buoys often miss. The company says the hardware was designed to fit existing U.S. Navy launch tubes, signaling immediate compatibility with defense users.

Building a Data Business to Serve Dual-Use Demand

The value proposition is data density and persistence. Fisheries managers want sharper maps of temperature and salinity to forecast fish movement. Offshore wind operators need subsurface profiles to plan routes and reduce downtime. Meteorologists can feed more frequent profiles into coupled weather–ocean models to improve coastal forecasts. Defense organizations, meanwhile, care deeply about acoustic propagation and background noise to monitor subsurface activity.

Apeiron envisions customer-specific arrays that run continuously, with alerts and analytics published via a cloud portal or API. The founder, previously the CTO at In-Q-Tel, frames the approach as purpose-built for dual-use: sell to civilian and defense customers while standardizing hardware, software, and data streams to drive costs down.

Chasing a CubeSat-Style Breakthrough for the Ocean

The company claims it has already reduced the cost of collecting subsurface ocean data by roughly 100x at current scale and is targeting a 1,000x decrease as manufacturing and operations ramp. That ambition echoes the trajectory of CubeSats, which turned space imaging from bespoke missions into routine services through standardized platforms and frequent iteration. If Apeiron can prove reliability and low-latency delivery, the ocean domain could see a similar shift toward “data-as-a-service” at unprecedented coverage.

For context, traditional profiling platforms can cost tens of thousands of dollars per unit and often require ship time for deployment and recovery. By minimizing size, enabling air deployment, and automating mission control in the cloud, Apeiron is betting that it can increase sampling frequency while cutting the total cost of ownership for end users.

Crowded Waters And Practical Constraints

The field is hardly empty. Surface fleets from companies like Saildrone and Sofar Ocean have proven that autonomous systems can deliver high-value marine data at scale. Underwater gliders such as Teledyne’s Slocum, developed with institutions like Woods Hole Oceanographic Institution, are workhorses for research and monitoring. Apeiron’s differentiation hinges on dense subsurface arrays, rapid deployment, and a software layer that continuously assimilates measurements into predictive models.

Risks remain. Battery endurance limits duty cycles and dictates maintenance windows. Data rights and export controls can complicate dual-use sales. And any company promising to “flood the ocean” with robots must show environmental diligence—quiet operations, minimal entanglement risk, and responsible end-of-life practices—to meet standards set by agencies and research partners.

What Comes Next for Apeiron’s Ocean Data Platform

Near-term milestones to watch include multi-month pilot arrays with defense and commercial customers, demonstrated improvements in model skill scores after data assimilation, and proof that units can be launched, operated, and retrieved at scale without specialized infrastructure. Partnerships with NOAA, national navies, or major offshore developers would signal that the platform is becoming part of the operational ocean toolkit.

If Apeiron delivers on coverage density and cost, the industry could gain an underwater analog to the satellite revolution—a persistent, machine-driven map of the ocean’s interior that updates daily and is priced for widespread use. That would be a meaningful step toward closing one of Earth’s most consequential data gaps.