Amazon is preparing to open a closed beta of its in-house AI production suite for film and television, signaling a pivotal test of how generative and assistive AI can mesh with professional studio workflows. The initiative, developed by Amazon MGM Studios’ AI Studio and reported by Reuters, will invite select partners to trial tools designed to accelerate pre- and post-production without displacing creative teams.

The move gives Amazon a head start in shaping practical, studio-grade AI—less about splashy demos and more about integrating with real pipelines, schedules, and rights management. For Hollywood, the question is no longer whether AI will be used, but how responsibly and effectively it can be put to work.

What Amazon’s AI Studio Is Building for Production

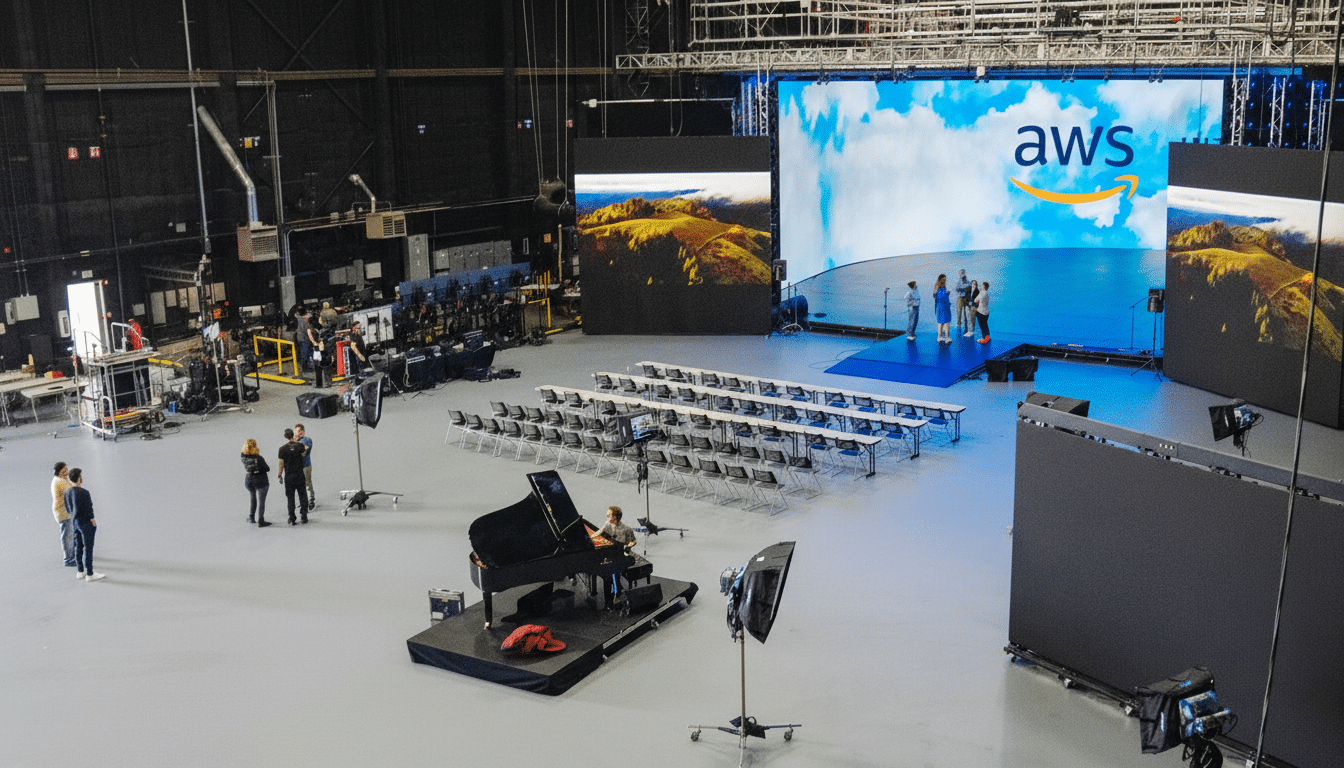

Amazon MGM Studios launched the AI Studio to build proprietary tools that support core workflows such as character and asset consistency across shots, previsualization, and editorial polish. According to people familiar with the program, the stack leans on Amazon Web Services for compute, compliance, and media supply-chain integration, and will tap multiple large language model providers depending on the task.

Early collaborators include filmmaker Robert Stromberg of Maleficent, actor-producer Kunal Nayyar, and former Pixar animator Colin Brady—industry figures steeped in VFX-heavy storytelling and animation pipelines. Their feedback is aimed at ensuring the tools feel like accelerators for departments such as art, VFX, editorial, and sound, rather than replacements for human expertise.

One telling data point: Amazon’s House of David reportedly incorporated 350 AI-generated shots in its second season, giving the studio a real-world sandbox to validate cost and schedule impact. Expect the beta to probe similar use cases—rapid iteration on look development, continuity checks, and time-consuming tasks like rotoscoping, cleanup, and localization passes.

Guardrails on IP and Model Training for Studios

Albert Cheng, who leads the AI Studio effort, has emphasized that the tools are designed to augment artists while keeping intellectual property locked down. That means scene data, character designs, and footage are not intended to be fed back into generalized models, a concern frequently raised by guilds and rights holders.

In practical terms, studios will look for clear provenance, opt-in training controls, and secure isolation between projects—areas where AWS already offers robust media-focused controls. Expect alignment with industry safeguards such as Trusted Partner Network standards and watermarking or audit logs to prove which elements are AI-assisted.

How It Fits the Industry’s AI Curve Right Now

Amazon’s beta lands amid a broader wave of experimentation. Netflix has acknowledged using generative techniques for complex sequences, citing work on The Eternaut. Animation and VFX shops have piloted AI for storyboard generation, crowd variation, background replacement, and script breakdowns—areas where speed gains can ripple through a schedule.

The promise is measurable: shaving days off previs, catching continuity errors before reshoots, or compressing localization turnaround. For streamers operating at scale, even low double-digit efficiency gains across multiple departments can translate to millions in savings per slate. Yet the labor implications remain sensitive. Recent guild agreements introduced consent, compensation, and crediting provisions to curb misuse and protect performers and writers.

The Business Stakes for Amazon in Film and TV

If the closed beta proves out, Amazon could fold the tools into its studio operations and, eventually, offer components through AWS alongside services like Nimble Studio and render management. That would position the company at both ends of the market: using AI to streamline its own productions while selling secure media AI infrastructure to third parties.

The company has also framed AI as a driver of operational efficiency across businesses. In that context, studio-grade AI that reduces versioning cycles, shortens editorial queues, and lowers VFX overhead is strategically aligned. Still, the narrative will be scrutinized closely in an industry wary of cost-cutting at the expense of creative jobs.

What to Watch in the Closed Beta for Film and TV

Key indicators will include:

- Whether the tools plug seamlessly into existing ecosystems like Autodesk ShotGrid, Adobe Creative Cloud, and common VFX pipelines

- Whether outputs meet broadcast and cinematic quality thresholds

- How well the system documents AI assistance for compliance and credits

Equally important is governance: clear rules on data usage, opt-outs for talent, and opt-ins for training any models on proprietary assets. If Amazon demonstrates solid gains while honoring those constraints, it could set a template other studios follow—turning AI from a flashpoint into a pragmatic utility for modern production.

The coming trial is less about novelty and more about reliability. If Amazon’s tools can deliver consistent results inside real show schedules, the experiment will mark a meaningful step toward an AI-enabled production stack that respects craft, protects IP, and ships on time.