Amazon is considering walking away from its long-standing deal with the United States Postal Service and setting up a competing national delivery operation, according to a report by The Washington Post. The companies have been in talks over a new contract that would replace the one expiring in 2026, but discussions are said to be strained by political pressure to privatize chunks of the postal system.

The stakes are enormous. Amazon pays the Postal Service billions of dollars a year to deliver packages — 7.5 percent of the agency’s revenue in 2025. The majority of that volume travels in the system through a service called Parcel Select, under which USPS does the “last mile” delivery portion for hard-to-reach or lower-density areas. Hauling that freight elsewhere might take away a linchpin in postal planners’ strategy to grow their share of that market and speed up financial pressure on portions of the network where packages already aren’t dense enough or numerous.

Why Amazon Might Go It Alone on National Parcel Delivery

For the past decade, Amazon has built a bruising logistics machine: a domestic air network; regional sortation centers; same-day sites; hundreds of thousands of delivery vans, including many Rivian EVs; and contractor-driven last mile. It is testing drones under its Prime Air brand — despite an FAA investigation underway — and it continues to work on autonomous ride-hailing and goods movement via Zoox. Having a larger piece of the stack lets Amazon dictate speed, reliability and cost while also reducing exposure to postal pricing, changes in service levels, and political winds.

From an economics perspective, the calculus for vertical integration is inching closer to a yes. By aggregating deliveries around fulfillment hubs and smaller pools of more densely served neighborhoods, Amazon increases “stop density,” the primary factor in driving last-mile efficiency. Analysts at Pitney Bowes, which publishes the Parcel Shipping Index, have estimated that Amazon Logistics has already assumed a significant share of its U.S. packages — as has MWPVL International, an independent logistics consultant. Every incremental route they add to Amazon’s network is easier to justify if it can support existing facilities, drivers, and data-driven routing systems.

What It Takes To Compete With A Postal Service

Competing with USPS isn’t the same as overtaking a carrier in urban parcel deliveries. USPS has a mandate to provide service to some 160 million delivery points in the U.S. Private carriers can’t use mailboxes, so a competing network has to handle doorstep delivery in places where drop density is low and delivery costs are high. Without extraordinary scale, clever zoning or cross-subsidies, profitable lanes can become money losers thanks to rural routes and seasonal fluctuations.

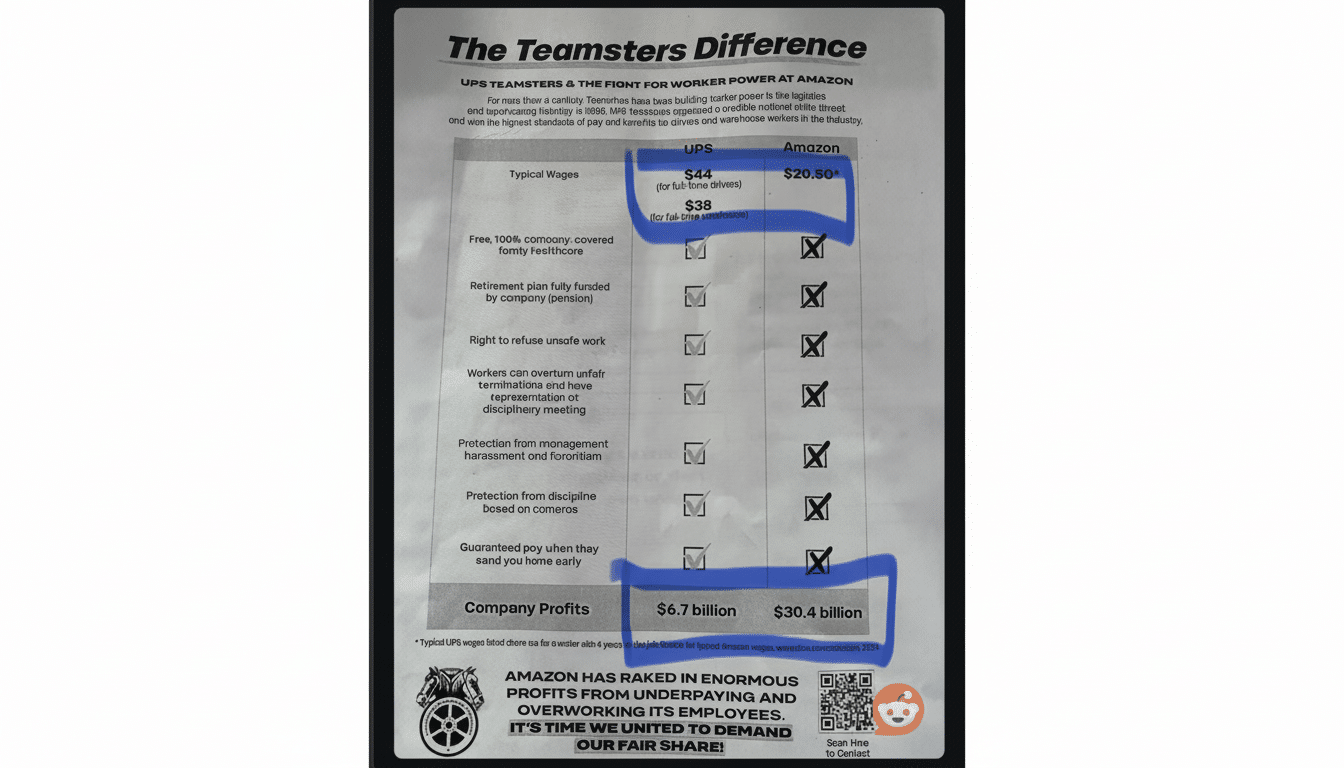

There are also regulatory and labor issues. While the Delivery Service Partner model Amazon uses spreads costs across tens of thousands of small businesses, a postal-scale operation suggests a much larger direct workforce and potentially more complicated labor relations with organized workers. Any effort to replace the USPS in rural areas would be subject to scrutiny by policymakers and the Postal Regulatory Commission, even if there is no direct rate oversight for a private competitor. Community resistance to traffic, warehousing and noise can slow expansion, and there are only so many times a day planes can come in and out of airports.

Finally, the capital bill is costly. Beefing up regional sortation, middle-mile trucking, and the air network — estimated by aviation analysts now to be about 100 planes strong — only takes a carrier so far. The real challenge is six-day (or better) traditional rural delivery with tight on-time performance, and cost-effective returns processing. UPS and FedEx developed those muscles over decades. Amazon is on a roll, yet achieving postal reach across the country requires time, physical assets and billions more in spend.

USPS Fallout And Competitive Ripples Across Carriers

USPS has been relying on package volume to help cover persistent losses in letter mail. And the loss of a customer who accounts for 7.5% of revenue would crush network utilization, undermining rural delivery’s delicate economics. The post office’s new plan, Delivering for America, turns on operational reforms and package growth; a sudden Amazon exit could compel the agency to make pricing changes, rationalize service or sharply accelerate cost cuts to keep that roadmap intact.

For the private carriers, the calculus is more nuanced. UPS and FedEx could win bandwidth in lanes Amazon isn’t yet prepared to internalize, but they would also face a bigger, faster-growing competitor if Amazon treks deeper into enterprise shipping and small-business packages. UPS has said in previous filings that Amazon is one of its largest customers; a shift in those volumes changes the terms of trade across the industry. On the other hand, regionals and even some of the companies working as an aggregated network (LaserShip/OnTrac — a merged network) could be looking at more consolidation possibilities or new partnerships as shippers spread their bets.

Small merchants may have felt the change in their checkout flows, as well as in their margins. By unifying a more integrated postal-like service with Buy with Prime and Multi-Channel Fulfillment, Amazon might provide quicker delivery zones and/or cheaper rates in exchange for off-Amazon marketplace volume. Yet early transitions often come with variability in service — the retailers will be watching closely to make sure returns, rural coverage and peak-season capacity meet expectations before reshaping their own carrier mixes.

What To Watch Next As Amazon Weighs USPS Delivery Split

The most important signals will emerge well ahead of the USPS contract expiration: trial city rollouts that bypass the USPS on additional routes, faster acquisition of property for sort centers and changes in Amazon’s rate cards and service commitments to third-party sellers. Regulatory dockets at the Postal Regulatory Commission and comments from the USPS Board of Governors will provide clues on how much the postal budget still depends on Amazon volume.

On the technology front, more details on Prime Air’s path through the FAA, new safety case approvals for Zoox operations and continued signs of Sunday delivery expansion will tell how aggressively Amazon aims to close the last-mile gap in low-density areas. Whether it becomes a negotiating lever — or the first chapter of an outright postal competitor — will define the next era of American parcel delivery.