Amazon is offering a well-timed discount on TurboTax Desktop Deluxe 2025 Federal & State, with the price down to $55.99 from its $79.99 list price for a 30% savings.

For filers who want the control and privacy of software on their PC or Mac, it is one of the first significant deals of tax season.

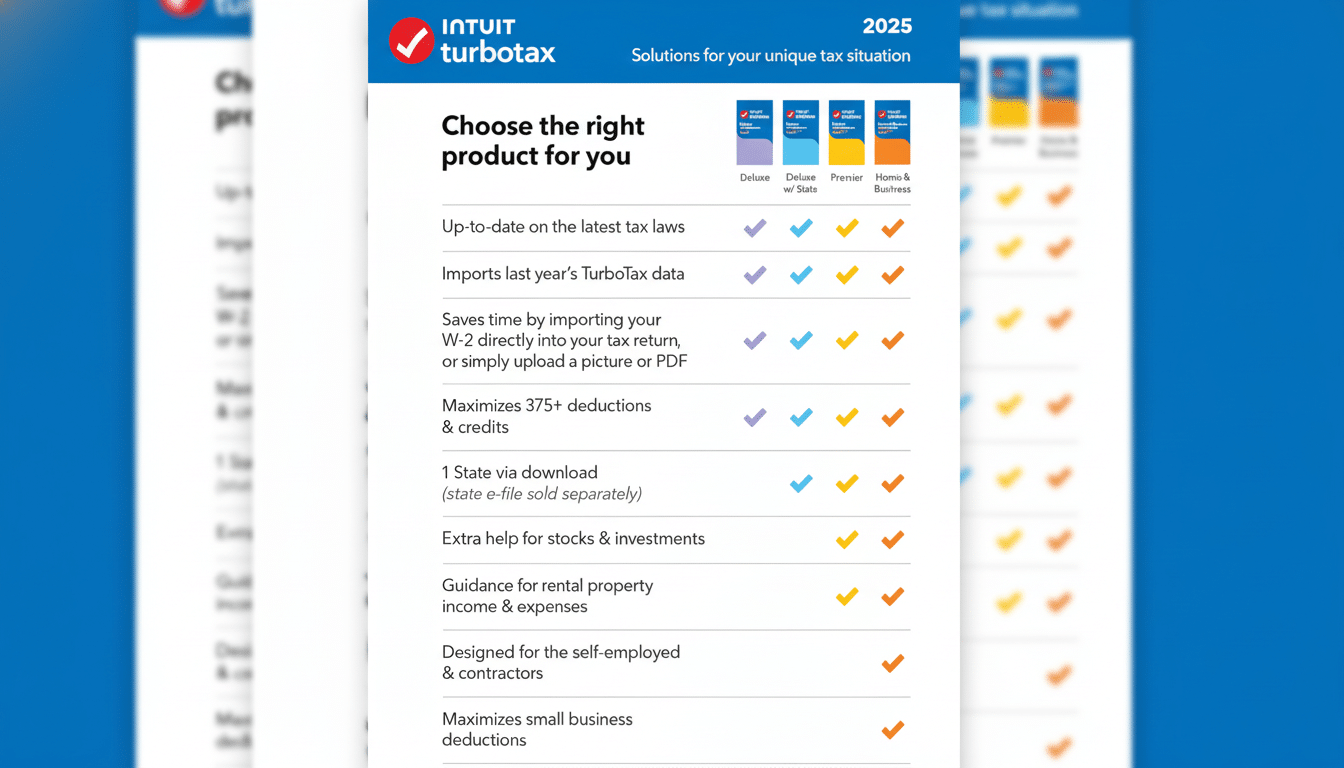

Desktop Deluxe is a tax service designed for taxpayers who want to itemize and need better support selecting deductions, without the need for stronger guidance for complex investments or business-level situations.

By now, most Americans e-file — the IRS says about 9 in 10 individual returns are filed electronically — and locking in solid software early can help reduce stress in a process that many of us tend to procrastinate until the last minute.

What’s Included in the TurboTax 30% Off Deal

This version comes with five federal e-files and one state download, enough for most households without making them purchase extra federal e-files. Deluxe sifts from 375-plus deductions and credits — identifying popular savings areas such as mortgage interest, property taxes and charitable donations; educator expenses; and some medical costs.

It can import a PDF of a return filed last year and, in conjunction with files saved to its service, use the data it contains to prefill much of what a new filing needs, minimizing mistakes from retyping information.

Importing some W-2s (the complex forms for corporate officer compensation aren’t on the list) and certain types of 1099s also works well, so you don’t need to re-key basic information containing wages or self-employment income. The program’s error checks should help flag missing forms or mismatches before you submit.

State e-filing may be an additional charge, as it is for most desktop-based tax software, though one download of a state program (for 44 states) is included.

Since it’s the desktop edition, your return data resides on your computer — a feature that suits some filers who desire offline access or who prepare multiple returns with one license. It also enables you to print and file unlimited copies of your returns for archiving.

Who Should Get Deluxe, and Who Should Upgrade

Deluxe is usually the sweet spot for W-2 employees, homeowners, and anyone who plans to itemize on Schedule A. It also covers typical investment situations for filers with 1099-INT or 1099-DIV forms to complete, as well as stocks and other investments to sell.

If you receive freelance or contractor income on 1099-NEC and want to fill out a Schedule C, we recommend stepping up to TurboTax Home & Business (which has some added help and options for covering self-employment income) or the Self-Employed edition, which includes extended support for business deductions, asset depreciation, and expense-tracking tools. The upgrade is needed so the forms and guidance fit the nature of side gigs or full-time self-employment.

Timing and Filing Notes for Early Tax Preparation

You can download the desktop application now, so that you can start organizing and inputting information right away! Not all IRS forms are issued simultaneously each season, however. The final versions of a handful of special-case forms usually come later in February, so some items may appear pending until those are finalized as well. As the forms are cleared for filing, you will be prompted to install the updates.

“The early bird catches the worm” still applies: You can enter your W-2s, popular 1099 forms and deduction details now and e-file when the IRS starts accepting returns (and all necessary forms are supported). And historically, the IRS has observed that people’s average refunds tend to be around $3,000 in the heart of filing season, so catching eligible credits and deductions with strong software can pay off.

Price Context and Value of the TurboTax Deluxe Deal

Tax software is traditionally discounted as we get closer to filing season, and 30% off at this early stage is a solid discount for the Desktop Deluxe tier. Purchasing now rather than paying full list just before the deadline locks in your savings, spreads the workload and eliminates last-minute scrambling that puts you at risk for missed deductions.

Quick Tips to Maximize the Value of Your Purchase

- Collect necessary documents before you begin: W-2s, 1099-INT/DIV/B, mortgage interest (Form 1098), property tax statements, charitable receipts, and last year’s return if you want to speed imports.

- File for family members if needed: The five federal e-files included with this software allow you to submit for multiple returns. Note that state e-filing may incur an additional fee, though the state program is included.

For most itemizers who don’t require business schedules, TurboTax Desktop Deluxe at $55.99 strikes the right balance between guidance, speed and cost. Priced 30% off on Amazon, it’s a sensible option to stay ahead of tax season without overspending for features you won’t use.