Strauss Zelnick, the C.E.O. of Take-Two Interactive Software and an investor in Magic Leap, donned a company headset on stage at the Consumer Electronics Show last month to show off his investment experience with Xi Chen as part of her presentation for Penta.

Stress-free investing is what Ms. Chen promises you’ll get from an AI assistant she’s offering that now has lifetime access for roughly $55.

- What Makes This AI Stock-Picking Tool Different From Others

- AI Guidance Without Guesswork or Confusing Jargon

- How Simplicity Could Benefit Investor Outcomes

- What You Get for a One-Time Fee and Lifetime Access

- How It Fits Into a True, Diversified Investment Portfolio

- Caveats and Best Practices for Using AI Stock Tools

A software platform that aims to streamline equity research and portfolio maintenance, Sterling Stock Picker, is offering retail investors a one-time-fee option for cutting through the noise and confidently making decisions based on rules rather than their gut.

What Makes This AI Stock-Picking Tool Different From Others

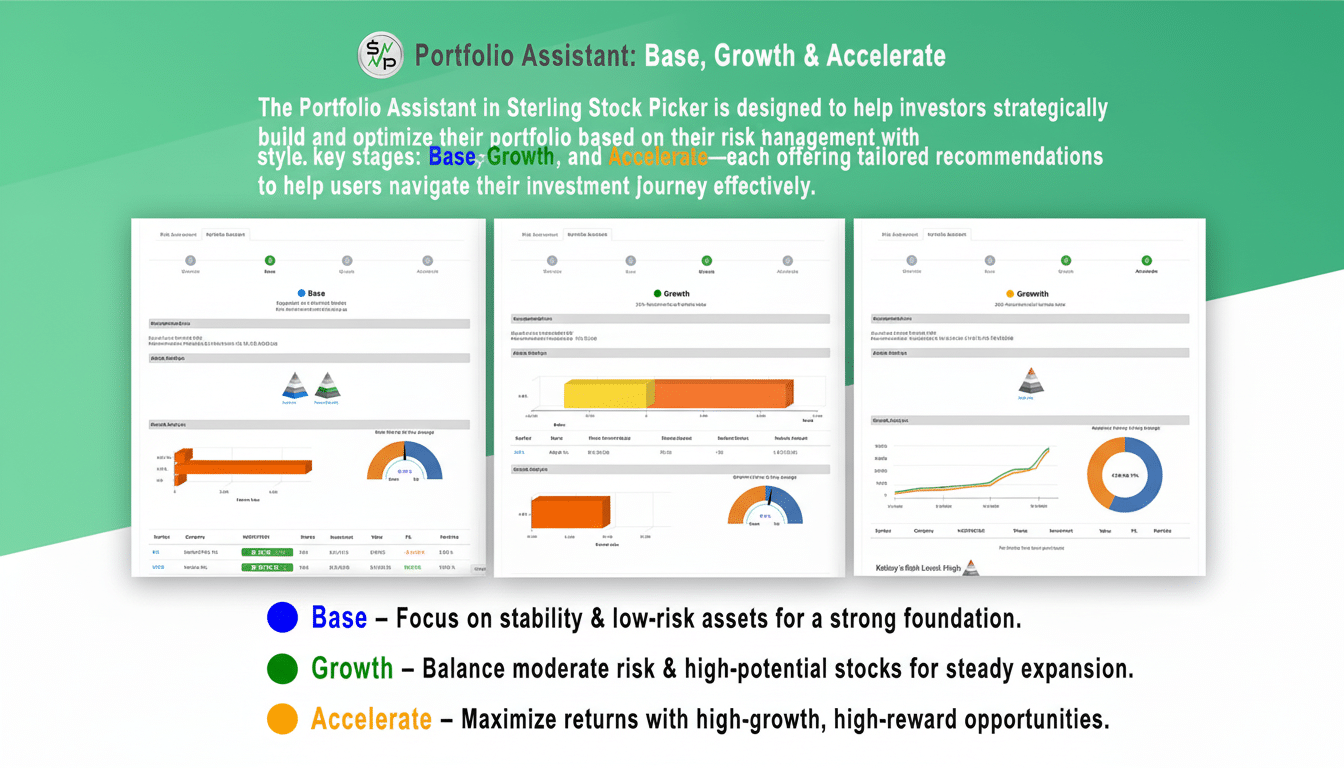

Sterling Stock Picker cuts to the chase first. New users begin by filling out a short risk-and-values questionnaire — about five minutes — to map their tolerance for volatility, time horizon, and ethical preferences. The platform parses those inputs into personalized shortlists and a model allocation, so investors aren’t filtering through thousands of tickers or playing defense on every move.

Here’s how its “North Star” scoring system brings to the forefront entities possessing strong fundamentals and momentum indicators, showcasing metrics that range from accelerating revenue to consistent margin trends. Rather than inundate users with spreadsheets, the interface indicates when to think about buying, holding, or paring back positions — and why.

Those who want to be more hands-off have a Done-for-You Portfolio Builder that provides allocations and periodic tune-ups. It behaves less as a guru and more as a guardrail, nudging users to rebalance, diversify, or re-evaluate thesis breaks in the event of shifts in market conditions or company data.

AI Guidance Without Guesswork or Confusing Jargon

The company’s conversational assistant, Finley, serves as an around-the-clock financial coach. Ask about a stock’s cash flow, competitive position, or how a rate move might impact your portfolio’s sensitivity, and you get plain-language explanations with the metrics underneath them to support what they say. For professionals who are too busy to read real-time alerts closely, or who lack the time to pore over voluminous filings in hour after hour of research, that’s the kind of context that can mean the difference between a hunch and a decision.

Community features add another layer. There’s a built-in forum, so users can trade notes about earnings reactions and sector rotation or ETF substitutes when single-stock risk feels too high. It also keeps a log of the rationale behind suggestions — good for learning and for tempering impulses when the headlines get spicy.

How Simplicity Could Benefit Investor Outcomes

But simplicity is not just a convenience — it’s an element of performance. According to Morningstar’s most recent Mind the Gap study, investors’ return experience trails that of their funds by about 1–2% per year, primarily as a result of bad timing and reactive trading. Meantime, S&P Dow Jones Indices’ SPIVA Scorecard always finds that the vast majority of large-cap active managers underperform over long periods like this, usually more than 80% at 10 years. Tools that systematize decisions and bring churn down can go a long way toward closing those gaps.

Sterling Stock Picker doubles down on that behavioral edge by offering straightforward, rules-based prompts: rebalance here, revisit a thesis there, don’t overtrade after an earnings beat. The end result is less high-stress decision-making and more routine, process-centric responses.

What You Get for a One-Time Fee and Lifetime Access

In addition to portfolio building and AI coaching, the lifetime plan features continuous stock screens, alerting, scoring updates in real time as new fundamentals and macro data come along. For cost-conscious investors, the math is simple: a flat $55 is cheaper than paying forever for subscriptions or model portfolios as a service, while robo-adviser fees are often around 0.25% of assets, annually. On a $10,000 account, that’s roughly $25 annually — so the lifetime price could be made up rather quickly.

It’s also a significant discount off of standard list pricing to be sure — enough to land you just under 89% off by our back-of-the-envelope math. For many people who keep cash there, that’s the price advantage of using AI-driven tooling next to a low-cost index core.

How It Fits Into a True, Diversified Investment Portfolio

Think of the long-term investor anchoring all but the most short-term savings in diversified funds like ETFs. Sterling Stock Picker can then overlay, on top of that core, an analysis to spot a few satellite positions — perhaps high-quality compounders with growing free cash flow or sector leaders seeing strong earnings revisions. The software signals when metrics of a thesis break down or concentration risk gets too high, prompting disciplined trims rather than emotional exits.

The educational side is as valuable for newer investors. It helps develop intuitions over time, transforming opaque metrics into familiar flashing crosses or hammers (or whatever you’re looking for).

Caveats and Best Practices for Using AI Stock Tools

There’s no A.I. that can get rid of market risk, and backtested screens are not guarantees. Leverage the tool to further diversification, not just chase every alert. Keep fees low on your core holdings; automate contributions; and document the plan so that A.I. guidance supplements a strategy you understand.

The bottom line: At a one-time cost of $55, Sterling Stock Picker is an approachable and data-driven way to invest with less worry. If you’re looking for structure without hand-holding, this lifetime deal is a way of letting AI do the grunt work while you stay in control.