Terra Industries, a Nigeria-based defensetech startup founded by Gen Z co-founders Nathan Nwachuku and Maxwell Maduka, has secured an additional $22 million led by Lux Capital—just weeks after closing an $11.75 million round spearheaded by 8VC. The fresh capital lifts total funding to $34 million and underscores surging investor appetite for African-built autonomous defense and critical infrastructure security systems.

A Fast Extension Backed by Notable Investors

Terra’s extension round, completed in under two weeks, included participation from existing and new backers such as 8VC, Nova Global, and Resilience17 Capital, the investment firm founded by Flutterwave CEO Olugbenga Agboola. According to the company, investors moved quickly after seeing faster-than-expected traction in government and commercial deals across multiple countries.

The brisk pace tracks a broader defensetech funding trend: building modern defense platforms is capital-intensive. For context, Anduril has raised more than $2.5 billion, Shield AI around $1 billion in equity, Skydio roughly $740 million, and Saronic about $830 million. Terra is earlier in its trajectory, but the willingness to preempt additional allocation signals confidence in the startup’s pipeline and execution.

What Terra Is Building for Africa’s Security Landscape

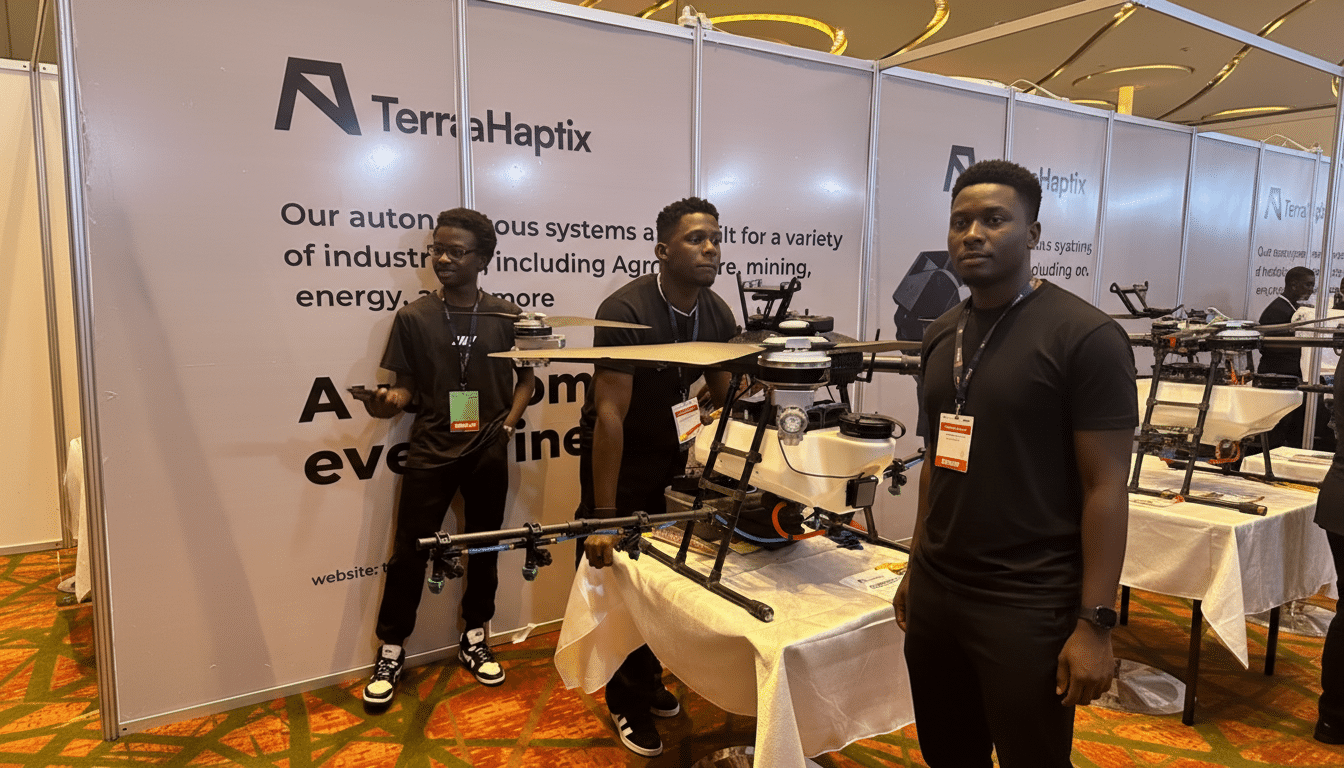

Founded in 2024, Terra designs infrastructure protection and autonomous systems tailored to African threat environments—think surveillance networks for energy corridors, AI-enabled perimeter security for ports and rail, and autonomous monitoring for mining and industrial assets. The company has said it aims to become “Africa’s first defense prime,” developing integrated platforms that tie sensors, software, and unmanned systems into a unified command-and-control layer.

Momentum is not purely theoretical. Terra reports more than $2.5 million in commercial revenue to date and says its systems are already protecting assets valued at roughly $11 billion. It recently won its first federal contract and has added undisclosed government and commercial customers beyond its home market of Nigeria, including a new partnership with AIC Steel.

Manufacturing Footprint Extends Beyond Africa

Through its collaboration with AIC Steel, Terra is setting up a joint manufacturing facility in Saudi Arabia focused on surveillance infrastructure and security systems. For a young company, this is a strategic move: local production can shorten lead times, stabilize component supply, and position Terra to serve customers across the Middle East and Africa. It also diversifies manufacturing away from single-country risk while building credibility with large industrial and sovereign buyers that prioritize domestic or regional assembly.

Why the Market Is Paying Attention to Terra’s Rise

Terrorism and infrastructure sabotage remain acute risks across the Sahel and sub-Saharan Africa. The Global Terrorism Index has identified the Sahel as the world’s terrorism epicenter in recent years, with sub-Saharan Africa accounting for a substantial share of global terrorism deaths. Energy pipelines, power transmission lines, and mining operations are frequent targets, creating persistent demand for cost-effective surveillance, counter-intrusion, and rapid-response capabilities.

Historically, many African governments have relied on external intelligence and imported systems from Russia, China, and Western suppliers. Local primes can close critical gaps by tailoring hardware and software to regional terrain, data realities, and procurement needs—while keeping sensitive data and maintenance workflows closer to home. That localization thesis aligns with broader sovereignty and resilience priorities flagged by organizations like the African Union and echoed across national security strategies worldwide.

The Business Case Behind the Raise and Strategy

Defensetech adoption hinges on proof of reliability and unit economics, not demos. Terra’s reported commercial revenue, early federal work, and cross-border expansion suggest the company is crossing from prototype to deployment at a pace unusual for a two-year-old startup. The Saudi manufacturing plan addresses a frequent scaling chokepoint—production capacity—while also opening doors to customers who demand local assembly and long-term sustainment.

For investors like Lux Capital, which has been active across frontier and national security technologies, Terra represents a regionally differentiated platform in a category with durable demand cycles. And for 8VC and others already backing defense autonomy plays, Terra’s traction provides portfolio synergy in sensing, AI, and command systems—capabilities that increasingly interoperate across land, air, sea, and critical infrastructure.

What to Watch Next for Terra and Its Expansion

Key milestones to monitor include disclosed government deployments in the Sahel and sub-Saharan Africa, proof points on counter-drone and perimeter intrusion detection performance, and progress toward standardized, export-ready product lines. Also critical: Terra’s ability to navigate complex compliance and end-use guardrails while partnering with multinationals and sovereign buyers.

If Terra sustains its current clip—converting pilots to multi-year contracts and scaling manufacturing on two continents—it will sharpen the case that Africa can produce homegrown defense primes with global reach, not just regional integrators. The new $22 million gives the company the runway to try to prove it.