Africa’s fast-rising defensetech startup Terra Industries has secured an additional $22 million in fresh funding, just weeks after closing an $11.75 million round. The extension, led by Lux Capital with participation from 8VC, Nova Global, and Resilience17 Capital, brings Terra’s total funding to $34 million and underscores investor conviction that a homegrown defense prime can emerge from the continent.

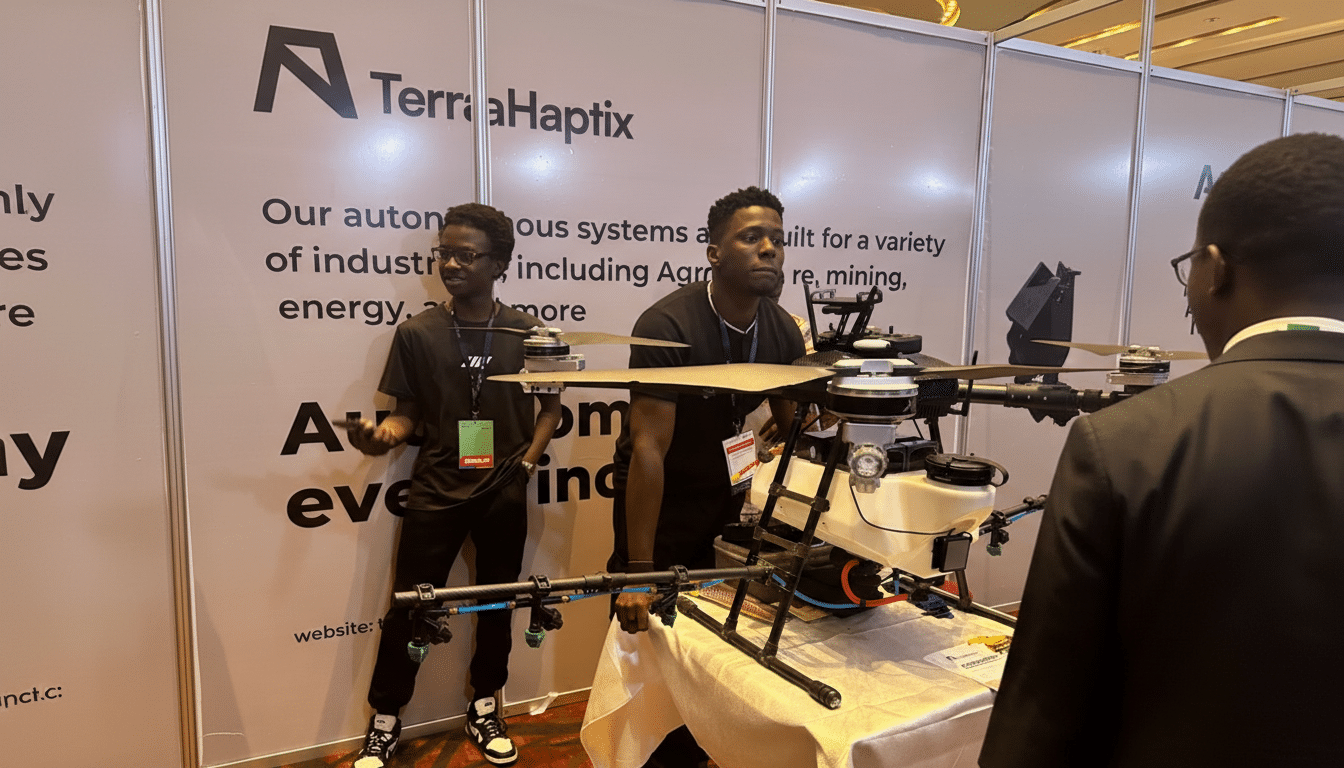

Founded in 2024 by two Gen Z entrepreneurs, CEO Nathan Nwachuku, 22, and CTO Maxwell Maduka, 24, the Nigeria-based company builds infrastructure and autonomous systems designed to help African governments and industrial operators monitor and respond to threats in real time. The new capital arrived in under two weeks, a pace that mirrors rapid deal momentum and a pipeline of government and commercial contracts.

A Push To Build Africa’s First Defense Prime

Terra’s thesis is straightforward: most of Africa’s critical security hardware and intelligence pipelines still originate from Russia, China, or Western suppliers, creating costly dependencies and slow deployment cycles. Nwachuku has said the company’s goal is to build “Africa’s first defense prime,” delivering autonomous defense systems and infrastructure security tools tailored to local terrain, budgets, and mission needs.

That ambition is gaining traction. Terra recently won its first federal contract and says it has generated more than $2.5 million in commercial revenue while protecting assets valued at roughly $11 billion. The company is expanding beyond Nigeria into additional African markets where terrorism and infrastructure sabotage are persistent risks, particularly across parts of sub-Saharan Africa and the Sahel.

Why The Extension Came Together So Quickly

Lux Capital leading the extension is notable in a sector where scale and staying power matter. Building a defense platform is capital-intensive: Anduril has raised more than $2.5 billion, Shield AI roughly $1 billion, Skydio about $740 million, and Saronic around $830 million. Terra’s backers are betting that a locally rooted supplier can move faster on integrations, logistics, and field support than distant incumbents, while still attracting world-class engineering talent and manufacturing partners.

Investors cite faster-than-expected traction on deals and partnerships as key catalysts for the round, which effectively “preempted” a longer fundraising timeline. The involvement of Resilience17 Capital, founded by Flutterwave CEO Olugbenga Agboola, further signals growing regional interest in dual-use and sovereign tech capabilities.

Manufacturing Footprint Extends To Saudi Arabia

Among Terra’s newest milestones is a partnership with AIC Steel to establish a joint manufacturing facility in Saudi Arabia focused on surveillance infrastructure and security systems. It is Terra’s first major manufacturing expansion outside Africa and reflects a pragmatic approach to supply-chain resilience, export logistics, and access to industrial capacity at scale.

For customers, a broader manufacturing footprint can shorten delivery times, improve spares availability, and enable faster iteration on hardware—critical factors in missions where the operational environment can change overnight. It also positions Terra to support cross-border deployments that require multi-jurisdictional compliance and serviceability.

Security Demand Tailwinds Across The Sahel

Security agencies and operators in Africa face a complex blend of insurgency, piracy, pipeline tampering, and cross-border banditry. The Institute for Economics and Peace’s Global Terrorism Index has identified the Sahel as the world’s epicenter of terrorism in recent years, with countries like Burkina Faso and Mali among the most affected. In that context, demand for cost-effective ISR, perimeter defense, critical infrastructure monitoring, and autonomous response tools is rising.

Terra’s pitch emphasizes localized adaptation—designing systems that handle extreme heat, dust, unstructured terrain, intermittent connectivity, and limited maintenance windows. That field-first design philosophy, if proven at scale, could differentiate Terra from imports optimized for very different operating theaters.

What To Watch Next For Terra’s Growth And Execution

Key markers over the next few quarters will include delivery against newly signed government and commercial contracts, product performance data in live deployments, and the pace at which the Saudi facility ramps production. Procurement velocity and unit economics will matter as Terra moves from pilots to multi-year programs.

Regulatory execution also looms large. As the company scales cross-border manufacturing and export, it will need rigorous compliance on dual-use technologies and end-user assurance—areas where younger defense firms often invest early to build trust with state buyers. Talent density, particularly in autonomy, sensing, and secure communications, will be another differentiator.

For now, the signal is clear: capital is flowing to a new generation of African defensetech builders. Terra’s $22 million extension, led by a top-tier deeptech investor, raises the bar for what an indigenous defense prime from the continent can look like—and how quickly it can form.