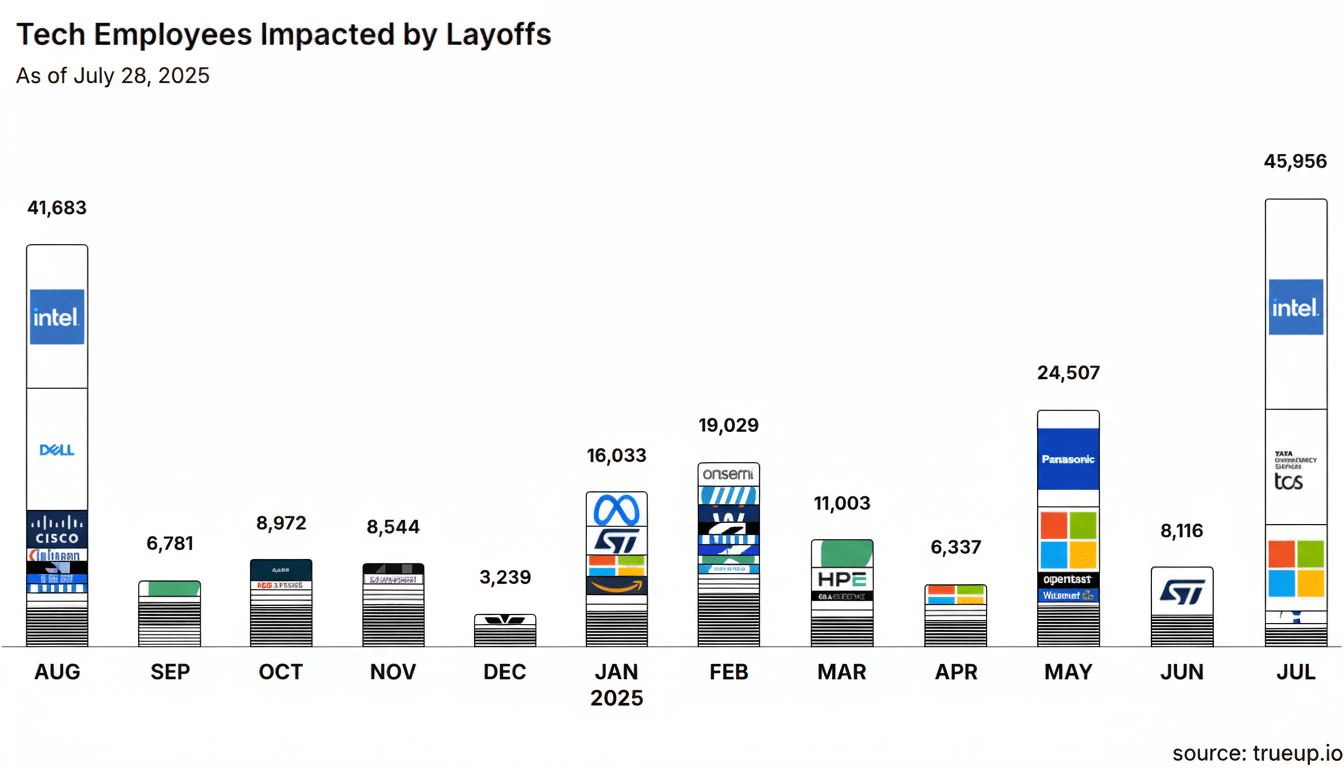

The tech layoff wave is far from over. After more than 150,000 tech jobs were eliminated at 549 companies in 2024, according to the job-tracking firm Layoffs, for the record, 2025 has also begun with another steep contraction. The tracker has recorded tens of thousands of roles eliminated to date, including a staggering 16,084 cuts in February alone — evidence that the reset is deep and broad rather than episodic.

Underneath those headlines are four converging forces that we all know about if you’re a PM or investor in San Francisco right now:

- Big Tech and enterprise cuts lead the totals in layoffs

- AI and automation as the driver behind restructuring

- Startups and sector hotspots show sharp percentage cuts

- EV hardware and semiconductors reset amid weaker demand

- Regional and role patterns appear across key tech hubs

- What to watch next as tech layoffs reshape hiring

- the AI productivity wave

- slower growth in ads and consumer hardware

- a colder EV market

- steady cost dogma from public markets

The upshot: a sweeping reimagination of teams, toolchains and priorities — and an inevitable reappraisal of where and how tech companies will hire next.

Big Tech and enterprise cuts lead the totals in layoffs

Amazon moved to eliminate some 14,000 corporate jobs after a monthslong internal review that scrutinized each division, and at least 660 positions across its New York City offices were cut as the year progressed, according to filings. The strategy echoes a broader corporate trend of streamlining product lines and cutting back overlapping support functions.

Intel said it would cut more than 21,000 jobs — about 20% of the company’s employees — as it dives into an enormous turnaround and adapts to export controls and a reshuffled mix of data centers. At the same time, local reports this week said to expect thousands of Oregon-area cuts as the chip maker constricts its manufacturing and R&D footprints.

Google also made targeted cuts to teams tied to Android, Pixel, and Chrome, touching Cloud in design roles. More reorgs in people operations came with internal placement windows in a nod to the company’s AI-first pivot. Salesforce, as well, shed hundreds of Bay Area jobs through WARN filings in keeping with its margin-first stance and a more AI-augmented customer support stack.

AI and automation as the driver behind restructuring

Companies are clear that automation is altering staffing models. Paycom reportedly eliminated over 500 roles after back-office work grew more efficient. Deliveroo said it would cut approximately 450 positions as it automates manual service roles, and Atlassian cut 150 customer support jobs after platform changes resulted in lower ticket volumes. Months after encouraging the entire company to make use of generative AI, Grammarly laid off technical writers.

This isn’t a mere cost-saving exercise. It is a reallocation. Firms are trimming layers of management and some operations while selectively adding applied researchers, data engineers, and AI product leads. Recruiters describe an increasing demand for retrieval-augmented generation and evaluation frameworks, and model governance expertise, even as non-core roles are on ice.

Startups and sector hotspots show sharp percentage cuts

Some of the sharpest percentage cuts have come from venture-backed startups. Playtika is intending to lay off approximately 20% of its workforce, or about 700 to 800 employees, according to Calcalist. It said it would reduce its workforce by 248 positions, or about 22 percent of its staff, after students started using AI tools more commonly. Bumble announced in an SEC filing that it was laying off approximately 240 jobs, or about 30 percent of its staff, to finance product and technology changes.

E-commerce infrastructure and dev tools were not exempt. Several cloud and security vendors have shared narrow but significant waves — such as Smartsheet, which plans to make more than 120 cuts related to a transition in leadership, and one big name in public cloud storage is rumored to be cutting about 6%, or around 700 jobs, in an efficiency push. WordPress.com’s parent company trimmed 16% across the board, and a leading enterprise video platform laid off roughly two-thirds of its U.S. team after being acquired.

In recruiting and marketplaces, a prominent hiring platform in the U.S. shuttered its Tel Aviv development center, eliminating about 80 roles, and Indeed and Glassdoor’s parent announced about 1,300 combined layoffs as part of a wider consolidation. Several of the AI-native startups also shed teams in data labeling and conversational AI, as they reoriented go-to-market and headed for profitability.

EV hardware and semiconductors reset amid weaker demand

EV makers and suppliers are re-calibrating to chillier demand and a more incentives-scarce environment. Rivian made multiple waves of cuts, including roughly 1.5% of all staff and another 200 positions, as it gets ready for a lower-cost model. General Motors cut 200 jobs in its EV factories in Detroit and Hamtramck. ABB said it plans to cut around 5,600 positions in automation, including some from its EV charging business, as part of efforts to improve productivity.

Cuts in the chip industry loom beyond Intel. Several device manufacturers and foundry ecosystem players also made site-specific cuts or saw voluntary exits, often citing export controls and the capital intensity of advanced nodes. Lenovo planned to cut more than 100 roles in the United States, and ByteDance reduced headcount in the Seattle region as part of a rebalancing process for its commerce and ads roadmap.

Regional and role patterns appear across key tech hubs

The Bay Area and Seattle corridors account for a disproportionate share of WARN filings — from San Francisco SaaS vendors to Eastside cloud teams. New York’s cuts are more in sales and ops as enterprise go-to-market coalesces. Israel’s tech hubs, such as Tel Aviv, have felt closures and cuts tied to global reorgs, while India-based platforms have slashed product and tech ranks as they right-size themselves post-pandemic growth spurt.

Support, undifferentiated operations, and middle-management roles are the most vulnerable. Meanwhile, IC-level engineering talent in applied AI, security, and infrastructure is still eating it up — but with even higher bars on impact (expectations for immediate time-to-productivity) and performance.

What to watch next as tech layoffs reshape hiring

Look for more focused pruning combined with selective AI recruiting as companies adjust org charts for automation. Keep an eye out for further consolidation in creator economy tools, adtech and crypto, and for EV supply chains to actually align to what realistic demand curves look like. Semiconductors will continue to manage national industrial policies with the needs of corporate margins.

For workers, the shift points to a persistent theme of this cycle. While headline layoffs are on the rise, the job market is diverging. Bistritz notes that candidates who can deliver AI-fueled features, scale data platforms or harden security perimeters are still making sales. The balance of 2025 will assess who can retool fast — and which companies transform the savings from layoffs into sustained product velocity.