From waste-to-value products to small business software, this morning’s startup launch offerings spanned a range of verticals.

Despite some market volatility, the march of technology continues.

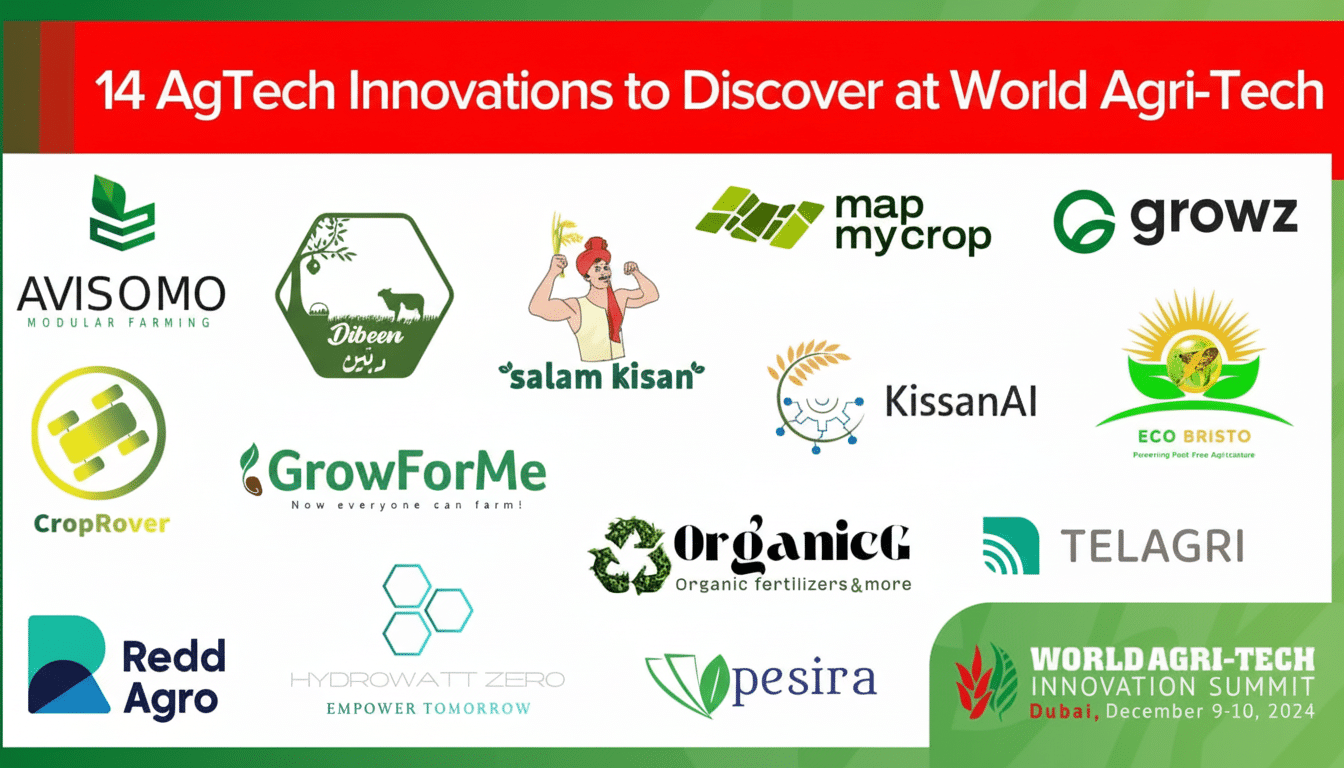

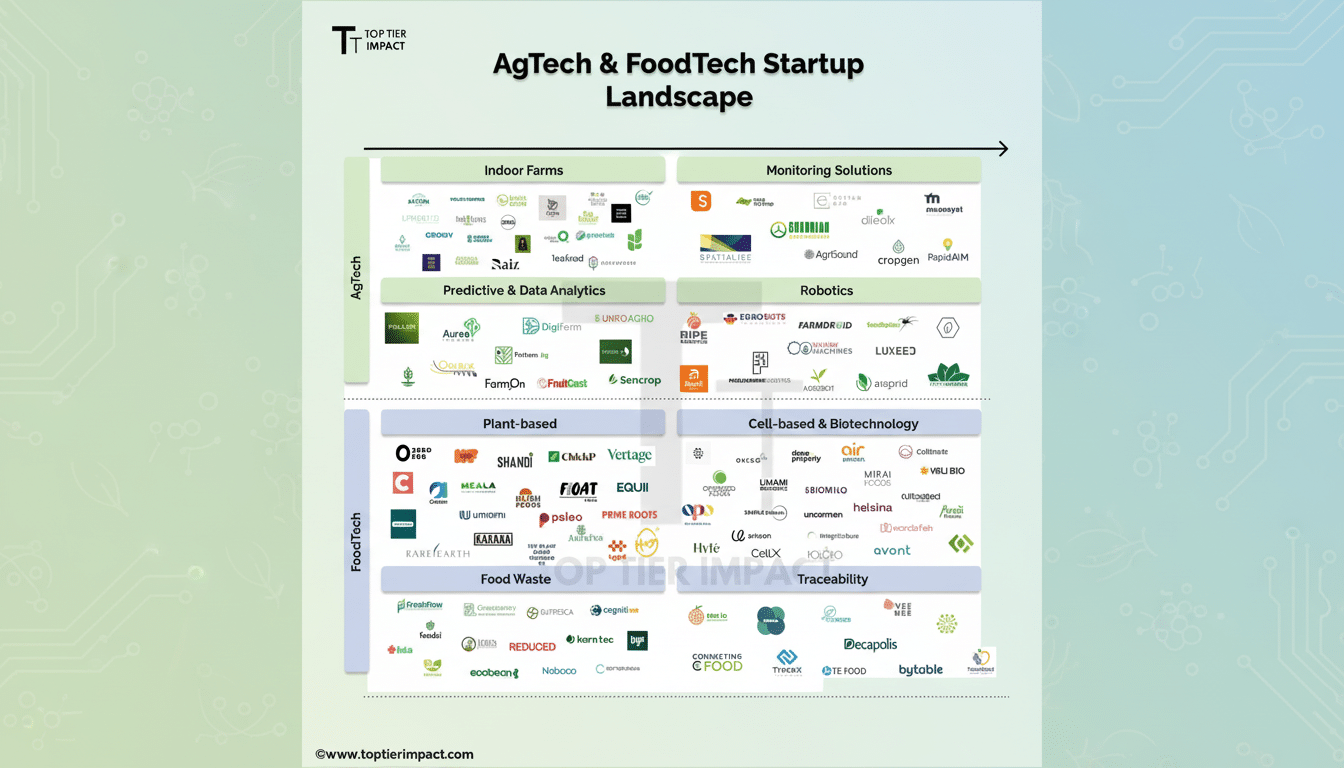

Fourteen startups — winnowed down from hundreds of candidates, all with a scientific spin — demonstrated what it means to make hard science and data something that can scale in the messy, margin-thin world of food. Together, they confront the three big constraints that the sector faces: climate risk, labor scarcity and resource efficiency.

Why These Startups Matter To Food Systems

According to the University of Oxford, global food systems contribute around 26% of all greenhouse emissions and agriculture uses approximately 70% of water withdrawals worldwide, according to the United Nations. Meanwhile, the World Resources Institute calculates that half as much food again will have to be produced by mid-century while both emissions and inputs are reduced. The Battlefield standouts reflect where we expect the next efficiency gains to happen: data-driven aquaculture, regenerative land analytics, chemical reduction in industry, circular supply chains and robotics that fill labor gaps.

The 14 Standouts Who Will Be Watched Closely

Äio, for example, converts lignocellulosic waste such as sawdust into edible fats with the help of a modified yeast strain. If that pans out, food brands may also be able to hedge against volatile vegetable oil markets and decrease the land linked to palm and soy. The company has a second high-margin channel in the cosmetics industry which will allow the business to take on pricing.

Their product, which uses machine learning to interpret satellite imagery, sidesteps capex and maintenance costs of dense sensor networks to send real-time water-quality intelligence to shrimp and fish farms. Now that half the world’s seafood comes from farms, early warning of algal blooms and oxygen swings can avert mass death events that destroy whole crops.

Clave constructs AI agents for quick-service restaurant franchises to question their own operations data and run targeted promotions. For chains on thin margins or with fragmented point-of-sale systems, crunching historical and live store data into location-based offers can boost same-store sales without blanket discounting.

CredoSense loads multispectral crop diagnostics and inference models into a tiny, low-power device that reads plant stress early. By bringing together multiple sensing technologies into one handheld device, the company says it wants to help close the chasm between agronomist theory and in-field practice at scale.

Forte Biotech provides shrimp farms with quick, on-site pathogen testing, which it developed in collaboration with the National University of Singapore. Timely identification of disease in ponds can dramatically improve survival while decreasing the need to use prophylactic antibiotics, an increasing regulatory — as well as consumer — pain point.

Genesis transforms dirt data into business intelligence for land stewards, associating lab results with their extensive material base that informs the application of regenerative practices. While increasingly more buyers are attaching premiums to verifiable soil health, the capacity to translate biology into ROI is a competitive edge for both growers and lenders.

Greeny Solutions uses AI to control and automate IoT on indoor farms for nutrient dosing, climate and disease alerts. Energy still represents the number one cost in controlled environment agriculture and software that decreases setpoints but maintains yields is becoming a sector value driver.

Y Combinator alum Instacrops layers field sensors, satellite data and AI agents to recommend irrigation and fertilization actions on the fly. Growers in water-starved areas have demonstrated that precision irrigation can reduce consumption by double-digit percentages without hurting yields, a point all the more critical as droughts worsen.

Kadeya runs a closed-loop beverage station, pairing refill machines with reusable bottles that the company collects, cleans and then redeploys to customers. Eliminating single-use containers altogether, the facilities argue, can slash packaging waste and reduce logistics emissions associated with palletized drinks.

MUI-Robotics is digitizing smell for machines, teaching models that allow robots to detect odors related to food safety, chemicals and health. If infallible, working olfaction would provide a game-changer for quality control, since the detection of spoilage or gas leaks or contamination might no longer require constant human sampling.

Shin Starr Robotics constructs mobile, automated kitchens that cook on the go, with a focus on delivery at restaurant quality. If the timing-by-temperature-tracking curve is nailed, mobile cook-to-arrival could bypass sogginess and augment throughput without adding store frontage.

Tensorfield uses AI-powered robots to search and destroy weeds when they’re at the cotyledon stage — all without using herbicides, just superheated vegetable oil. As resistance to herbicides spreads across millions of acres, non-chemical weed control that maintains soil structure is gaining interest among specialty crop growers.

Unibaio makes biodegradable microparticles from shrimp waste to exercise agrochemicals more accurately. More precise targeting reduces the amount of active ingredient sprayed, lowering costs and curbing runoff — a win not just for profit but also for watershed health across more than 35 crop varieties.

Verley makes bioidentical dairy proteins using precision fermentation, providing functional equivalency for products such as whey and casein. With high-protein foods in demand, fermentation allows formulators to keep texture and nutrition intact while having a smaller land and methane footprint than conventionally produced dairy.

What This Means For Investors And Operators

Three threads ran through the cohort. First, layers of data that replace field guesswork — from ponds to soil to kitchens — are shifting from pilots into products with distinct payback windows. Second, chemical reduction is reaching a turning point as regulation ramps up and buyers call for visibility of residues. Third, circularity is becoming operational, rather than just marketing, as waste streams like sawdust and shrimp shells are turned into valuable inputs.

None of this changes the sector’s hard realities: seasonality, dispersed customers and long sales cycles. But the Battlefield winners are constructing with those constraints in mind, privileging retrofit-friendly hardware, software that conforms to existing workflows and unit economics not dependent on subsidies. For an industry compelled to work under pressure to produce more with less, it’s that pragmatism that is the true innovation.